How Many Amuse Group Holding Limited (HKG:8545) Shares Have Insiders Sold, In The Last Year?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So before you buy or sell Amuse Group Holding Limited (HKG:8545), you may well want to know whether insiders have been buying or selling.

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

View our latest analysis for Amuse Group Holding

Amuse Group Holding Insider Transactions Over The Last Year

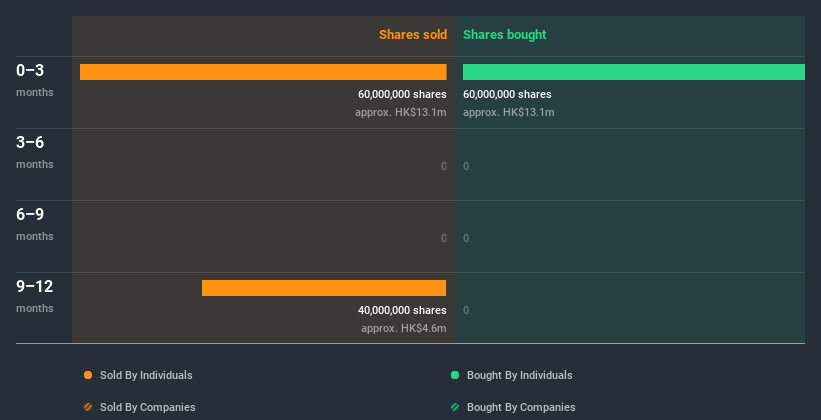

In the last twelve months, the biggest single purchase by an insider was when insider Junqi Zhou bought HK$13m worth of shares at a price of HK$0.22 per share. That means that an insider was happy to buy shares at above the current price of HK$0.10. Their view may have changed since then, but at least it shows they felt optimistic at the time. We always take careful note of the price insiders pay when purchasing shares. It is encouraging to see an insider paid above the current price for shares, as it suggests they saw value, even at higher levels. Junqi Zhou was the only individual insider to buy during the last year.

Wai Keung Li divested 100.00m shares over the last 12 months at an average price of HK$0.18. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Amuse Group Holding

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Amuse Group Holding insiders own 49% of the company, worth about HK$48m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Amuse Group Holding Tell Us?

We can't make any useful conclusions about recent trading, since insider buying and selling has been balanced. While we gain confidence from high insider ownership of Amuse Group Holding, we can't say the same about their transactions in the last year, in the absence of further purchases. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Be aware that Amuse Group Holding is showing 4 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Amuse Group Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8545

Amuse Group Holding

An investment holding company, designs, markets, distributes, and sells toys and related products in Hong Kong, Japan, the United States, the People’s Republic of China, Taiwan, South Korea, Germany, Australia, Italy, France, and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)