- Hong Kong

- /

- Commercial Services

- /

- SEHK:8315

Greatwalle Inc. (HKG:8315) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

To the annoyance of some shareholders, Greatwalle Inc. (HKG:8315) shares are down a considerable 27% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 74% share price decline.

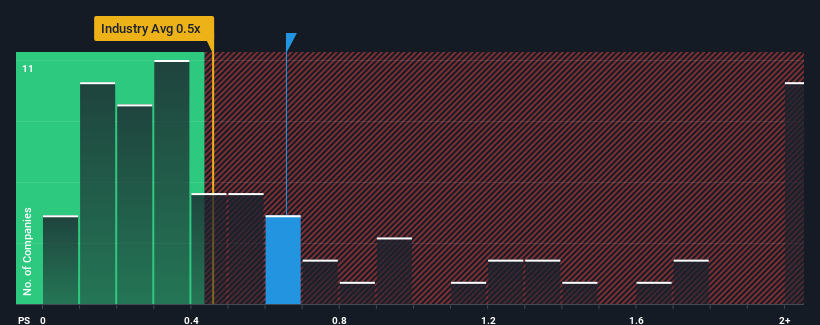

Although its price has dipped substantially, it's still not a stretch to say that Greatwalle's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Commercial Services industry in Hong Kong, where the median P/S ratio is around 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Greatwalle

How Has Greatwalle Performed Recently?

The recent revenue growth at Greatwalle would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on Greatwalle will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Greatwalle's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Greatwalle's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 6.0% gain to the company's revenues. The latest three year period has also seen a 21% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 9.1% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it interesting that Greatwalle is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Greatwalle's P/S

With its share price dropping off a cliff, the P/S for Greatwalle looks to be in line with the rest of the Commercial Services industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Greatwalle revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Greatwalle, and understanding them should be part of your investment process.

If you're unsure about the strength of Greatwalle's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8315

Century Plaza Hotel Group

An investment holding company, provides security guarding services in Hong Kong and the People’s Republic of China.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives