- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2549

Exploring October 2024's Undiscovered Gems in Hong Kong Stocks

Reviewed by Simply Wall St

The Hong Kong stock market has experienced a significant upswing, with the Hang Seng Index climbing 10.2% in response to optimism surrounding Beijing's extensive support measures, despite ongoing global tensions and economic uncertainties. In this dynamic environment, identifying stocks that demonstrate resilience and potential for growth becomes crucial, particularly those that can navigate current geopolitical challenges and capitalize on supportive economic policies.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Lvji Technology Holdings | 3.06% | 4.56% | -1.87% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China, with a market capitalization of approximately HK$14.92 billion.

Operations: The company generates revenue primarily from the extraction and sale of coal products in China. It has a market capitalization of approximately HK$14.92 billion.

Kinetic Development Group, a smaller player in the market, has shown robust financial health with its debt to equity ratio decreasing from 28.4% to 12.5% over five years. The company reported impressive earnings growth of 39.2%, outpacing the industry average of 4.6%. Trading at a substantial discount of 54% below estimated fair value, it also announced a special dividend of HK$0.04 per share recently, reflecting strong cash flow and profitability prospects.

Bank of Gansu (SEHK:2139)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank of Gansu Co., Ltd., along with its subsidiary Pingliang Jingning Chengji Rural Bank Co., Ltd., offers a range of banking services in the People’s Republic of China and has a market capitalization of approximately HK$6.78 billion.

Operations: Bank of Gansu generates revenue primarily through retail banking (CN¥2.10 billion) and corporate banking (CN¥1.21 billion), while its financial market operations reported a negative impact of CN¥368.60 million.

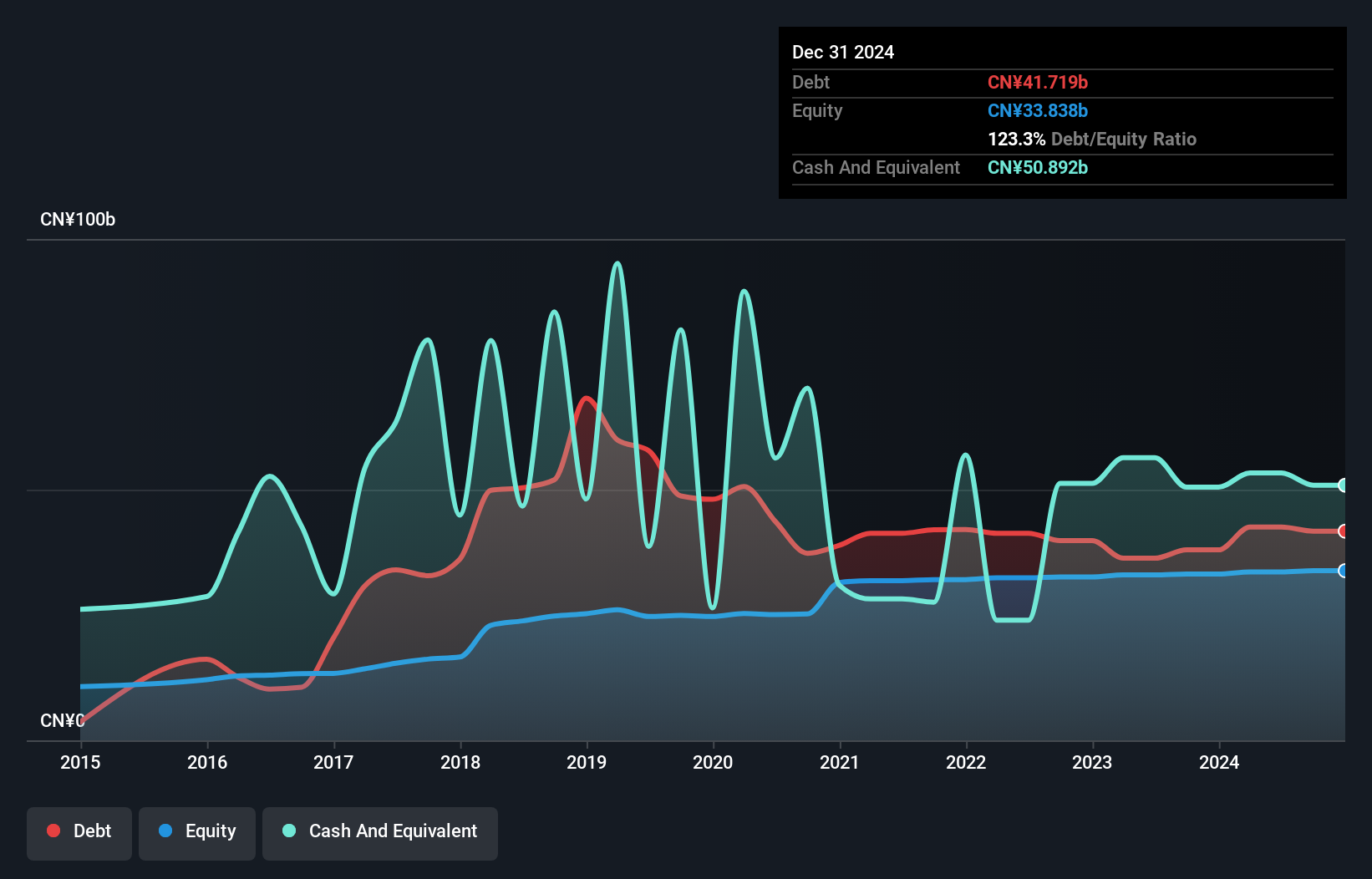

With total assets of CN¥422.2 billion and equity at CN¥33.6 billion, Bank of Gansu stands out with a robust allowance for bad loans at 135%, covering its 1.9% non-performing loan ratio effectively. The bank's funding is primarily low risk, with customer deposits making up 86% of liabilities, ensuring stability despite a volatile share price recently. While earnings have dipped by 6.4% annually over five years, the price-to-earnings ratio remains attractive at 9.7x against the market's 10.6x.

- Dive into the specifics of Bank of Gansu here with our thorough health report.

Gain insights into Bank of Gansu's historical performance by reviewing our past performance report.

Carote (SEHK:2549)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carote Ltd is an investment holding company that offers a variety of kitchenware products to brand-owners and retailers under the CAROTE brand, with a market cap of HK$3.91 billion.

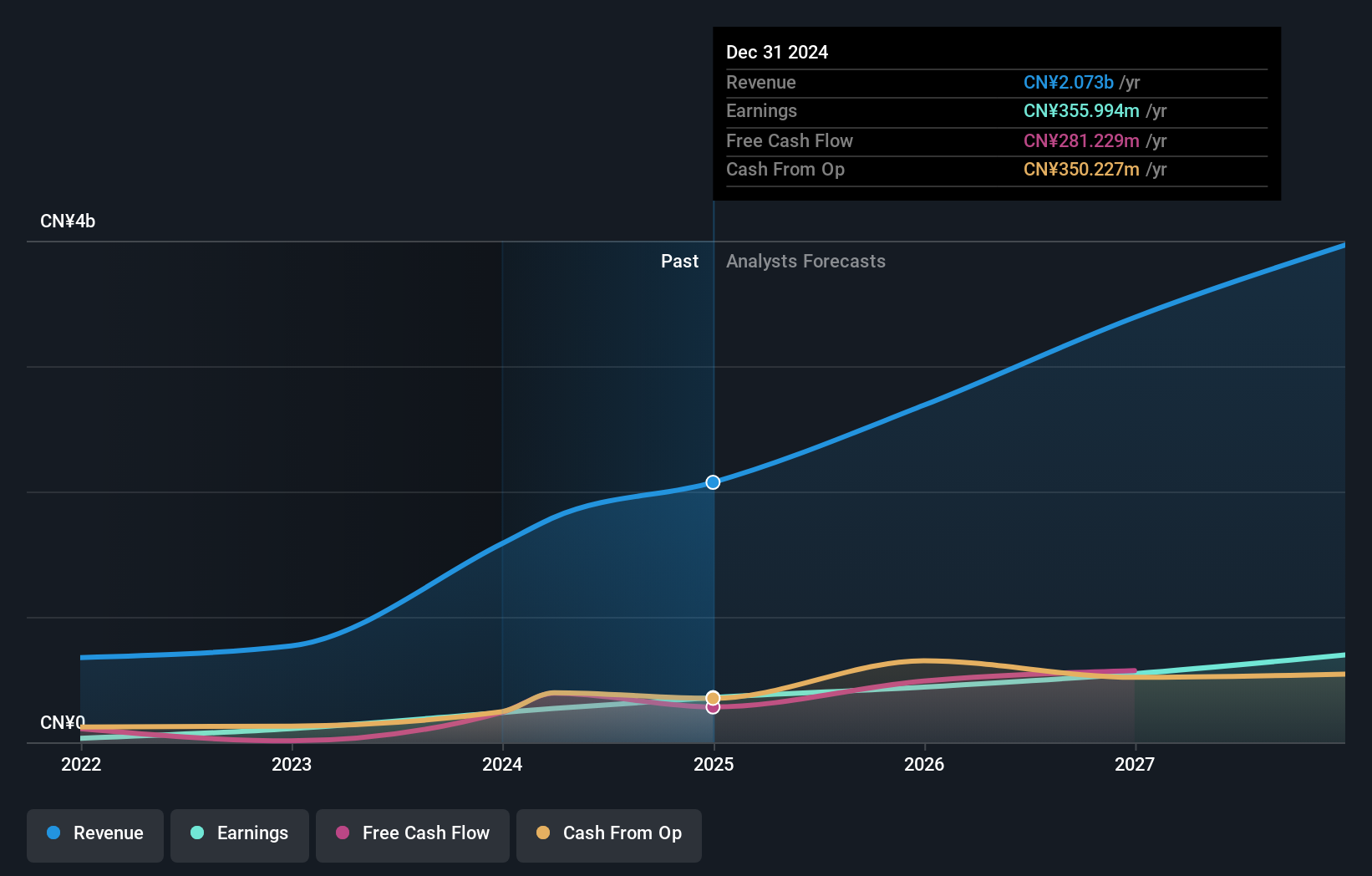

Operations: Carote Ltd generates revenue through two primary segments: the ODM Business, which contributes CN¥210.80 million, and the Branded Business, which brings in CN¥1.58 billion.

Carote recently made waves with a HKD 750.62 million IPO, offering shares at HKD 5.78 each, showcasing its value proposition. Trading at a hefty discount of 77.9% below estimated fair value, Carote's earnings have surged by 92%, outpacing the Consumer Durables industry growth of 20%. The company boasts more cash than total debt and maintains high-quality earnings, although its shares remain highly illiquid in the market.

- Take a closer look at Carote's potential here in our health report.

Explore historical data to track Carote's performance over time in our Past section.

Make It Happen

- Delve into our full catalog of 173 SEHK Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2549

Carote

An investment holding company, provides a range of kitchenware products to brand-owners and retailers under the CAROTE brand.

Exceptional growth potential with excellent balance sheet.