Key Things To Understand About China Environmental Technology and Bioenergy Holdings' (HKG:1237) CEO Pay Cheque

The CEO of China Environmental Technology and Bioenergy Holdings Limited (HKG:1237) is Zheyan Wu, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for China Environmental Technology and Bioenergy Holdings.

View our latest analysis for China Environmental Technology and Bioenergy Holdings

How Does Total Compensation For Zheyan Wu Compare With Other Companies In The Industry?

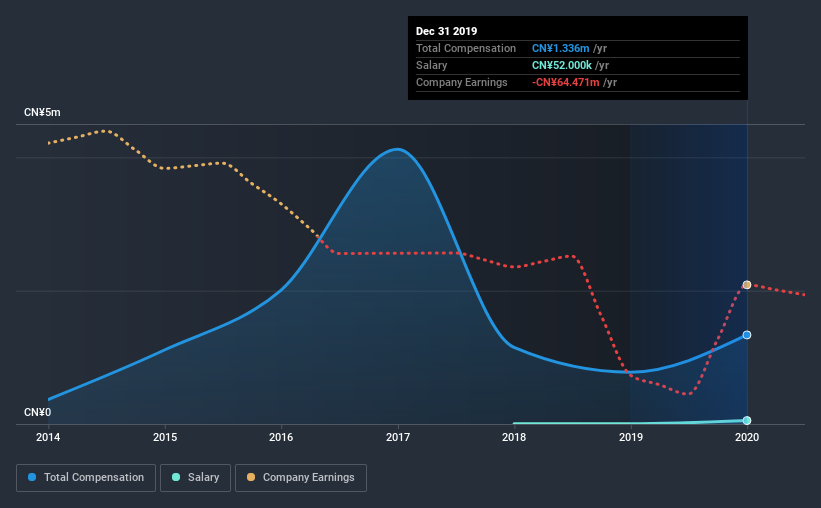

At the time of writing, our data shows that China Environmental Technology and Bioenergy Holdings Limited has a market capitalization of HK$122m, and reported total annual CEO compensation of CN¥1.3m for the year to December 2019. We note that's an increase of 72% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥52k.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥1.6m. So it looks like China Environmental Technology and Bioenergy Holdings compensates Zheyan Wu in line with the median for the industry. Furthermore, Zheyan Wu directly owns HK$363k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥52k | CN¥4.0k | 4% |

| Other | CN¥1.3m | CN¥773k | 96% |

| Total Compensation | CN¥1.3m | CN¥777k | 100% |

Speaking on an industry level, nearly 72% of total compensation represents salary, while the remainder of 28% is other remuneration. Interestingly, the company has chosen to go down an unconventional route in that it pays a smaller salary to Zheyan Wu as compared to non-salary compensation over the one-year period examined. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at China Environmental Technology and Bioenergy Holdings Limited's Growth Numbers

Over the last three years, China Environmental Technology and Bioenergy Holdings Limited has shrunk its earnings per share by 32% per year. Its revenue is down 15% over the previous year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has China Environmental Technology and Bioenergy Holdings Limited Been A Good Investment?

Given the total shareholder loss of 86% over three years, many shareholders in China Environmental Technology and Bioenergy Holdings Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

China Environmental Technology and Bioenergy Holdings primarily uses non-salary benefits to reward its CEO. As previously discussed, Zheyan is compensated close to the median for companies of its size, and which belong to the same industry. Meanwhile, EPS growth and shareholder returns have been in the red for the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 4 warning signs (and 1 which can't be ignored) in China Environmental Technology and Bioenergy Holdings we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade China Environmental Technology and Bioenergy Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1237

China Environmental Technology and Bioenergy Holdings

An investment holding company, manufactures and sells outdoor wooden products in the People's Republic of China, North America, Europe, other Asia Pacific, and Australasia.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives