- Hong Kong

- /

- Consumer Durables

- /

- SEHK:638

Kin Yat Holdings (HKG:638) Use Of Debt Could Be Considered Risky

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Kin Yat Holdings Limited (HKG:638) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Kin Yat Holdings

What Is Kin Yat Holdings's Debt?

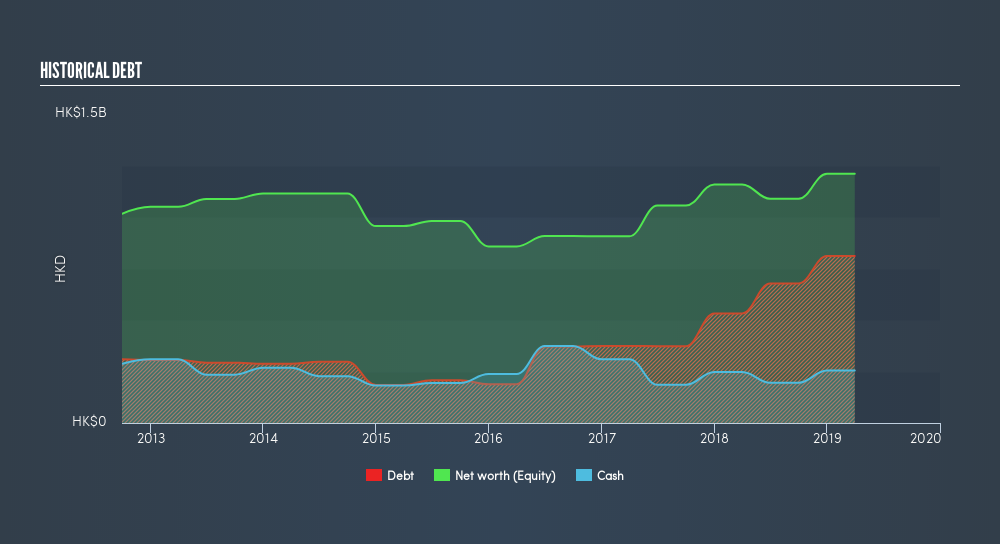

As you can see below, at the end of March 2019, Kin Yat Holdings had HK$810.1m of debt, up from HK$531.9m a year ago. Click the image for more detail. However, it does have HK$255.1m in cash offsetting this, leading to net debt of about HK$555.0m.

How Healthy Is Kin Yat Holdings's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Kin Yat Holdings had liabilities of HK$2.04b due within 12 months and liabilities of HK$139.4m due beyond that. Offsetting this, it had HK$255.1m in cash and HK$335.9m in receivables that were due within 12 months. So its liabilities total HK$1.59b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the HK$403.8m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Kin Yat Holdings would likely require a major re-capitalisation if it had to pay its creditors today. Either way, since Kin Yat Holdings does have more debt than cash, it's worth keeping an eye on its balance sheet.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Kin Yat Holdings has a debt to EBITDA ratio of 3.74 and its EBIT covered its interest expense 5.38 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Unfortunately, Kin Yat Holdings's EBIT flopped 13% over the last four quarters. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. When analysing debt levels, the balance sheet is the obvious place to start. But it is Kin Yat Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Kin Yat Holdings burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Kin Yat Holdings's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. After considering the datapoints discussed, we think Kin Yat Holdings has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Over time, share prices tend to follow earnings per share, so if you're interested in Kin Yat Holdings, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:638

Kin Yat Holdings

An investment holding company, engages in the design, manufacture, sale, and trading of electrical and electronic products, motor drives, encoder film, and other products.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives