- Hong Kong

- /

- Consumer Durables

- /

- SEHK:229

Investor Optimism Abounds Raymond Industrial Limited (HKG:229) But Growth Is Lacking

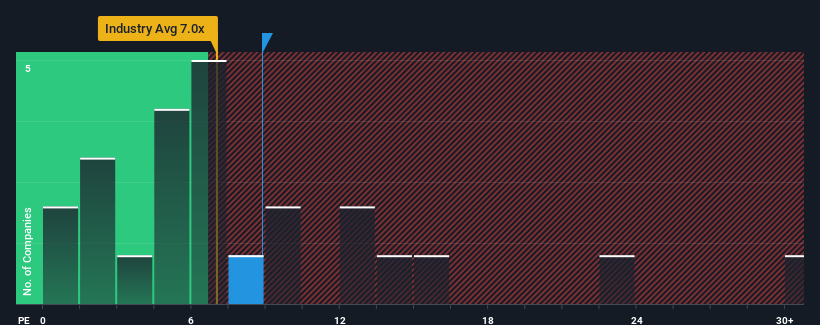

There wouldn't be many who think Raymond Industrial Limited's (HKG:229) price-to-earnings (or "P/E") ratio of 8.9x is worth a mention when the median P/E in Hong Kong is similar at about 9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

The earnings growth achieved at Raymond Industrial over the last year would be more than acceptable for most companies. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for Raymond Industrial

Is There Some Growth For Raymond Industrial?

In order to justify its P/E ratio, Raymond Industrial would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 15%. However, this wasn't enough as the latest three year period has seen a very unpleasant 2.5% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's an unpleasant look.

With this information, we find it concerning that Raymond Industrial is trading at a fairly similar P/E to the market. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

What We Can Learn From Raymond Industrial's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Raymond Industrial currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Raymond Industrial has 2 warning signs (and 1 which can't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:229

Raymond Industrial

Engages in the manufacture and sale of electrical home appliances in Asia, Europe, Latin America, North America, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives