- Hong Kong

- /

- Commercial Services

- /

- SEHK:895

Strong week for Dongjiang Environmental (HKG:895) shareholders doesn't alleviate pain of five-year loss

Dongjiang Environmental Company Limited (HKG:895) shareholders should be happy to see the share price up 21% in the last month. But don't envy holders -- looking back over 5 years the returns have been really bad. The share price has failed to impress anyone , down a sizable 64% during that time. So we're hesitant to put much weight behind the short term increase. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

While the stock has risen 21% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Dongjiang Environmental

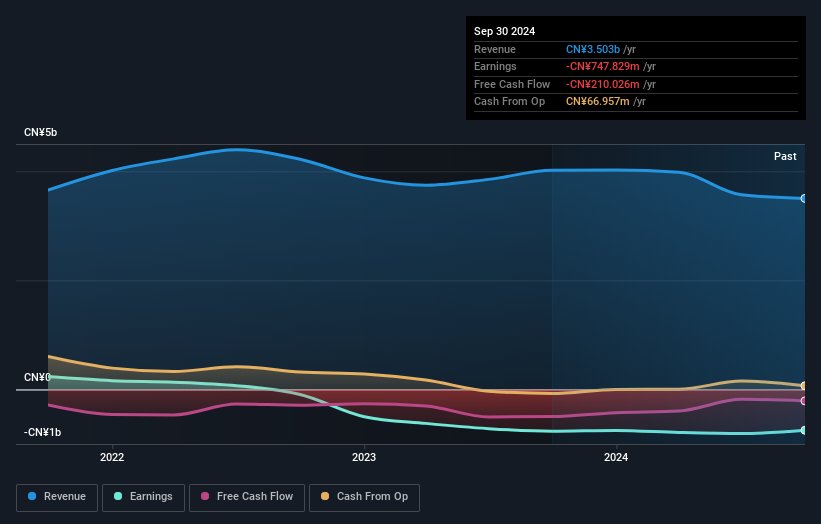

Because Dongjiang Environmental made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Dongjiang Environmental saw its revenue increase by 3.5% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 10% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Dongjiang Environmental stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Dongjiang Environmental's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Dongjiang Environmental shareholders, and that cash payout explains why its total shareholder loss of 60%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Dongjiang Environmental shareholders are up 30% for the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 10% per year, over five years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Dongjiang Environmental better, we need to consider many other factors. For instance, we've identified 2 warning signs for Dongjiang Environmental that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

If you're looking to trade Dongjiang Environmental, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:895

Dongjiang Environmental

Provides environmental services in the People’s Republic of China.

Very low and overvalued.