- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2285

Optimistic Investors Push Chervon Holdings Limited (HKG:2285) Shares Up 37% But Growth Is Lacking

Chervon Holdings Limited (HKG:2285) shares have continued their recent momentum with a 37% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

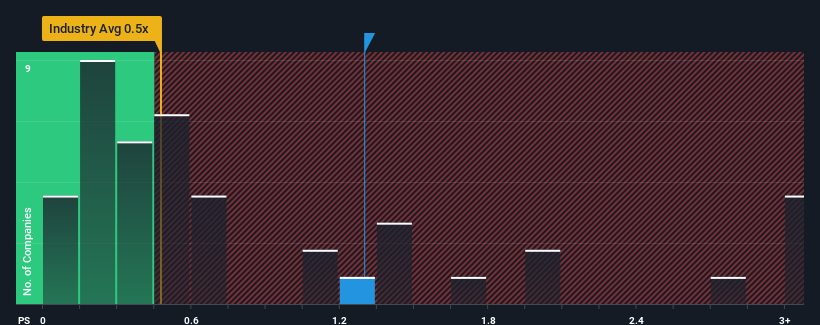

Since its price has surged higher, given close to half the companies operating in Hong Kong's Consumer Durables industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Chervon Holdings as a stock to potentially avoid with its 1.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Chervon Holdings

What Does Chervon Holdings' P/S Mean For Shareholders?

Recent times haven't been great for Chervon Holdings as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chervon Holdings.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Chervon Holdings would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 31%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 15% each year over the next three years. With the industry predicted to deliver 13% growth per year, the company is positioned for a comparable revenue result.

With this information, we find it interesting that Chervon Holdings is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Chervon Holdings' P/S

Chervon Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given Chervon Holdings' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Chervon Holdings you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2285

Chervon Holdings

Engages in the research, development, manufacture, testing, sale, and after-sale servicing of power tools, outdoor power equipment, and related products in North America, Europe, China, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success