- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:8476

Market Participants Recognise Ocean One Holding Ltd.'s (HKG:8476) Earnings

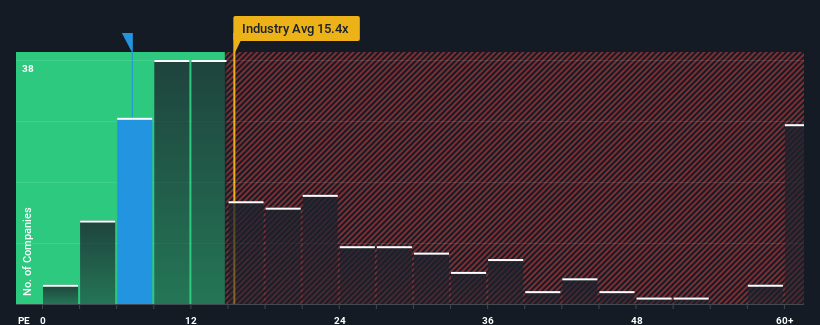

There wouldn't be many who think Ocean One Holding Ltd.'s (HKG:8476) price-to-earnings (or "P/E") ratio of 7.2x is worth a mention when the median P/E in Hong Kong is similar at about 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

For instance, Ocean One Holding's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Ocean One Holding

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Ocean One Holding's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 75% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

It's interesting to note that the rest of the market is similarly expected to grow by 23% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Ocean One Holding's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On Ocean One Holding's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Ocean One Holding maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Ocean One Holding you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8476

Ocean One Holding

An investment holding company, engages in the import and wholesale of frozen seafood products in Hong Kong, Macau, Mainland China, and Japan.

Flawless balance sheet with acceptable track record.