Assessing Ubtech Robotics (SEHK:9880) Valuation as Investors Reevaluate Growth Prospects

Reviewed by Kshitija Bhandaru

See our latest analysis for Ubtech Robotics.

After a jumpy ride this year, Ubtech Robotics’ share price has pushed modestly higher, with a 1-year total shareholder return of 0.46%. This suggests momentum is still vulnerable but not fading. Though there hasn’t been a major headline event recently, the stock’s latest moves reflect investors’ shifting appetite for growth and evolving risk perceptions as Ubtech’s fundamentals continue to improve.

If you’re rethinking your watchlist, this could be the right moment to discover fast growing stocks with high insider ownership

With impressive revenue gains but profits still elusive and shares trading close to analyst targets, the real question is whether Ubtech is still undervalued or if future growth is already fully reflected in the price.

Price-to-Sales of 47.1x: Is it justified?

Ubtech Robotics trades at a staggering price-to-sales ratio of 47.1x, well above both its industry peers and historical fair value levels. With a last close of HK$157.3, the stock’s pricing implies investors are expecting extraordinary revenue growth or future profitability far in excess of current benchmarks.

The price-to-sales multiple tells us how much investors are willing to pay for each dollar of revenue. This is a common yardstick for high-growth tech firms, especially those not yet profitable. At 47.1x, Ubtech’s valuation dwarfs the Hong Kong Machinery industry average and raises questions about whether rapid top-line expansions can truly justify such a premium.

Compared to industry peers (0.9x on average) and a computed fair price-to-sales ratio of 5.9x, Ubtech’s current level looks highly elevated. The market could be pricing in aggressive future growth, but this figure is well outside the typical range even for innovative players. If sentiment or growth forecasts falter, this ratio may be poised to compress toward more conventional benchmarks.

Explore the SWS fair ratio for Ubtech Robotics

Result: Price-to-Sales of 47.1x (OVERVALUE)

However, with profits still negative and shares trading above analyst targets, any slowdown in revenue growth could quickly reverse recent gains.

Find out about the key risks to this Ubtech Robotics narrative.

Another View: SWS DCF Model Weighs In

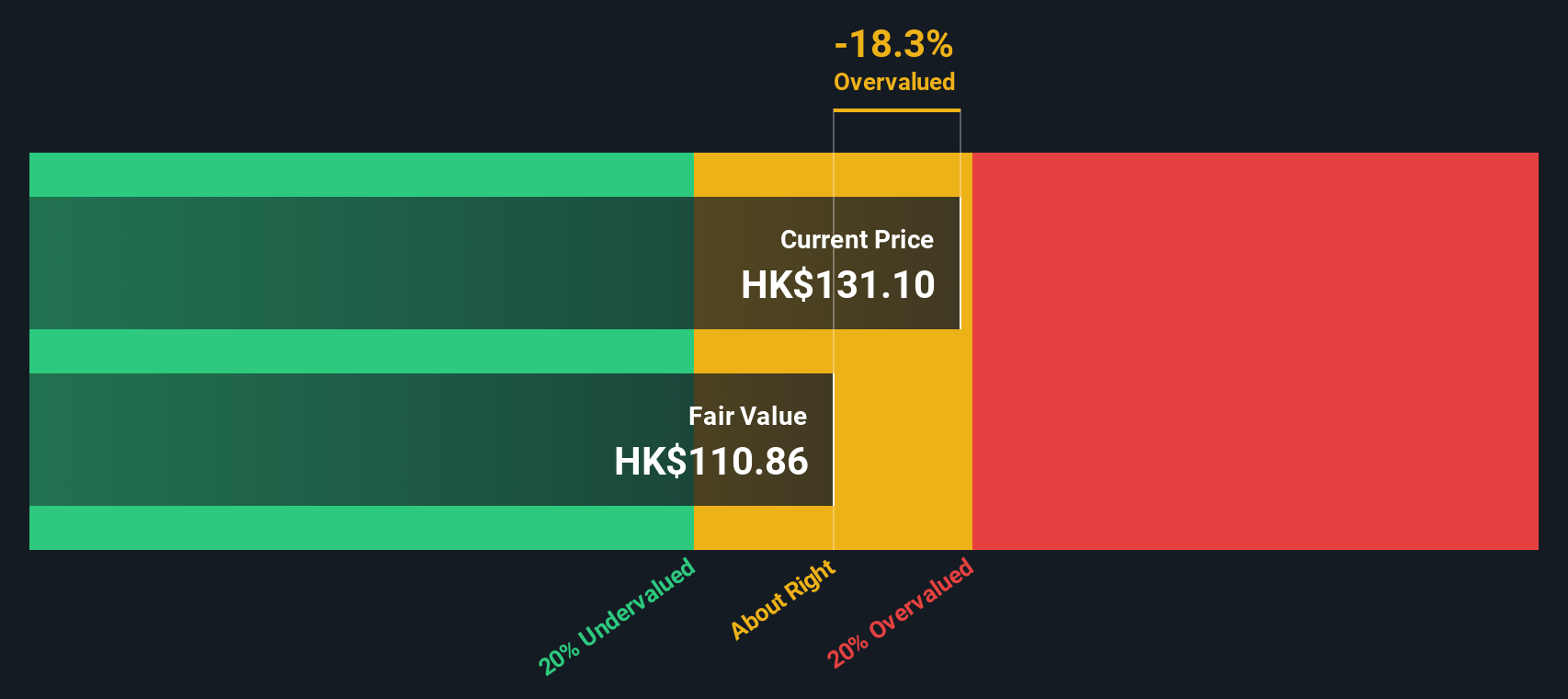

Taking a different approach, the SWS DCF model puts Ubtech’s fair value at only HK$112.28, well below the latest close of HK$157.3. This paints a sharply contrasting picture with the premium suggested by revenue multiples and hints at significant downside risk if cash flows are prioritized. Which lens will investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ubtech Robotics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ubtech Robotics Narrative

If these perspectives don’t align with your outlook or you’d rather dive into the numbers yourself, you can craft a personal take on Ubtech’s prospects in just a few minutes with Do it your way.

A great starting point for your Ubtech Robotics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Get ahead of the crowd and uncover stocks you might be missing. The market rewards those who look beyond the obvious. Make your next smart investing move with these screens:

- Boost your portfolio's yield by targeting higher-income opportunities with these 19 dividend stocks with yields > 3% yielding over 3%.

- Ride the momentum powering tomorrow’s breakthroughs by tapping into these 24 AI penny stocks at the intersection of artificial intelligence and rapid business growth.

- Catch compelling bargains backed by strong cash flows through these 893 undervalued stocks based on cash flows vetted for value, not just hype.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9880

Ubtech Robotics

Engages in the research, design, development, production, commercialization, marketing, and sale of robotic products and services in China and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives