- Hong Kong

- /

- Consumer Services

- /

- SEHK:1765

Investors Continue Waiting On Sidelines For XJ International Holdings Co., Ltd. (HKG:1765)

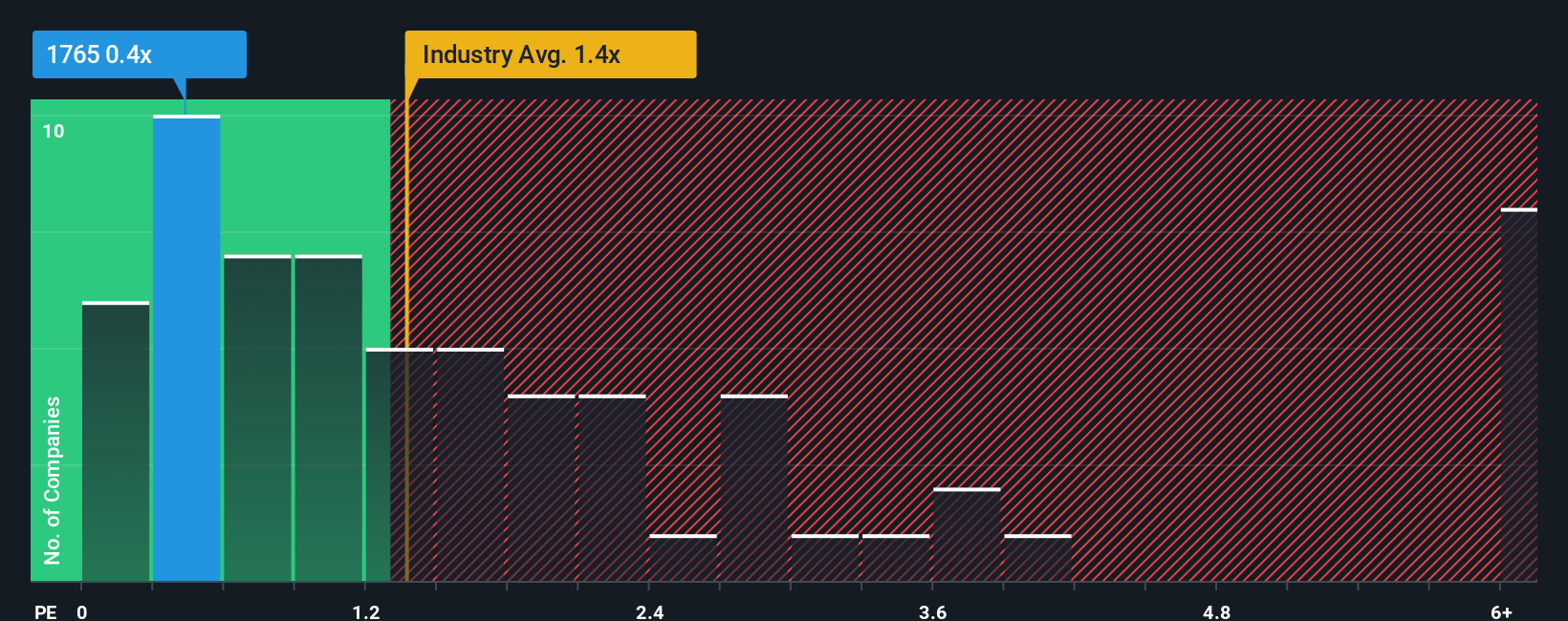

When close to half the companies operating in the Consumer Services industry in Hong Kong have price-to-sales ratios (or "P/S") above 1.4x, you may consider XJ International Holdings Co., Ltd. (HKG:1765) as an attractive investment with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for XJ International Holdings

How XJ International Holdings Has Been Performing

XJ International Holdings has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on XJ International Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, XJ International Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 3.2% gain to the company's revenues. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 14% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that XJ International Holdings is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From XJ International Holdings' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that XJ International Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for XJ International Holdings with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of XJ International Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1765

XJ International Holdings

An investment holding company, engages in the provision of higher education and secondary vocational education services in China and Malaysia.

Solid track record and good value.

Market Insights

Community Narratives