Billion Industrial Holdings' (HKG:2299 three-year decrease in earnings delivers investors with a 12% loss

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Billion Industrial Holdings Limited (HKG:2299) shareholders, since the share price is down 12% in the last three years, falling well short of the market return of around 80%. The last week also saw the share price slip down another 7.9%.

If the past week is anything to go by, investor sentiment for Billion Industrial Holdings isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

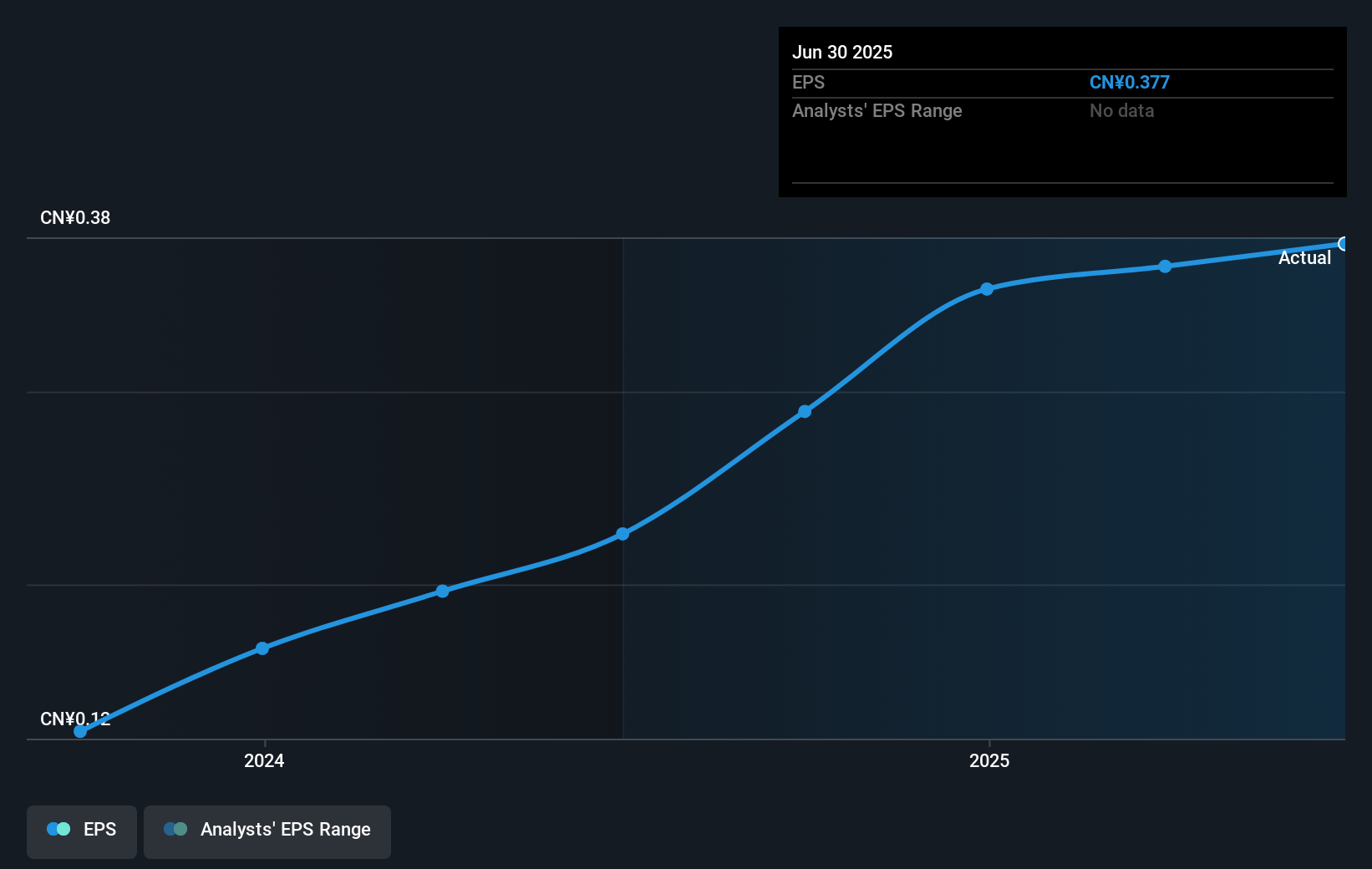

During the three years that the share price fell, Billion Industrial Holdings' earnings per share (EPS) dropped by 21% each year. In comparison the 4% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Billion Industrial Holdings' earnings, revenue and cash flow.

A Different Perspective

Billion Industrial Holdings shareholders are up 8.3% for the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 0.6% per year over five year. This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Billion Industrial Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Billion Industrial Holdings , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Billion Industrial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2299

Billion Industrial Holdings

Engages in manufacturing and sales of polyester filament yarns, polyester, polyester industrial yarns, and ES fiber products in the People’s Republic of China and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives