In recent weeks, Asian markets have experienced a positive shift in sentiment, buoyed by the temporary de-escalation of trade tensions between the U.S. and China, which has helped lift indices such as China's CSI 300 and Hong Kong's Hang Seng Index. In this environment, identifying small-cap stocks that are potentially undervalued requires careful consideration of factors like market positioning and growth potential amidst evolving economic conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.4x | 1.0x | 40.62% | ★★★★★★ |

| Puregold Price Club | 8.6x | 0.4x | 23.23% | ★★★★★☆ |

| East West Banking | 3.1x | 0.7x | 35.91% | ★★★★★☆ |

| Atturra | 29.9x | 1.2x | 33.43% | ★★★★★☆ |

| Hansen Technologies | 291.8x | 2.8x | 22.64% | ★★★★★☆ |

| Dicker Data | 19.9x | 0.7x | -41.60% | ★★★★☆☆ |

| Sing Investments & Finance | 7.2x | 3.7x | 41.71% | ★★★★☆☆ |

| Smart Parking | 74.5x | 6.6x | 44.82% | ★★★☆☆☆ |

| PWR Holdings | 36.4x | 5.0x | 21.41% | ★★★☆☆☆ |

| Integral Diagnostics | 162.4x | 1.9x | 41.86% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Smart Parking (ASX:SPZ)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Smart Parking operates in the parking management and technology solutions sector, with a focus on providing services across regions such as the United Kingdom, New Zealand, Australia, and Germany; the company has a market capitalization of A$100.23 million.

Operations: Smart Parking generates revenue primarily from its Parking Management operations in the United Kingdom, New Zealand, and Germany, alongside its Technology Division. The company has seen a notable trend in its gross profit margin, reaching 64.13% as of September 2024. Operating expenses are a significant cost component, with depreciation and amortization also contributing to the expense structure.

PE: 74.5x

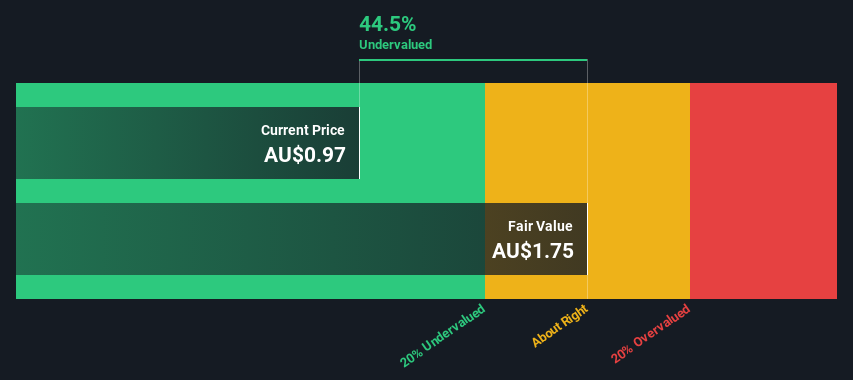

Smart Parking, a player in the parking technology sector, has recently been added to the S&P/ASX Emerging Companies and All Ordinaries Index. Despite facing lower profit margins this year (8.8% from 13.6%), they are poised for earnings growth of 34% annually. A recent follow-on equity offering raised A$45 million, indicating strategic expansion efforts. Insider confidence is evident with recent share purchases, suggesting potential optimism about future prospects despite reliance on higher-risk external borrowing for funding.

East West Banking (PSE:EW)

Simply Wall St Value Rating: ★★★★★☆

Overview: East West Banking Corporation is a Philippine-based financial institution providing a range of banking and financial services, with a market capitalization of approximately ₱20.55 billion.

Operations: East West Banking generates revenue primarily from its banking operations, with a notable gross profit margin of 98.93% as of the latest quarter. The company's cost structure includes operating expenses which have shown an upward trend, reaching ₱23.08 billion in the first quarter of 2025. General and administrative expenses form a significant part of these operating costs, amounting to ₱11.27 billion in the same period.

PE: 3.1x

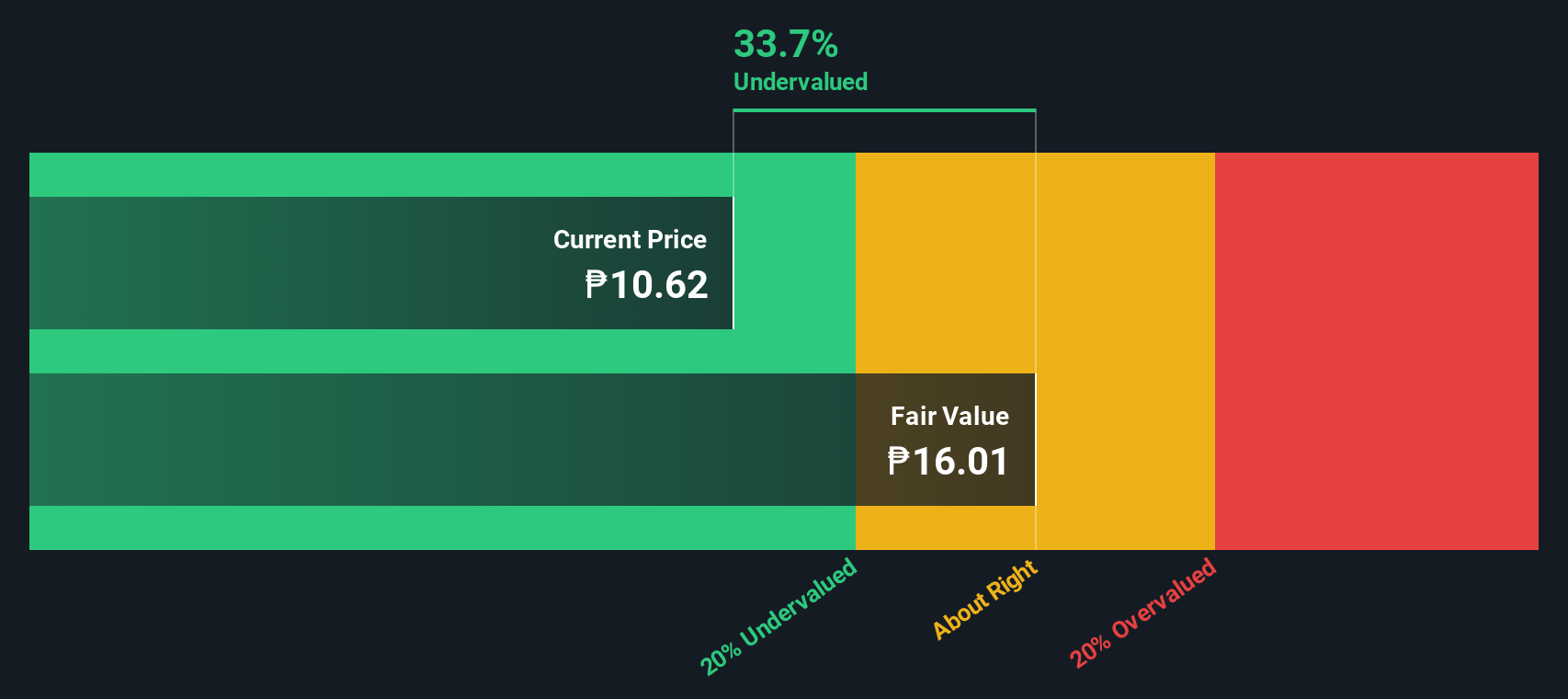

East West Banking, a smaller player in Asia's financial sector, has seen its earnings grow from PHP 6.1 billion to PHP 7.6 billion over the last year, with basic earnings per share rising from PHP 2.7 to PHP 3.38. Despite a high bad loan ratio of 4.4% and a low allowance for these loans at 66%, insider confidence is evident through recent share purchases by executives earlier this year, signaling potential growth prospects amidst challenges.

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti is a company involved in the design, construction, and marketing of yachts and recreational boats with a market capitalization of approximately HKD 7.12 billion.

Operations: The primary revenue stream is from the design, construction, and marketing of yachts and recreational boats. The company has seen fluctuations in its gross profit margin, with a notable increase to 37.38% by the end of 2022. Operating expenses have been steadily rising over time, impacting overall profitability.

PE: 10.1x

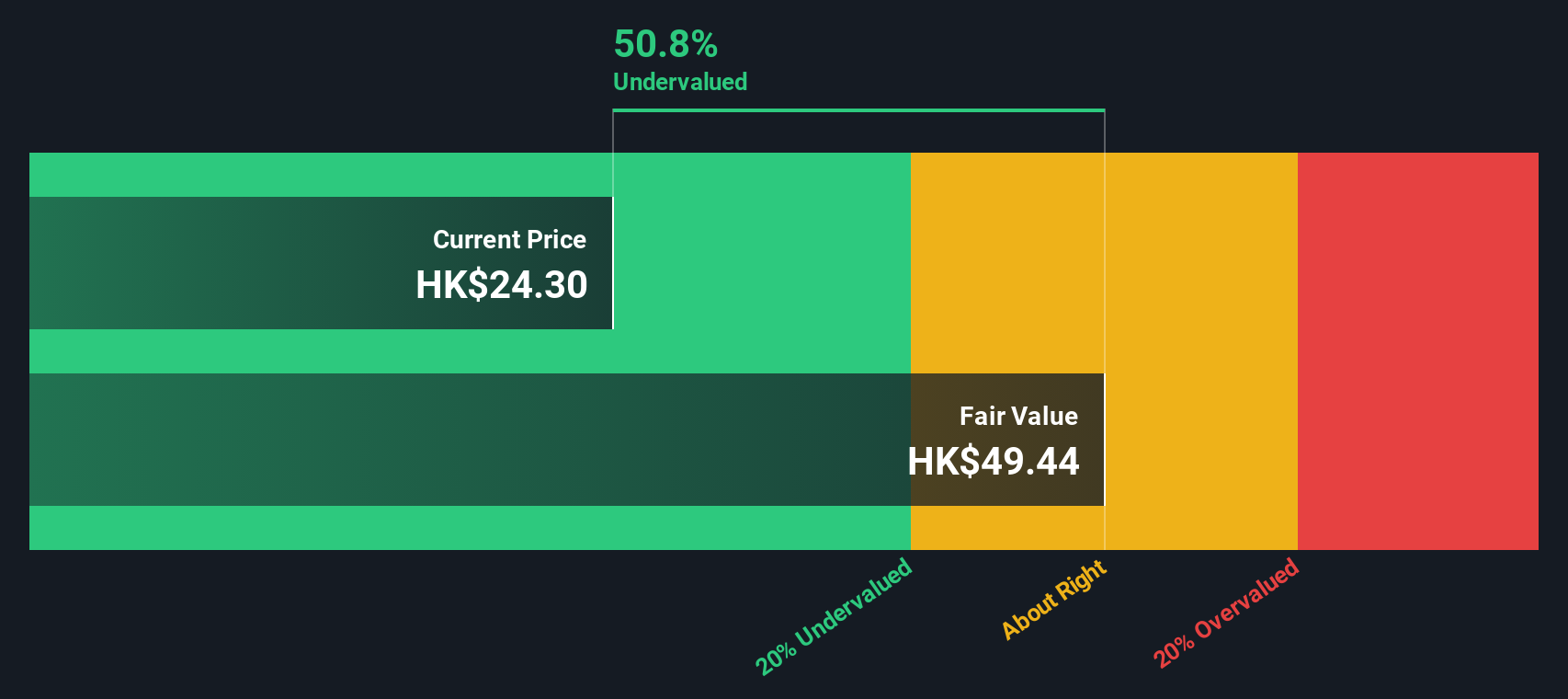

Ferretti, a company with growing profits and high-quality earnings, recently reported sales of €1.34 billion for 2024, up from the previous year. With insider confidence evident from Karel Komarek's purchase of 1 million shares worth approximately €21.35 million between March and May 2025, there's a clear vote of confidence in its potential. Despite relying on higher-risk external borrowing for funding, Ferretti's forecasted annual earnings growth rate of 9.56% suggests promising prospects in the competitive yacht manufacturing industry.

- Delve into the full analysis valuation report here for a deeper understanding of Ferretti.

Understand Ferretti's track record by examining our Past report.

Next Steps

- Take a closer look at our Undervalued Asian Small Caps With Insider Buying list of 66 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9638

Ferretti

Designs, constructs, markets, and sells yachts and vessels under the Riva, Wally, Ferretti Yachts, Pershing, Itama, Easy Boat, CRN, and Custom Line brand names.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives