Cabbeen Fashion Limited's (HKG:2030) Share Price Not Quite Adding Up

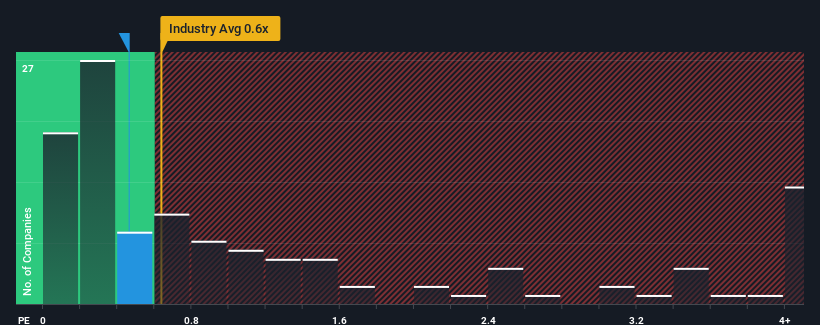

There wouldn't be many who think Cabbeen Fashion Limited's (HKG:2030) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Luxury industry in Hong Kong is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Cabbeen Fashion

What Does Cabbeen Fashion's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Cabbeen Fashion's revenue has been unimpressive. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. Those who are bullish on Cabbeen Fashion will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Cabbeen Fashion's earnings, revenue and cash flow.How Is Cabbeen Fashion's Revenue Growth Trending?

Cabbeen Fashion's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 34% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 12% shows it's an unpleasant look.

With this in mind, we find it worrying that Cabbeen Fashion's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We find it unexpected that Cabbeen Fashion trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

You should always think about risks. Case in point, we've spotted 2 warning signs for Cabbeen Fashion you should be aware of, and 1 of them is potentially serious.

If these risks are making you reconsider your opinion on Cabbeen Fashion, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2030

Cabbeen Fashion

A fashion casual menswear company, designs and sells apparel, shoes, and accessories for men, women, and kids under the Cabbeen, Cabbeen Urban, and 2AM brands in the People’s Republic of China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives