- Hong Kong

- /

- Infrastructure

- /

- SEHK:1785

Discovering Undiscovered Gems in Hong Kong for October 2024

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields, Hong Kong's Hang Seng Index has seen a slight decline amidst broader economic adjustments in China. In this environment, investors may find opportunities in small-cap stocks that demonstrate resilience and potential for growth despite macroeconomic challenges. Identifying a promising stock often involves looking for companies with strong fundamentals and innovative strategies that can withstand market fluctuations and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Datang Environment Industry Group (SEHK:1272)

Simply Wall St Value Rating: ★★★★★★

Overview: Datang Environment Industry Group Co., Ltd. operates in the environmental protection industry, focusing on flue gas desulfurization and denitrification, water treatment, and solid waste treatment services with a market cap of HK$2.55 billion.

Operations: Datang Environment Industry Group generates revenue primarily from its environmental protection services, including flue gas desulfurization and denitrification, water treatment, and solid waste management. The company's financial performance is influenced by the cost structure associated with these services.

Datang Environment Industry Group has shown strong financial performance with a notable 64% earnings growth over the past year, outpacing the Commercial Services industry. The company's debt to equity ratio improved significantly from 83.5% to 41.8% over five years, indicating effective debt management. Interest payments are well covered with an EBIT coverage of 5.9 times, reflecting solid operational efficiency. Recent earnings reports highlight a net income increase to CNY 463 million for nine months ending September 2024, up from CNY 393 million last year, showcasing robust profitability despite slightly lower sales figures compared to the previous year.

- Click here to discover the nuances of Datang Environment Industry Group with our detailed analytical health report.

Learn about Datang Environment Industry Group's historical performance.

Chengdu Expressway (SEHK:1785)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chengdu Expressway Co., Ltd. is involved in the development, operation, and management of expressways in Chengdu, Sichuan province, China, with a market capitalization of HK$3.86 billion.

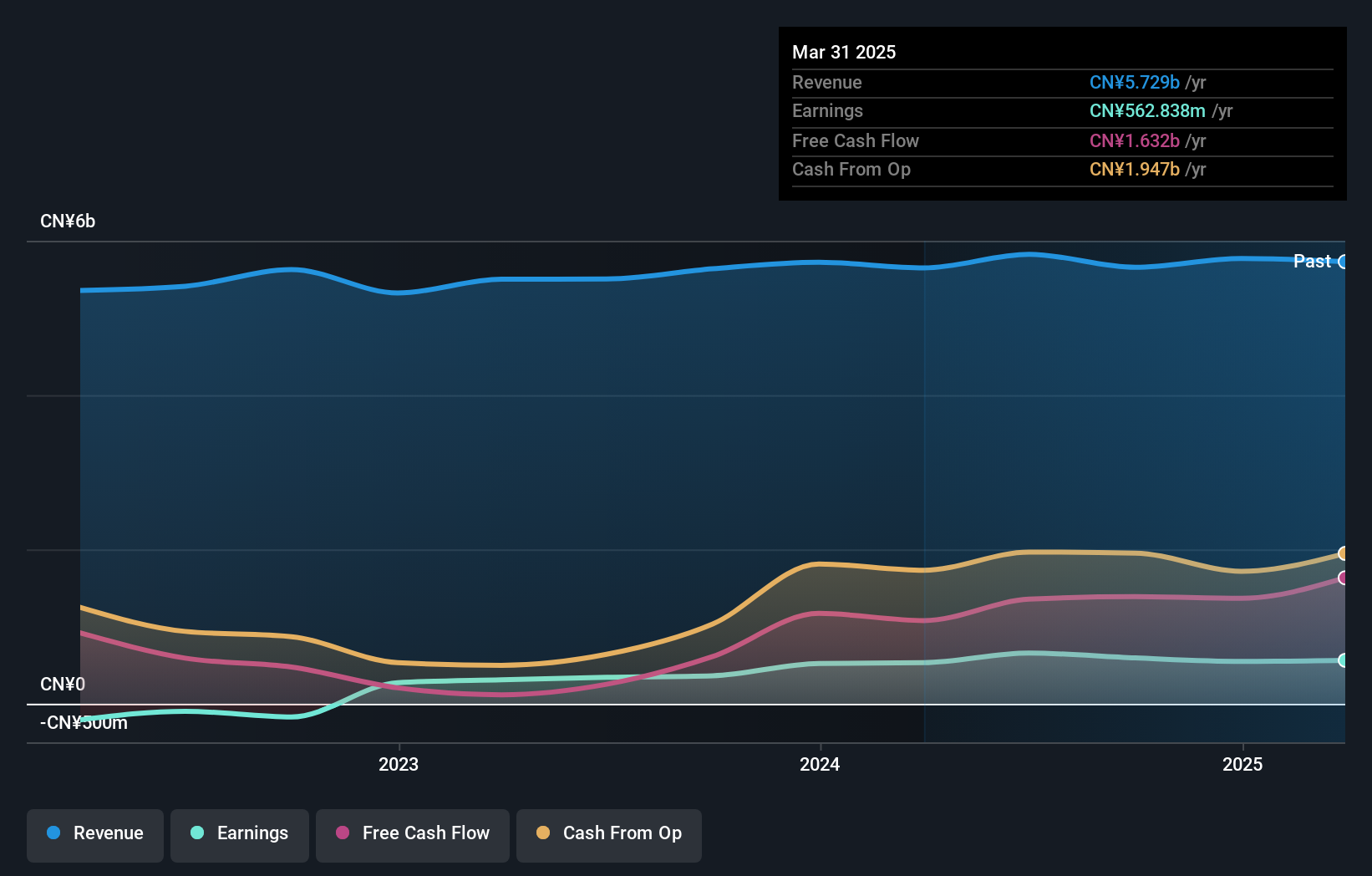

Operations: Chengdu Expressway generates revenue primarily from its expressway operations, contributing CN¥1.59 billion, and energy segment, adding CN¥1.32 billion.

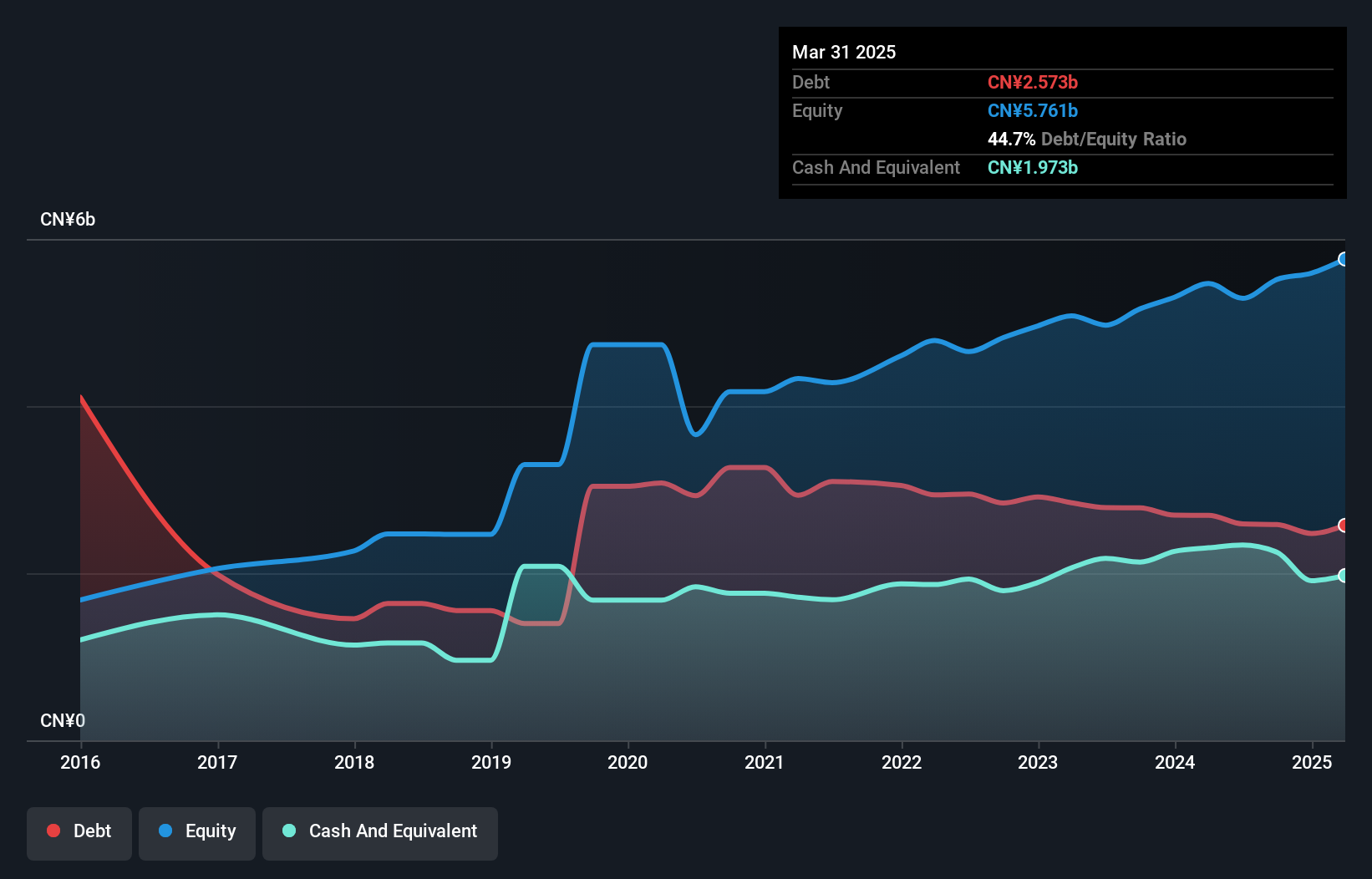

Chengdu Expressway, a modest player in the infrastructure sector, has been making waves with its robust financial health. The company reported sales of CNY 1.41 billion for the first half of 2024, slightly up from CNY 1.40 billion last year, though net income dipped to CNY 291 million from CNY 319 million. Despite this slip in earnings per share to CNY 0.18 from CNY 0.19, its interest payments are comfortably covered by EBIT at an impressive ratio of 18 times. Trading at a significant discount of over half its estimated fair value and boasting a satisfactory net debt to equity ratio of just under five percent further highlights its potential as an undervalued opportunity within the industry landscape.

Luzhou Bank (SEHK:1983)

Simply Wall St Value Rating: ★★★★★★

Overview: Luzhou Bank Co., Ltd. operates in the People’s Republic of China, offering corporate and retail banking as well as financial market services, with a market cap of approximately HK$4.67 billion.

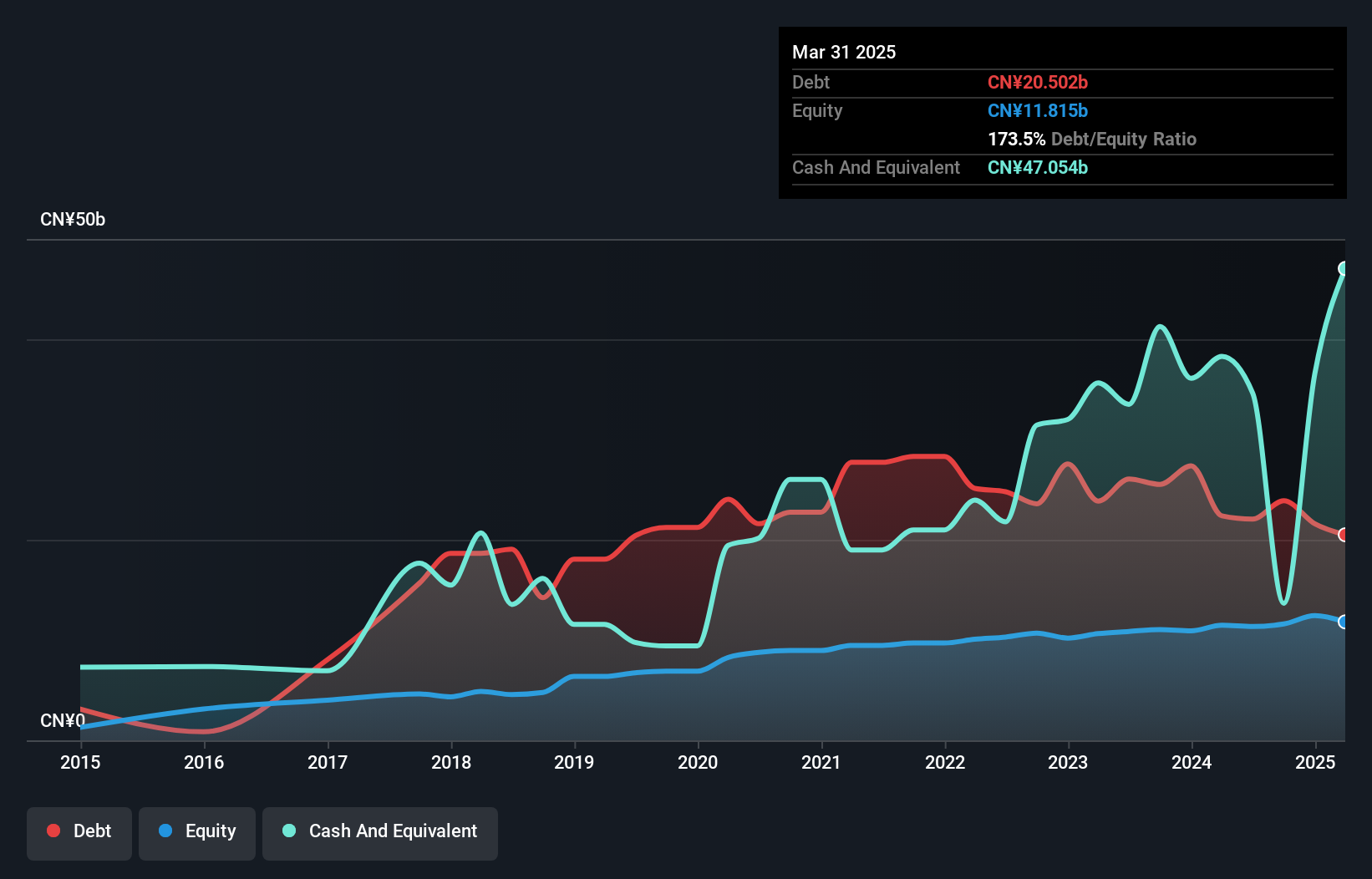

Operations: Luzhou Bank generates revenue primarily through corporate and retail banking services, alongside financial market activities. The bank's net profit margin has shown variability, reflecting changes in income and expenses over time.

Luzhou Bank, a smaller financial player in Hong Kong, showcases solid fundamentals with total assets of CN¥165.2 billion and equity of CN¥11.4 billion. Its net interest margin stands at 2.4%, while it holds a sufficient allowance for bad loans at 1.3% of total loans, indicating prudent risk management. Impressively, earnings surged by 38% over the past year, outpacing the industry average growth rate of 3%. The bank relies on low-risk funding sources for 83% of its liabilities, primarily through customer deposits rather than external borrowing—an approach contributing to its robust financial health and potential undervaluation in the market.

- Take a closer look at Luzhou Bank's potential here in our health report.

Assess Luzhou Bank's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Reveal the 166 hidden gems among our SEHK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1785

Chengdu Expressway

Engages in the development, operation, and management of expressways located in Mainland China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives