- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2382

High Growth Tech Stocks to Watch in December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating consumer confidence and mixed economic indicators, technology stocks continue to capture investor interest, with the Nasdaq Composite leading recent gains despite some volatility. In this environment, identifying high-growth tech stocks involves considering companies that demonstrate robust innovation potential and resilience amid shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Sunny Optical Technology (Group) (SEHK:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunny Optical Technology (Group) Company Limited is an investment holding company involved in the design, research, development, manufacturing, and sale of optical and optical-related products as well as scientific instruments, with a market capitalization of approximately HK$77.34 billion.

Operations: Sunny Optical Technology (Group) Company Limited generates revenue primarily from three segments: Optical Components, Optical Instruments, and Optoelectronic Products, with the latter contributing CN¥25.10 billion. The company is involved in the full spectrum of activities from design to sale in these areas.

Sunny Optical Technology has demonstrated robust financial performance with earnings growth surpassing the industry average at 17.2% over the past year, notably higher than the electronic industry's 11.7%. This growth trajectory is supported by a significant R&D investment focus, aligning with an annual revenue increase projected at 10.2%. The recent executive shifts, including Mr. Wang Wenjie's appointment as CEO, could signal strategic realignments poised to sustain or even accelerate this momentum in an evolving tech landscape.

China Film (SHSE:600977)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Film Co., Ltd. operates in the production, distribution, projection, technology, service, and innovation of films and television dramas both within China and internationally, with a market cap of CN¥22.18 billion.

Operations: China Film Co., Ltd. generates revenue through various segments including film production, distribution, and projection services both domestically and internationally. The company is involved in technological advancements and service innovations within the film and television industry.

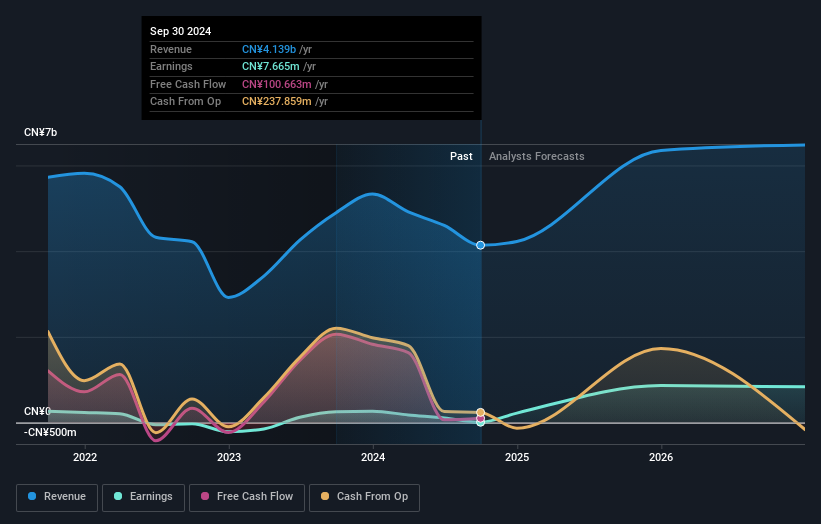

Despite a challenging year with a notable revenue drop from CNY 4.21 billion to CNY 3.02 billion, China Film has managed to maintain a positive trajectory in net income growth, projected at an impressive 84.85% annually. This resilience is underscored by substantial R&D investments aimed at innovation and market adaptation, aligning with their strategic shifts evident from recent high-level meetings and earnings calls. The company's ability to navigate through industry downturns while laying foundations for future growth through focused corporate strategies and shareholder engagement suggests potential for recovery and value creation in the evolving entertainment landscape.

Chengdu Jiafaantai Education TechnologyLtd (SZSE:300559)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Jiafaantai Education Technology Co., Ltd. operates in the education technology sector and has a market capitalization of CN¥4.85 billion.

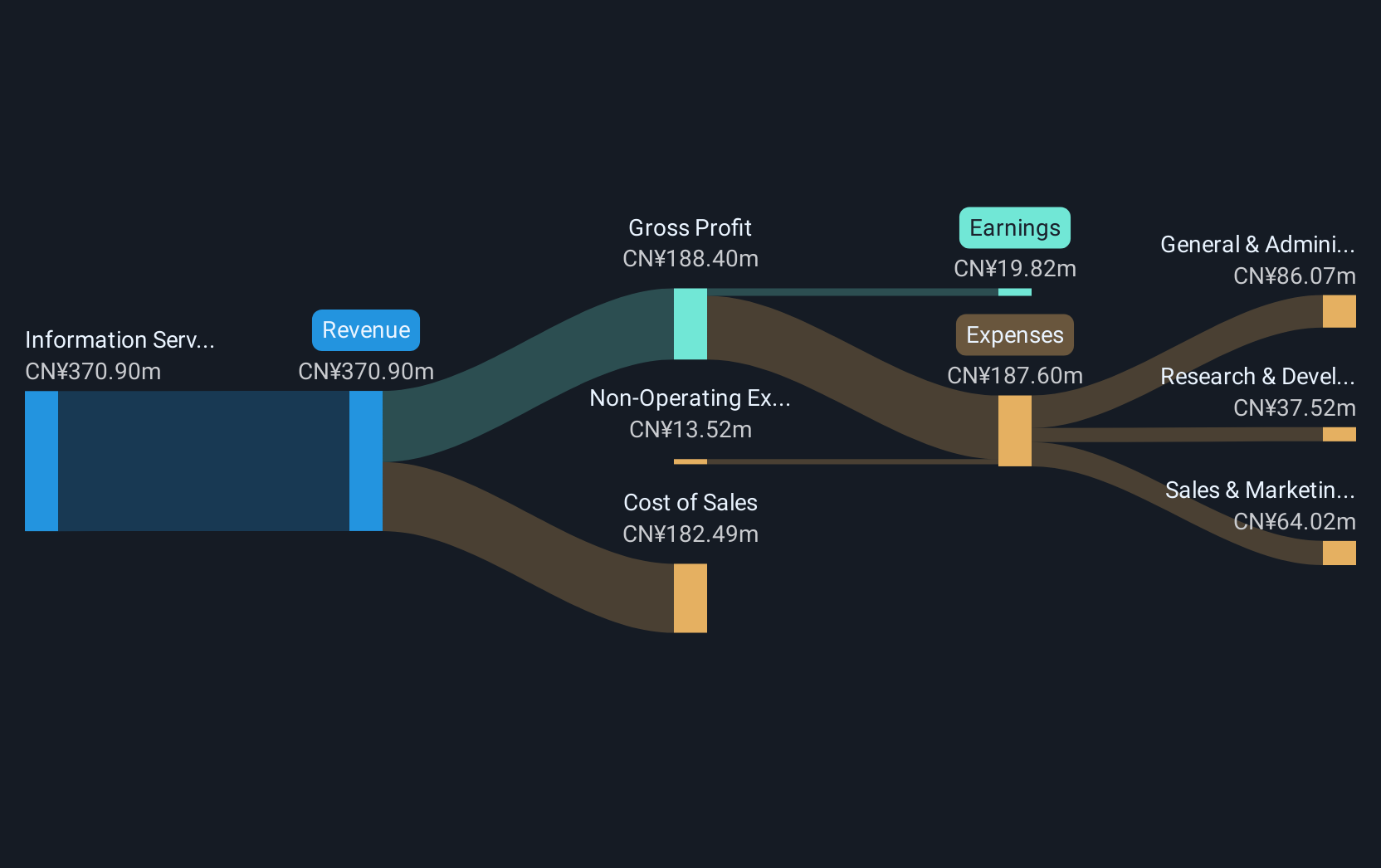

Operations: Chengdu Jiafaantai Education Technology Co., Ltd. generates revenue primarily from its Information Services - Computer Applications segment, which contributes CN¥506.40 million. The company operates within the education technology sector, focusing on delivering computer application services to its clients.

Chengdu Jiafaantai Education TechnologyLtd, recently dropped from the S&P Global BMI Index, faces challenges reflected in its latest financials with a significant revenue decline to CNY 338.03 million from CNY 436.01 million year-over-year and a halved net income of CNY 50.26 million. Despite these hurdles, the company's forecasted annual earnings growth of 42.5% and revenue growth rate of 27.7% outpace the broader Chinese market's projections of 25.5% and 13.7%, respectively, highlighting its potential resilience and adaptability in the competitive education technology sector.

Where To Now?

- Navigate through the entire inventory of 1270 High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2382

Sunny Optical Technology (Group)

An investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives