- Hong Kong

- /

- Capital Markets

- /

- SEHK:6066

Three Value Stocks Estimated Below Intrinsic Worth For January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with inflation concerns and political uncertainties weighing on investor sentiment, value stocks have demonstrated relative resilience compared to their growth counterparts. In this environment, identifying stocks that are trading below their intrinsic worth can offer potential opportunities for investors seeking stability and long-term growth amidst market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.32 | TRY78.59 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.89 | 49.9% |

| Elekta (OM:EKTA B) | SEK61.10 | SEK122.02 | 49.9% |

| Zhende Medical (SHSE:603301) | CN¥21.00 | CN¥41.91 | 49.9% |

| Meriaura Group Oyj (OM:MERIS) | SEK0.49 | SEK0.98 | 50% |

| Constellium (NYSE:CSTM) | US$10.32 | US$20.58 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5865.00 | ¥11696.51 | 49.9% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.8% |

| AK Medical Holdings (SEHK:1789) | HK$4.28 | HK$8.52 | 49.8% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥9.20 | CN¥18.39 | 50% |

Underneath we present a selection of stocks filtered out by our screen.

China Southern Airlines (SEHK:1055)

Overview: China Southern Airlines Company Limited provides airline transportation services across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally, with a market cap of HK$103.06 billion.

Operations: The company's revenue primarily comes from providing airline transportation services across mainland China, Hong Kong, Macau, Taiwan, and international destinations.

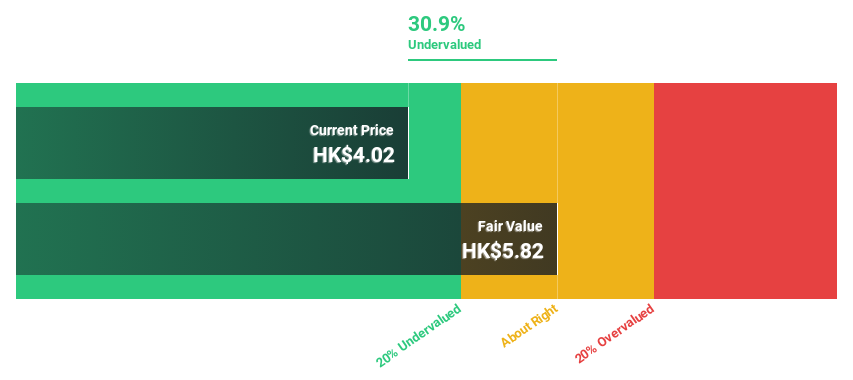

Estimated Discount To Fair Value: 28.9%

China Southern Airlines is trading at HK$4.02, below its estimated fair value of HK$5.65, indicating potential undervaluation based on cash flow analysis. The company's earnings are forecast to grow significantly, with expectations of profitability within three years, surpassing average market growth rates. Recent operating results show strong passenger and cargo metrics with improving load factors, supported by increased revenue and net income for the first nine months of 2024 compared to the previous year.

- Our expertly prepared growth report on China Southern Airlines implies its future financial outlook may be stronger than recent results.

- Take a closer look at China Southern Airlines' balance sheet health here in our report.

Bloks Group (SEHK:325)

Overview: Bloks Group Limited focuses on the design, development, and sales of assembly toys in China with a market cap of HK$21.37 billion.

Operations: The company's revenue is primarily derived from its assembly toys segment, generating CN¥1.61 billion.

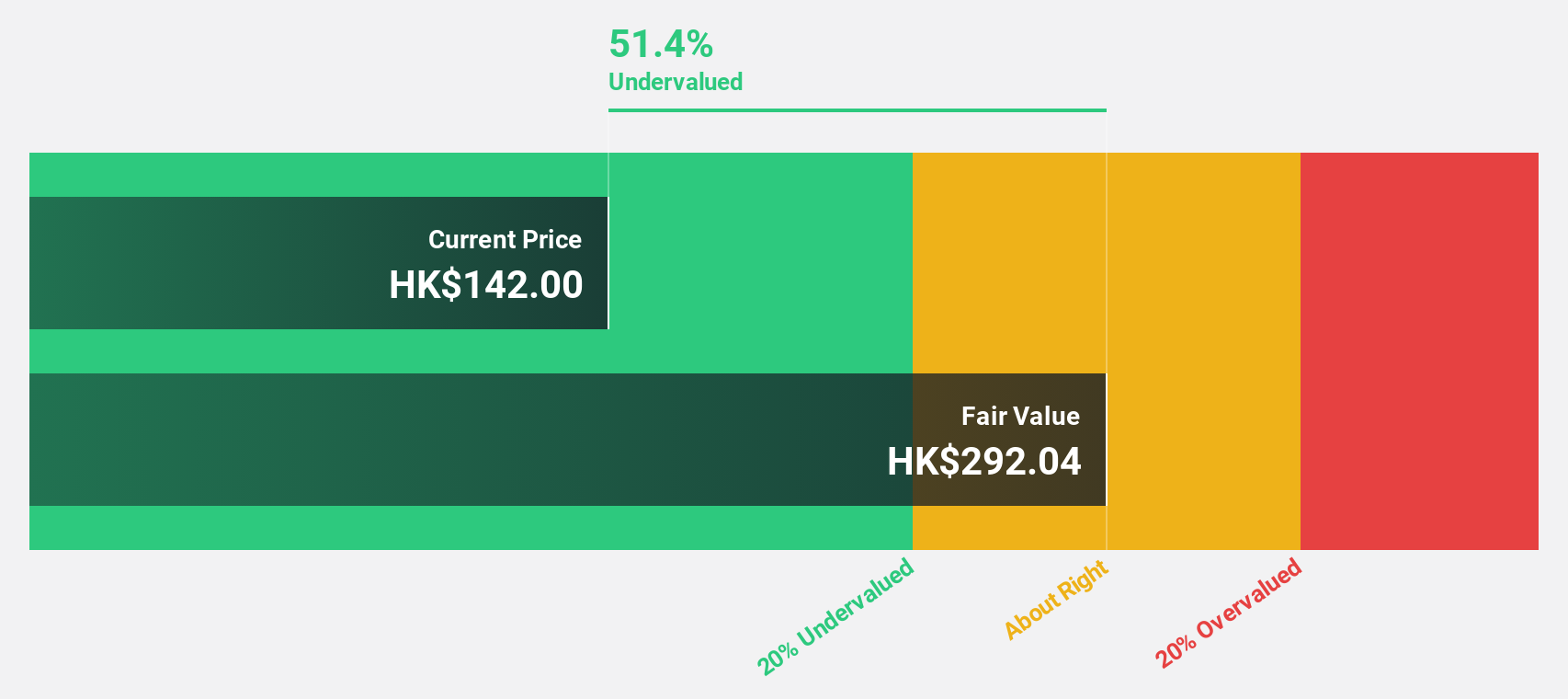

Estimated Discount To Fair Value: 34.5%

Bloks Group, trading at HK$82.20, is considered undervalued with a fair value estimate of HK$125.53 based on discounted cash flow analysis. The company recently completed an IPO raising HK$1.67 billion, which could support its growth trajectory. Revenue grew by 169.3% last year and is expected to continue growing at 21.5% annually, outpacing the Hong Kong market's average growth rate, while profitability is anticipated within three years despite current illiquidity concerns.

- Our growth report here indicates Bloks Group may be poised for an improving outlook.

- Get an in-depth perspective on Bloks Group's balance sheet by reading our health report here.

CSC Financial (SEHK:6066)

Overview: CSC Financial Co., Ltd., along with its subsidiaries, offers investment banking services both in Mainland China and internationally, with a market cap of HK$174.80 billion.

Operations: CSC Financial Co., Ltd.'s revenue segments include investment banking services provided both domestically in Mainland China and on an international scale.

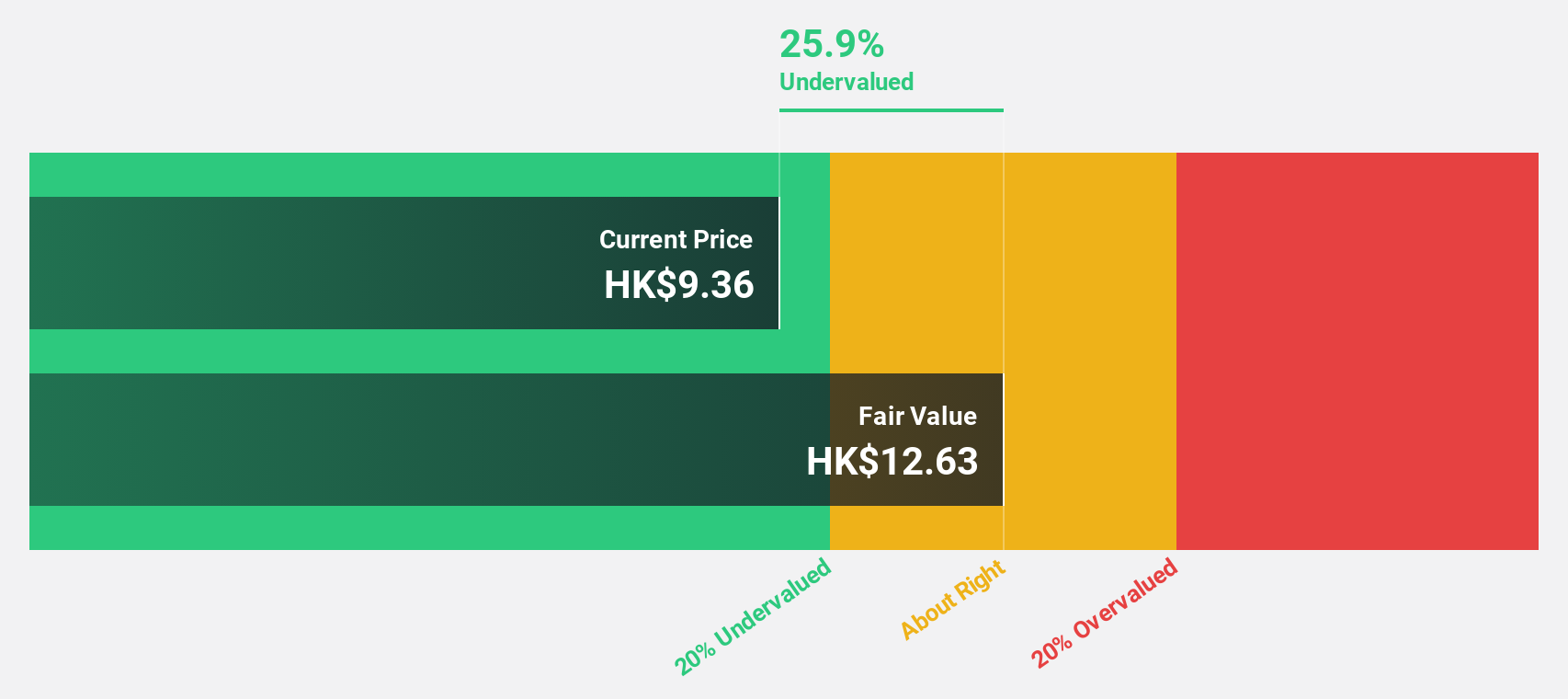

Estimated Discount To Fair Value: 32.2%

CSC Financial, trading at HK$9.52, is significantly undervalued based on a discounted cash flow analysis with a fair value estimate of HK$14.04. The company's earnings are projected to grow 36.9% annually, surpassing the Hong Kong market's average growth rate of 10.7%. Despite recent executive changes and board appointments, these developments are not expected to disrupt operations or its financial trajectory significantly.

- The growth report we've compiled suggests that CSC Financial's future prospects could be on the up.

- Dive into the specifics of CSC Financial here with our thorough financial health report.

Where To Now?

- Access the full spectrum of 878 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6066

CSC Financial

Provides investment banking services in Mainland China and internationally.

Very undervalued with reasonable growth potential.