Skyworth Group Limited (HKG:751), is not the largest company out there, but it saw significant share price movement during recent months on the SEHK, rising to highs of HK$4.48 and falling to the lows of HK$3.08. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether Skyworth Group's current trading price of HK$3.15 reflective of the actual value of the small-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at Skyworth Group’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

Check out our latest analysis for Skyworth Group

What Is Skyworth Group Worth?

According to my price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average, the stock price seems to be justfied. I’ve used the price-to-earnings ratio in this instance because there’s not enough visibility to forecast its cash flows. The stock’s ratio of 4.69x is currently trading slightly below its industry peers’ ratio of 6.98x, which means if you buy Skyworth Group today, you’d be paying a reasonable price for it. And if you believe that Skyworth Group should be trading at this level in the long run, then there’s not much of an upside to gain over and above other industry peers. Although, there may be an opportunity to buy in the future. This is because Skyworth Group’s beta (a measure of share price volatility) is high, meaning its price movements will be exaggerated relative to the rest of the market. If the market is bearish, the company’s shares will likely fall by more than the rest of the market, providing a prime buying opportunity.

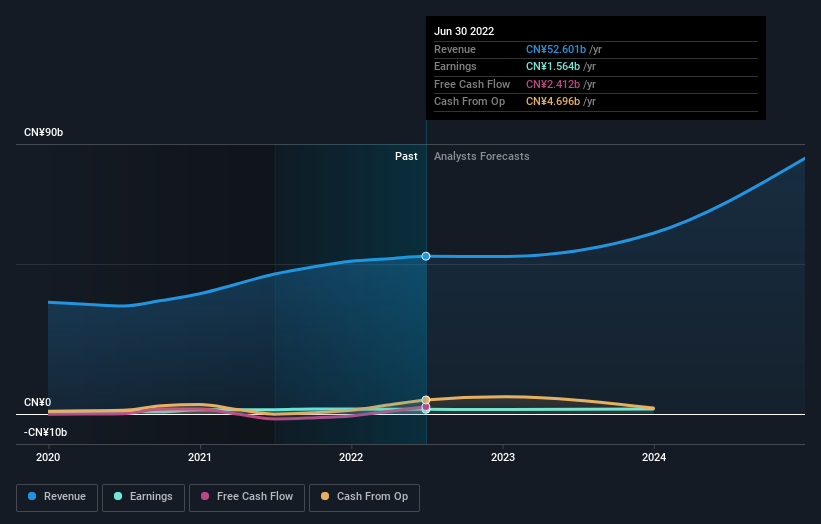

Can we expect growth from Skyworth Group?

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. Though in the case of Skyworth Group, it is expected to deliver a relatively unexciting earnings growth of 0.3%, which doesn’t help build up its investment thesis. Growth doesn’t appear to be a main reason for a buy decision for Skyworth Group, at least in the near term.

What This Means For You

Are you a shareholder? 751’s future growth appears to have been factored into the current share price, with shares trading around industry price multiples. However, there are also other important factors which we haven’t considered today, such as the track record of its management team. Have these factors changed since the last time you looked at 751? Will you have enough confidence to invest in the company should the price drop below the industry PE ratio?

Are you a potential investor? If you’ve been keeping an eye on 751, now may not be the most optimal time to buy, given it is trading around industry price multiples. However, the positive growth outlook may mean it’s worth diving deeper into other factors in order to take advantage of the next price drop.

If you want to dive deeper into Skyworth Group, you'd also look into what risks it is currently facing. At Simply Wall St, we found 3 warning signs for Skyworth Group and we think they deserve your attention.

If you are no longer interested in Skyworth Group, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:751

Skyworth Group

Researches, develops, manufactures, sells, and trades in consumer electronic products in Mainland China, Asia, Europe, the Americas, and Africa.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)