- Hong Kong

- /

- Entertainment

- /

- SEHK:1003

Asian Market Insights: Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

Amidst global market fluctuations, notably driven by renewed U.S.-China trade tensions and geopolitical uncertainties, investors are increasingly seeking opportunities in diverse regions such as Asia. Penny stocks, often associated with smaller or newer companies, continue to present intriguing possibilities for growth despite their traditional moniker. By focusing on those with robust financials and solid fundamentals, investors can uncover potential hidden gems that may offer significant returns.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.85 | HK$2.32B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.41 | HK$872.11M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.46 | HK$2.04B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.28 | SGD518.77M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.68 | THB2.81B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.14 | SGD12.36B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.03 | HK$2.97B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.70 | THB9.5B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 960 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Huanxi Media Group (SEHK:1003)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Huanxi Media Group Limited is an investment holding company involved in the media and entertainment industry in the People’s Republic of China and Hong Kong, with a market cap of HK$1.55 billion.

Operations: The company generates revenue primarily from its investment in film and TV programmes rights, amounting to HK$98.91 million.

Market Cap: HK$1.55B

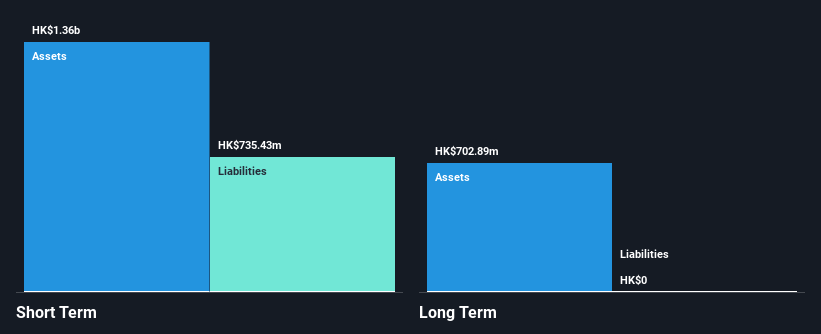

Huanxi Media Group, with a market cap of HK$1.55 billion, is navigating through financial challenges as it remains unprofitable despite reducing losses over the past five years. The company has a solid asset base, with HK$1.1 billion in short-term assets surpassing both its short-term and long-term liabilities. However, it faces liquidity concerns with less than a year of cash runway based on current free cash flow trends. Revenue is forecasted to grow at 39% annually, yet the share price remains highly volatile amidst significant insider selling and recent executive changes impacting leadership stability.

- Jump into the full analysis health report here for a deeper understanding of Huanxi Media Group.

- Review our growth performance report to gain insights into Huanxi Media Group's future.

Sino Hotels (Holdings) (SEHK:1221)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sino Hotels (Holdings) Limited is an investment holding company that operates and manages hotels in Hong Kong with a market cap of HK$1.87 billion.

Operations: The company's revenue is derived from investment holding (HK$6.75 million) and hotel operations at the City Garden Hotel (HK$100.36 million), along with club operation and hotel management services (HK$16.02 million).

Market Cap: HK$1.87B

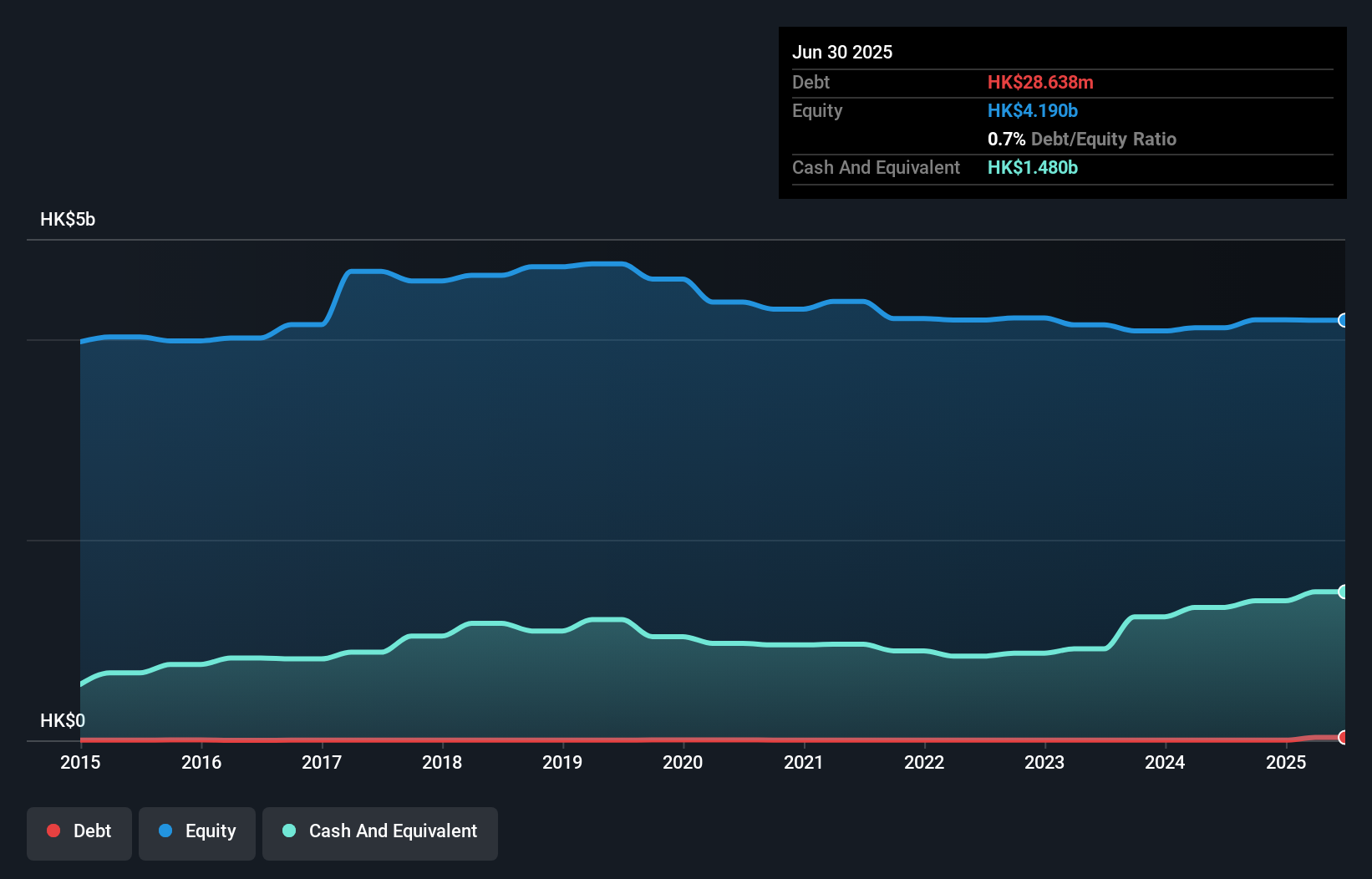

Sino Hotels (Holdings) Limited, with a market cap of HK$1.87 billion, demonstrates financial stability through its solid asset base, as short-term assets of HK$1.5 billion comfortably cover short-term liabilities of HK$49.5 million. The company has no long-term liabilities and maintains more cash than total debt, indicating prudent financial management. Despite a low return on equity at 2.5%, the company's earnings have grown by 60.7% over the past year, surpassing industry averages and reflecting high-quality earnings with improved profit margins from 48.1% to 83.9%. Recent board changes may influence strategic direction moving forward.

- Unlock comprehensive insights into our analysis of Sino Hotels (Holdings) stock in this financial health report.

- Evaluate Sino Hotels (Holdings)'s historical performance by accessing our past performance report.

VPower Group International Holdings (SEHK:1608)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: VPower Group International Holdings Limited is an investment holding company that designs, integrates, sells, and installs engine-based electricity generation units across Hong Kong, Mainland China, other Asian countries, Latin America, and internationally with a market cap of HK$1.73 billion.

Operations: The company's revenue is primarily derived from two segments: System Integration (SI) contributing HK$470.96 million and Investment, Building and Operating (IBO) generating HK$907.96 million.

Market Cap: HK$1.73B

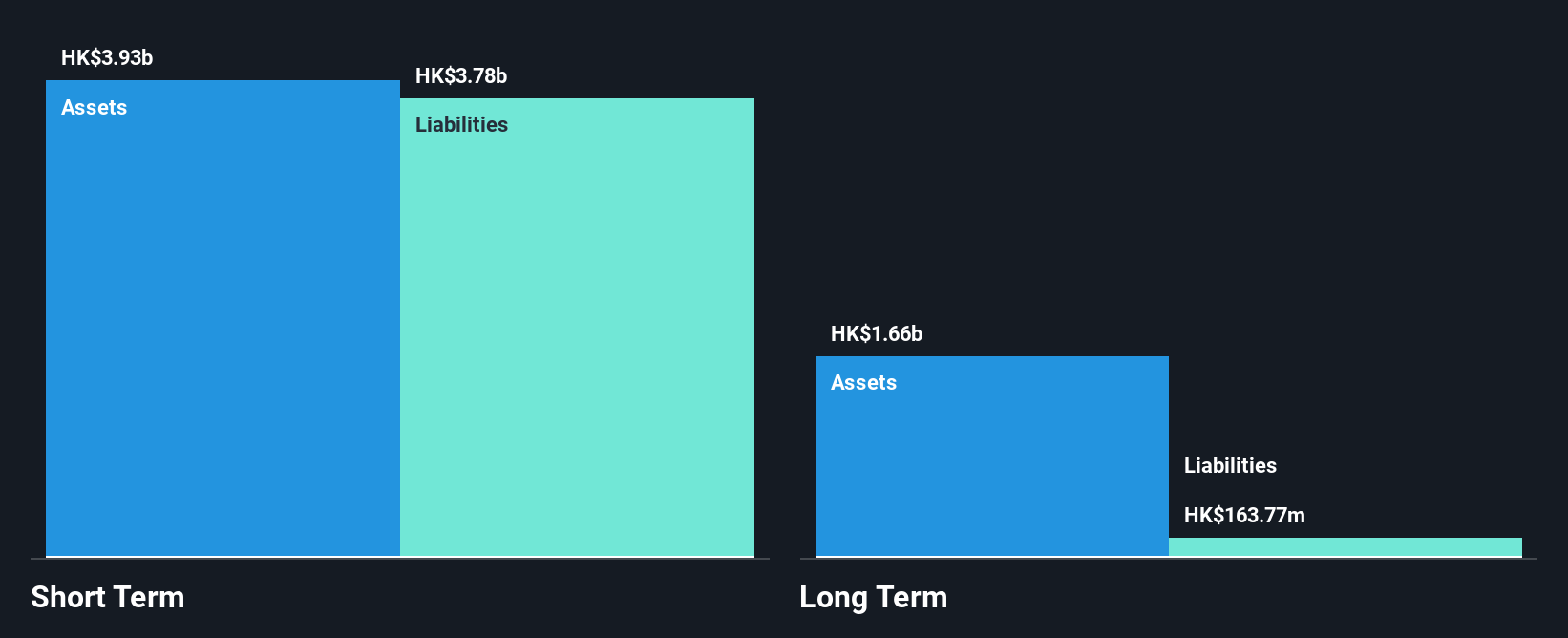

VPower Group International Holdings Limited, with a market cap of HK$1.73 billion, has faced challenges despite recent profitability improvements. The company reported HK$612.1 million in sales for the first half of 2025, down from HK$816.57 million a year ago, but achieved a net income of HK$20.68 million compared to a previous loss. This turnaround is partly due to asset disposals and reduced interest expenses from repaid borrowings. While short-term assets exceed liabilities by HK$100 million, the company's high net debt-to-equity ratio of 97.6% remains concerning amid its unprofitability and inexperienced management team and board.

- Dive into the specifics of VPower Group International Holdings here with our thorough balance sheet health report.

- Assess VPower Group International Holdings' previous results with our detailed historical performance reports.

Make It Happen

- Unlock our comprehensive list of 960 Asian Penny Stocks by clicking here.

- Seeking Other Investments? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huanxi Media Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1003

Huanxi Media Group

An investment holding company, engages in the media and entertainment, and related businesses in the People’s Republic of China and Hong Kong.

Adequate balance sheet with low risk.

Market Insights

Community Narratives