- Hong Kong

- /

- Professional Services

- /

- SEHK:8462

Here's Why Omnibridge Holdings (HKG:8462) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Omnibridge Holdings (HKG:8462). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Omnibridge Holdings

Omnibridge Holdings' Improving Profits

Over the last three years, Omnibridge Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Omnibridge Holdings' EPS grew from S$0.0016 to S$0.0031, over the previous 12 months. Year on year growth of 97% is certainly a sight to behold.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The previous 12 months are something that Omnibridge Holdings will want to put behind them after seeing a drop in EBIT margin and revenue for the period. This is less than stellar for the company.

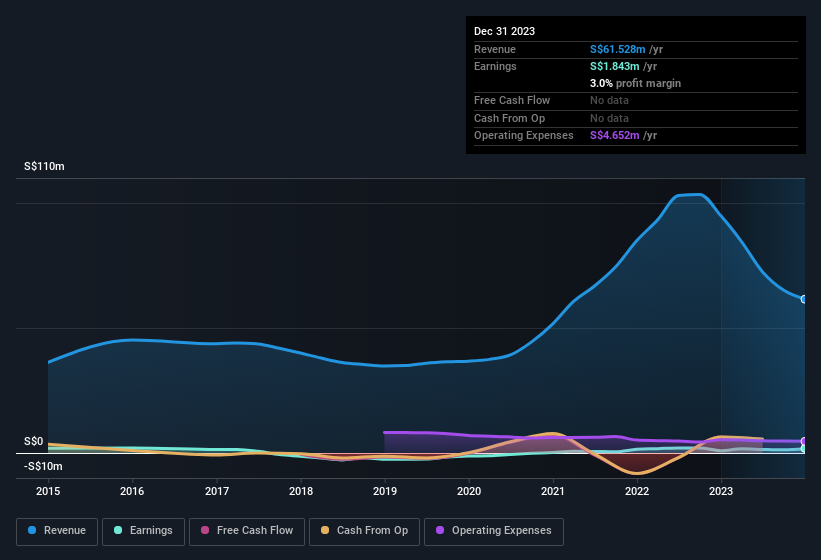

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Omnibridge Holdings isn't a huge company, given its market capitalisation of HK$56m. That makes it extra important to check on its balance sheet strength.

Are Omnibridge Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Omnibridge Holdings shares, in the last year. Add in the fact that Daoji Lin, the Independent Non-Executive Director of the company, paid S$83k for shares at around S$0.078 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Is Omnibridge Holdings Worth Keeping An Eye On?

Omnibridge Holdings' earnings have taken off in quite an impressive fashion. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Omnibridge Holdings on your watchlist. However, before you get too excited we've discovered 3 warning signs for Omnibridge Holdings (2 are a bit unpleasant!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Omnibridge Holdings, you'll probably love this curated collection of companies in HK that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8462

Omnibridge Holdings

An investment holding company, provides human resources outsourcing and recruitment services to public and private sectors in Singapore and Hong Kong.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success