As December 2024 unfolds, global markets have experienced a mixed bag of results, with U.S. consumer confidence dipping and major stock indexes showing moderate gains despite some mid-week declines. In such a fluctuating market landscape, identifying stocks that may offer value becomes crucial for investors. Penny stocks—though the term might seem outdated—still represent an intriguing investment area, especially when these smaller or newer companies are built on solid financial foundations. This article explores three penny stocks that exhibit financial strength and potential for long-term growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$138.53M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.75 | MYR443.74M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,827 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

AFYREN SAS (ENXTPA:ALAFY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AFYREN SAS produces petroleum-based molecules for various sectors including feed, food, flavors and fragrances, life sciences, materials sciences, lubricants and technical fluids, with a market cap of €60.05 million.

Operations: The company generates revenue through its chemicals segment, amounting to €2.79 million.

Market Cap: €60.05M

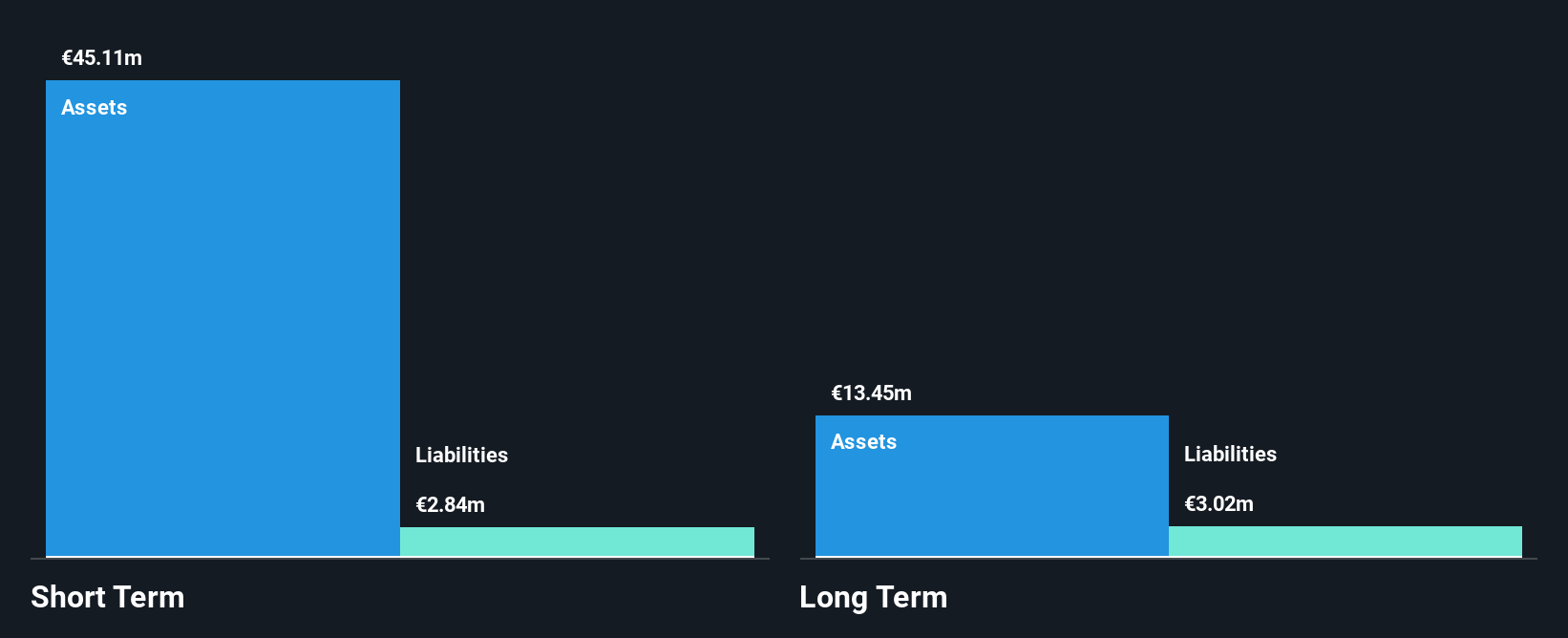

AFYREN SAS, with a market cap of €60.05 million, is currently unprofitable and not expected to achieve profitability in the near term. Despite this, the company has strong liquidity, with short-term assets (€47.2M) exceeding both short- and long-term liabilities. Revenue for the first half of 2024 was €1.36 million, down from €1.96 million a year ago, while net losses slightly increased to €5.32 million. The management team is experienced with an average tenure of 5 years and plans to expand production capacity significantly by 2028 to drive future revenue growth beyond €150 million annually.

- Click to explore a detailed breakdown of our findings in AFYREN SAS' financial health report.

- Learn about AFYREN SAS' future growth trajectory here.

EverChina Int'l Holdings (SEHK:202)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EverChina Int'l Holdings Company Limited is an investment holding company involved in property investment and hotel operations in China and Bolivia, with a market cap of HK$882.62 million.

Operations: The company generates revenue primarily from its agricultural operations, which contributed HK$74.58 million, and property investment operations, adding HK$29.43 million.

Market Cap: HK$882.62M

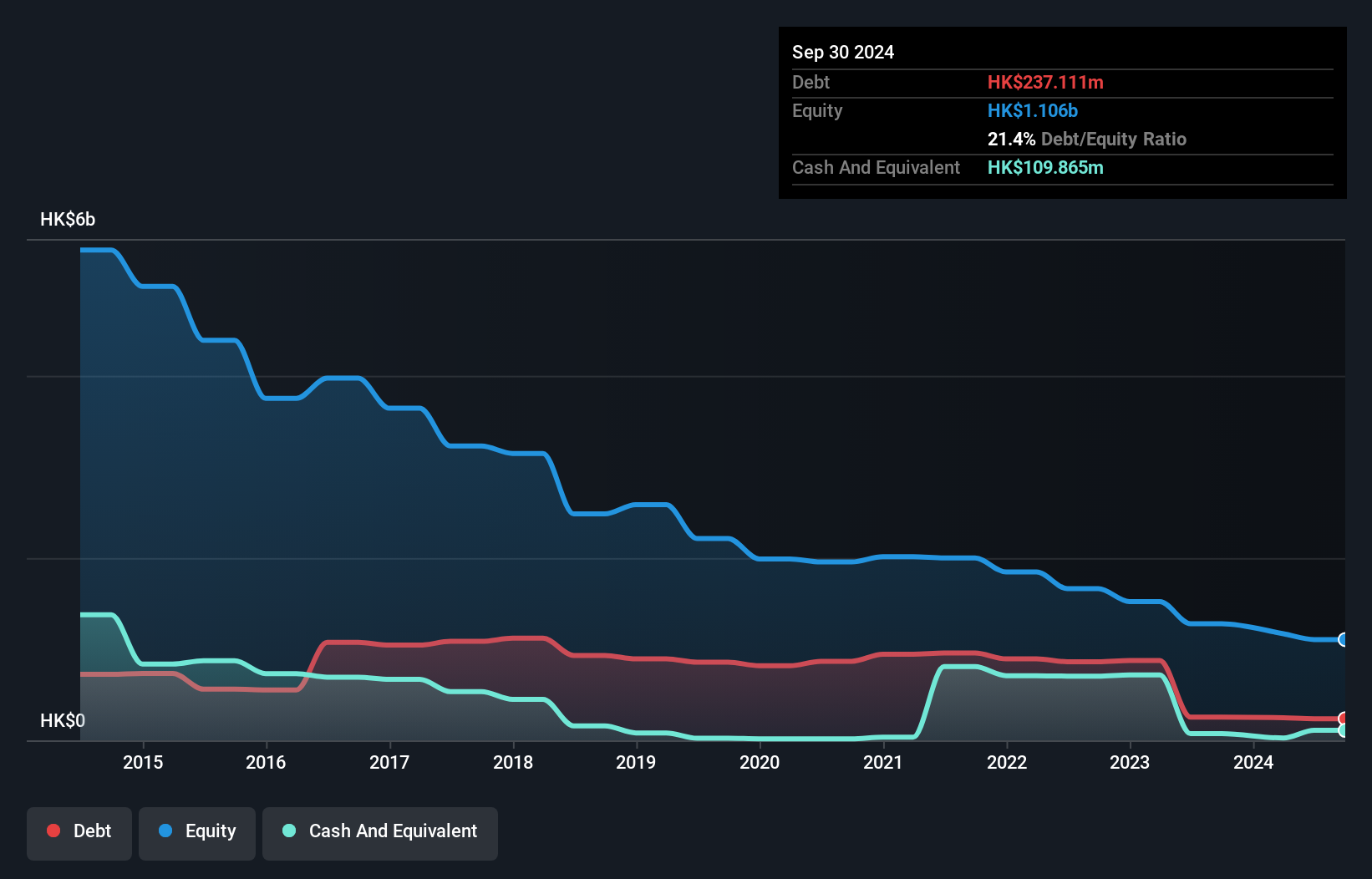

EverChina Int'l Holdings, with a market cap of HK$882.62 million, has shown some improvement despite ongoing challenges. The company reported HK$46.13 million in sales for the half-year ending September 2024, slightly up from the previous year. Although it remains unprofitable with a net loss of HK$67.73 million, losses have reduced over five years at 10% annually. The company's financial position is relatively stable; short-term assets exceed liabilities and its debt-to-equity ratio has improved to 21.4%. Recent board changes include Ms. Wang Xue's appointment as an executive director, potentially enhancing strategic direction given her extensive experience in international investment and operations.

- Navigate through the intricacies of EverChina Int'l Holdings with our comprehensive balance sheet health report here.

- Evaluate EverChina Int'l Holdings' historical performance by accessing our past performance report.

Grand Pharmaceutical Group (SEHK:512)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Grand Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and sale of pharmaceutical preparations, medical devices, biotechnology and healthcare products, and pharmaceutical raw materials with a market cap of HK$16.63 billion.

Operations: The company generates revenue of HK$10.59 billion from its Pharmaceuticals segment.

Market Cap: HK$16.63B

Grand Pharmaceutical Group, with a market cap of HK$16.63 billion, is making strides in the pharmaceutical sector by advancing its innovative product pipeline. Recent developments include the submission of a New Drug Application for GPN01768 to treat Demodex blepharitis in China and the approval of NOVASYNC for coronary imaging. Financially, the company is trading at a significant discount to its estimated fair value and maintains strong interest coverage with EBIT covering interest payments 17.8 times over. Its debt management is prudent, evidenced by satisfactory net debt to equity and well-covered short-term liabilities exceeding HK$8 billion against long-term liabilities of HK$2.6 billion.

- Click here to discover the nuances of Grand Pharmaceutical Group with our detailed analytical financial health report.

- Understand Grand Pharmaceutical Group's earnings outlook by examining our growth report.

Key Takeaways

- Unlock our comprehensive list of 5,827 Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:512

Grand Pharmaceutical Group

An investment holding company, engages in the research and development, manufacture, and sale of pharmaceutical preparations and medical devices, biotechnology and healthcare products, and pharmaceutical raw materials.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives