Cabbeen Fashion (HKG:2030) earnings and shareholder returns have been trending downwards for the last three years, but the stock spikes 12% this past week

This week we saw the Cabbeen Fashion Limited (HKG:2030) share price climb by 12%. But that is small recompense for the exasperating returns over three years. In that time, the share price dropped 56%. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Cabbeen Fashion

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Cabbeen Fashion became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

With a rather small yield of just 1.4% we doubt that the stock's share price is based on its dividend. Arguably the revenue decline of 12% per year has people thinking Cabbeen Fashion is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

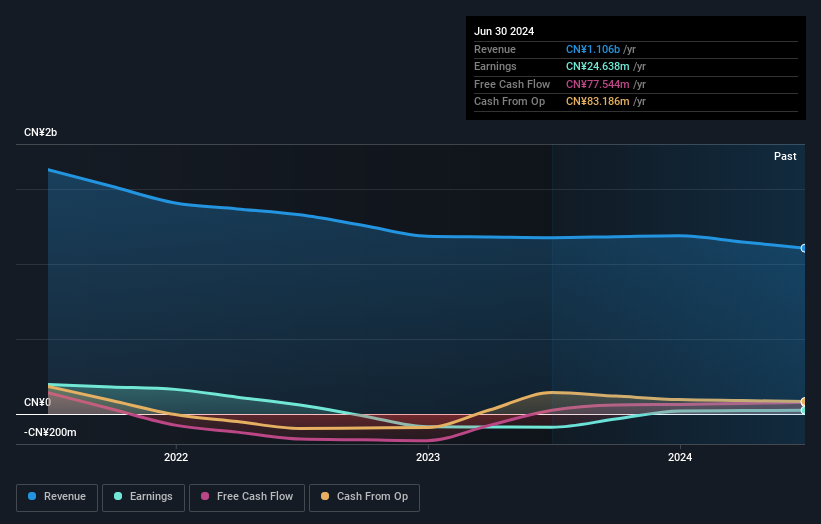

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Cabbeen Fashion shareholders gained a total return of 27% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 0.8% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Cabbeen Fashion .

Cabbeen Fashion is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2030

Cabbeen Fashion

A fashion casual menswear company, designs and retails apparel, shoes, and accessories for men, women, and kids under the Cabbeen, Cabbeen Lifestyle, Cabbeen Urban, Cabbeen Love, and 2AM brands in the People’s Republic of China.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives