Global markets have experienced a turbulent start to the year, with U.S. equities facing declines amid inflation concerns and political uncertainty, while European indices showed resilience. In such choppy market conditions, investors often seek opportunities in sectors that may offer potential growth at lower price points. Penny stocks, though often seen as a relic term, continue to present intriguing opportunities when backed by strong financials and solid fundamentals. This article highlights three promising penny stocks that stand out for their financial strength and potential for growth in today's complex market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.60 | £412.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.89 | £712.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$545.92M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.36 | THB2.66B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| Starflex (SET:SFLEX) | THB2.58 | THB2.02B | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

Click here to see the full list of 5,702 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Meitu (SEHK:1357)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Meitu, Inc., an investment holding company, focuses on developing beauty-related digital solutions for image, video, and design production in China and internationally, with a market cap of HK$12.80 billion.

Operations: The company's revenue is derived from its Internet Business segment, which generated CN¥3.06 billion.

Market Cap: HK$12.8B

Meitu, Inc. is navigating the penny stock landscape with a market cap of HK$12.80 billion and revenue from its Internet Business segment reaching CN¥3.06 billion. Despite negative earnings growth over the past year, Meitu's short-term assets comfortably cover both short and long-term liabilities, indicating financial stability. The company has more cash than total debt, ensuring interest payments are not a concern. Analysts anticipate earnings growth of 26.85% annually, while the stock trades significantly below fair value estimates. Recent announcements about a potential special dividend reflect proactive shareholder engagement amidst stable weekly volatility and experienced management oversight.

- Jump into the full analysis health report here for a deeper understanding of Meitu.

- Learn about Meitu's future growth trajectory here.

Chinasoft International (SEHK:354)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chinasoft International Limited, along with its subsidiaries, provides IT solutions, outsourcing, and training services across several countries including China and the United States, with a market cap of HK$11.67 billion.

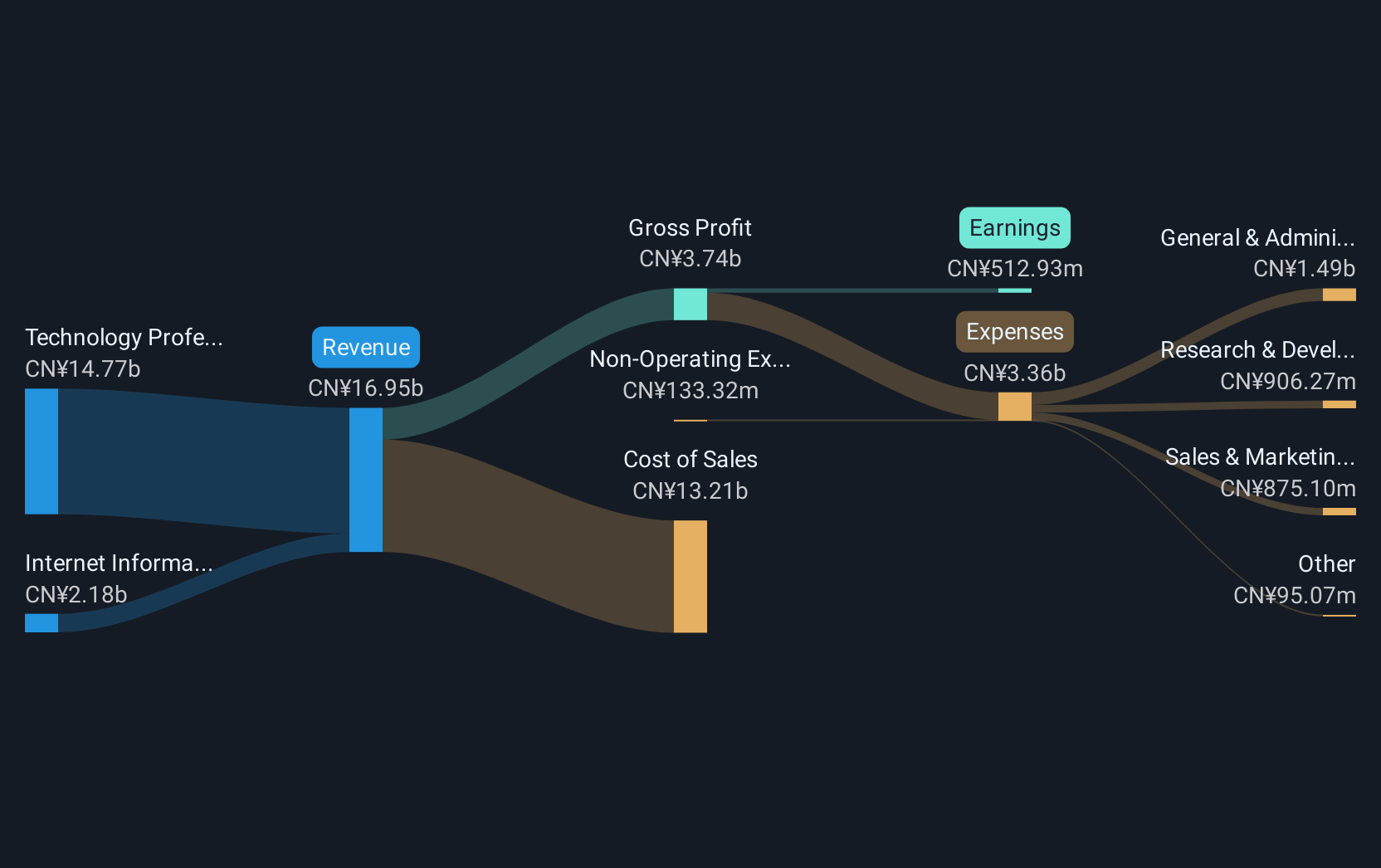

Operations: The company generates revenue primarily from its Technology Professional Services Group, contributing CN¥14.47 billion, and its Internet Information Technology Services Group, which adds CN¥2.13 billion.

Market Cap: HK$11.67B

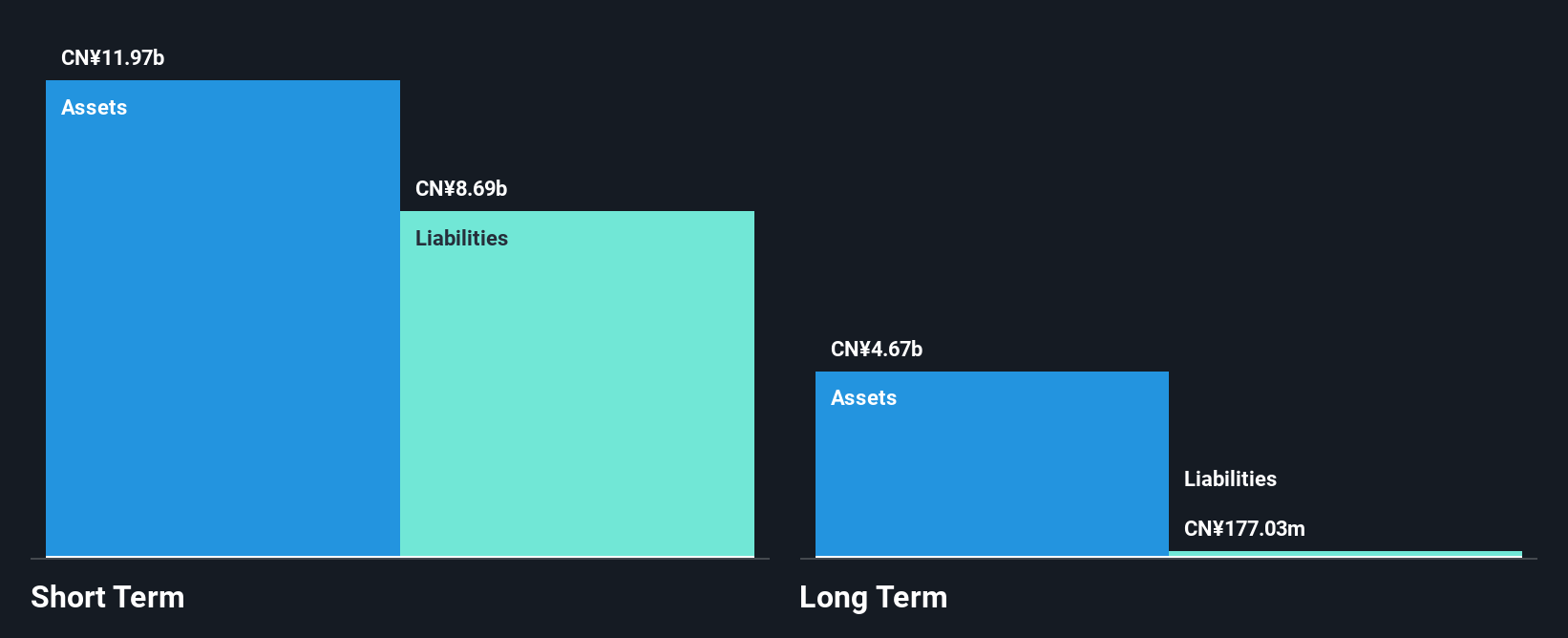

Chinasoft International, with a market cap of HK$11.67 billion, is positioned in the penny stock realm through its significant involvement in IT services. The company has demonstrated robust revenue generation, particularly from its Technology Professional Services Group (CN¥14.47 billion). Recent successful launches of HarmonyOS applications for major financial institutions highlight Chinasoft's expertise and strategic partnerships with Huawei. Financially stable, Chinasoft's short-term assets exceed both its short and long-term liabilities, while debt levels are well-managed with satisfactory coverage by operating cash flow. Earnings growth forecasts at 17.8% annually suggest potential upside amidst stable weekly volatility and experienced management oversight.

- Click here to discover the nuances of Chinasoft International with our detailed analytical financial health report.

- Examine Chinasoft International's earnings growth report to understand how analysts expect it to perform.

Pci Technology GroupLtd (SHSE:600728)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pci Technology Group Co., Ltd. specializes in providing artificial intelligence technology and products in China, with a market cap of CN¥8.94 billion.

Operations: The company generates CN¥7.34 billion in revenue from its Software and IT Services segment.

Market Cap: CN¥8.94B

Pci Technology Group Co., Ltd., with a market cap of CN¥8.94 billion, faces challenges despite its strong revenue from the Software and IT Services segment (CN¥7.34 billion). The company’s short-term assets (CN¥8.9 billion) cover both short-term (CN¥5.8 billion) and long-term liabilities (CN¥232.1 million), indicating solid liquidity management; however, it reported a net loss of CN¥193.05 million for the nine months ending September 2024, compared to a previous net income of CN¥183.2 million in the same period last year, highlighting profitability concerns amidst declining earnings over recent years and low return on equity at 0.2%.

- Dive into the specifics of Pci Technology GroupLtd here with our thorough balance sheet health report.

- Assess Pci Technology GroupLtd's previous results with our detailed historical performance reports.

Summing It All Up

- Investigate our full lineup of 5,702 Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:354

Chinasoft International

Engages in development and provision of information technology (IT) solutions, IT outsourcing, and training services in the People’s Republic of China, the United States, Malaysia, Japan, Singapore, India, and Saudi Arabia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives