As global markets navigate the complexities of recent interest rate cuts and fluctuating tech valuations, many investors are seeking opportunities in less conventional areas. Penny stocks, though often overlooked, can still offer intriguing growth prospects, particularly when these smaller or newer companies demonstrate strong financial health. This article will highlight several penny stocks that combine robust balance sheets with the potential for long-term success in today's evolving market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.50 | HK$896.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.14 | £474.95M | ✅ 5 ⚠️ 0 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.07 | SGD433.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6425 | $373.5M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.21 | MYR323.58M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.11 | £178.63M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,624 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China Dongxiang (Group) (SEHK:3818)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Dongxiang (Group) Co., Ltd. operates in the design, development, marketing, and sale of sport-related apparel, footwear, and accessories both in China and internationally with a market cap of HK$2.79 billion.

Operations: The company generates revenue primarily from its China sporting goods segment, amounting to CN¥1.68 billion.

Market Cap: HK$2.79B

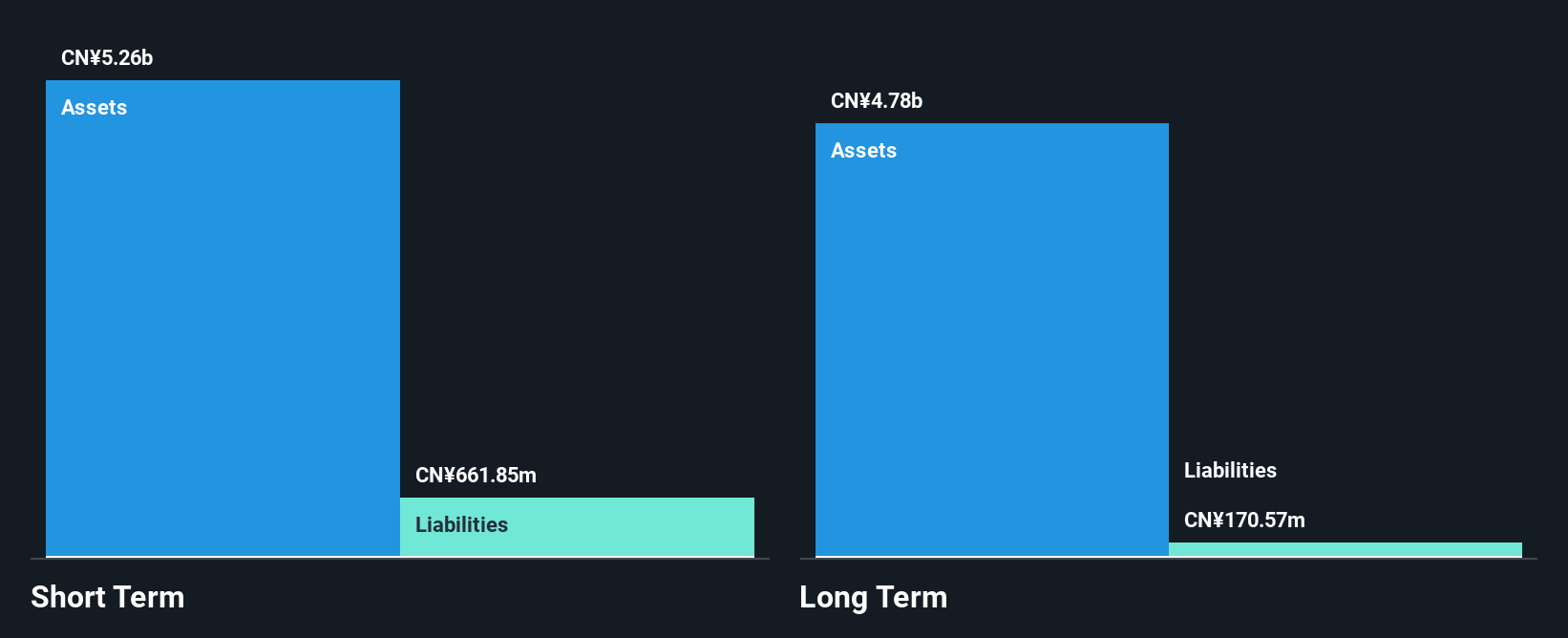

China Dongxiang (Group) Co., Ltd. recently declared a special interim dividend of RMB 0.0104 per share, reflecting its commitment to returning value to shareholders despite challenges in revenue growth. The company reported sales of CN¥748.09 million for the half year ended September 2025 with net income rising to CN¥203.77 million, indicating improved profitability compared to the previous year. With no debt and substantial short-term assets exceeding liabilities, China Dongxiang maintains a stable financial position, although its dividend sustainability is questionable given limited free cash flow coverage and declining earnings over the past five years.

- Dive into the specifics of China Dongxiang (Group) here with our thorough balance sheet health report.

- Understand China Dongxiang (Group)'s track record by examining our performance history report.

Basetrophy Group Holdings (SEHK:8460)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Basetrophy Group Holdings Limited is an investment holding company that functions as a substructure subcontractor in Hong Kong and the People's Republic of China, with a market cap of HK$221.34 million.

Operations: The company's revenue is derived from two main segments: Alcoholic Beverages Trading, generating HK$2.16 million, and Foundation and Related Works, contributing HK$57.44 million.

Market Cap: HK$221.34M

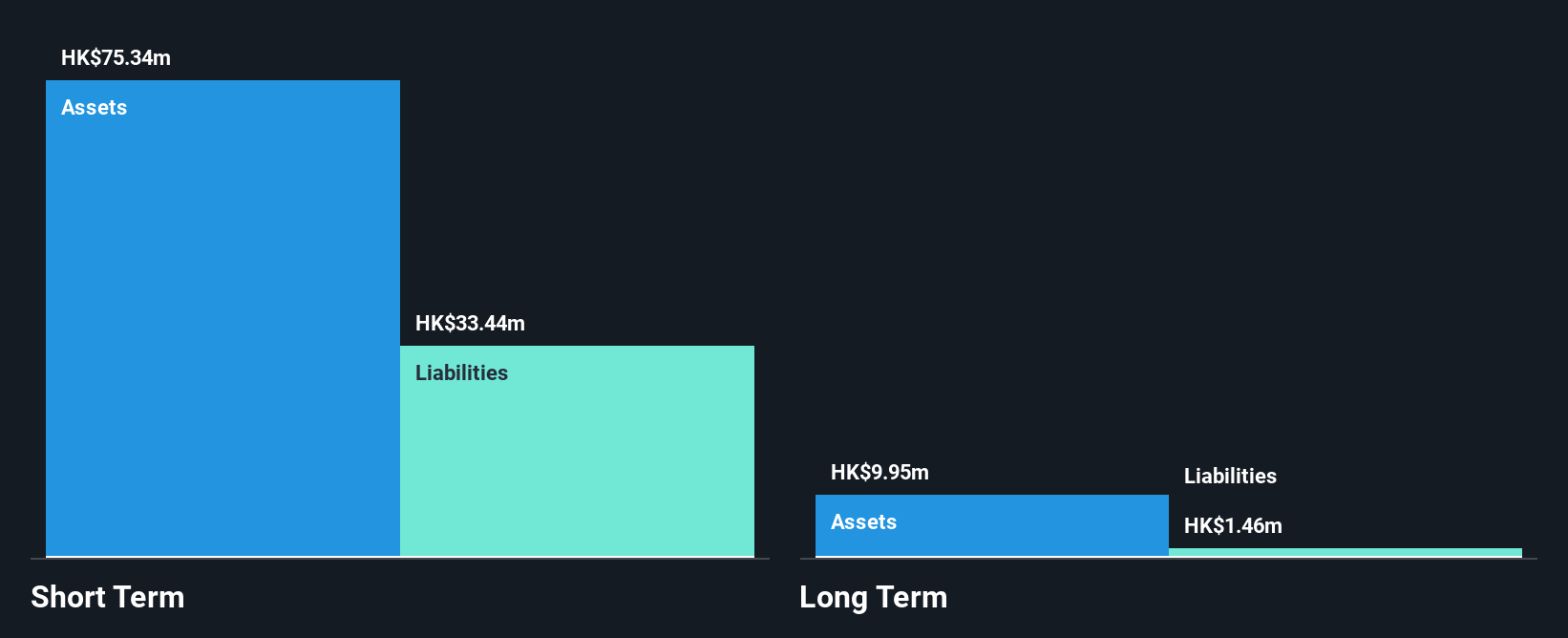

Basetrophy Group Holdings, with a market cap of HK$221.34 million, derives its revenue primarily from Foundation and Related Works (HK$57.44 million). Despite being unprofitable, it maintains a satisfactory net debt to equity ratio of 2.6% and has sufficient cash runway for over three years due to positive free cash flow. Recent board changes include the appointment of Mr. Chen Ping as co-chairman and Mr. Lu Jun as an executive director, both bringing extensive experience in corporate governance and strategic decision-making. The company has also filed follow-on equity offerings totaling HKD 25.54 million recently, indicating active capital management efforts amidst high share price volatility.

- Click to explore a detailed breakdown of our findings in Basetrophy Group Holdings' financial health report.

- Learn about Basetrophy Group Holdings' historical performance here.

Inner Mongolia Junzheng Energy & Chemical GroupLtd (SHSE:601216)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inner Mongolia Junzheng Energy & Chemical Group Ltd operates in the energy and chemical sectors, with a market capitalization of approximately CN¥40.08 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥40.08B

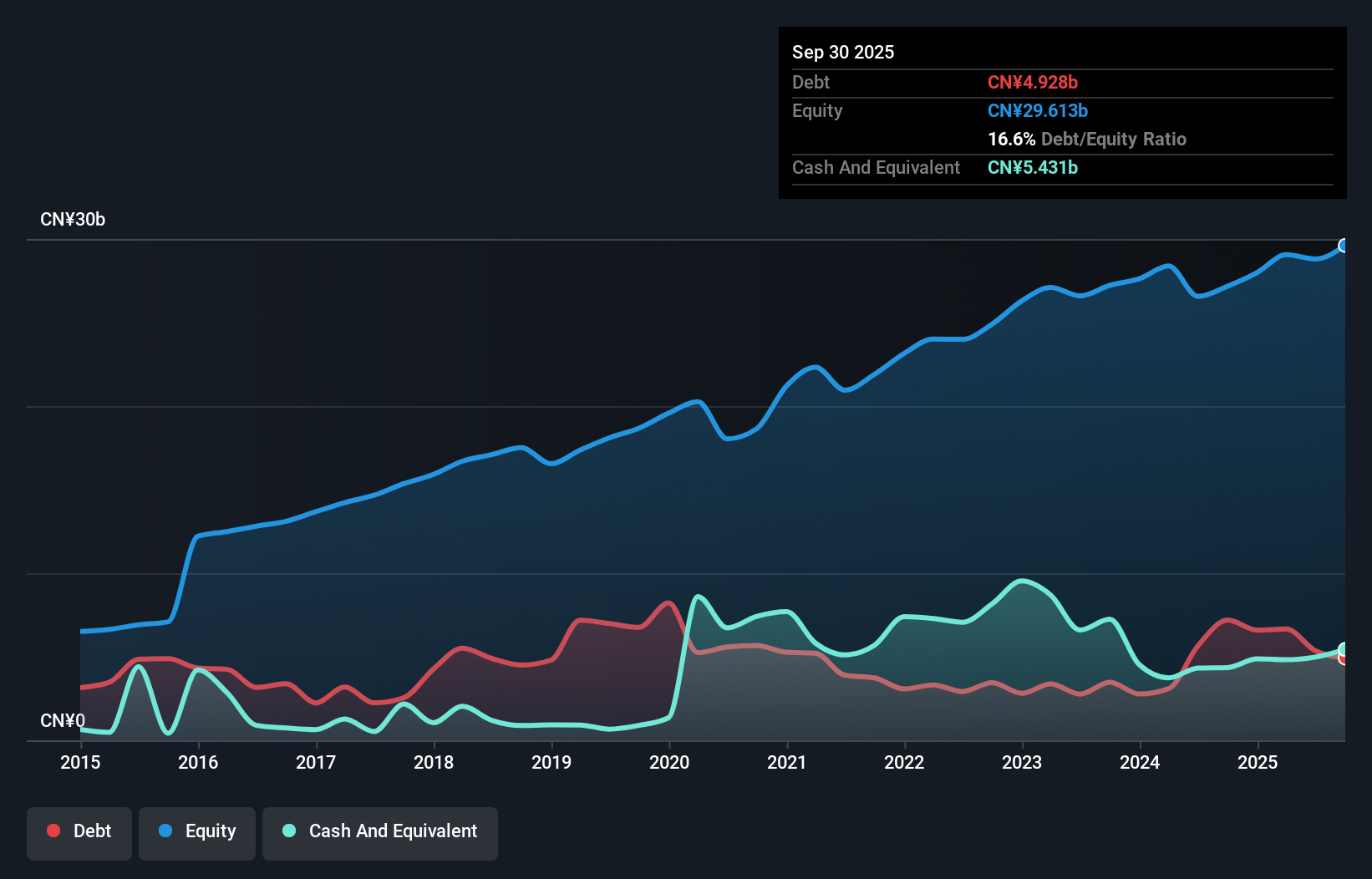

Inner Mongolia Junzheng Energy & Chemical Group Ltd, with a market cap of CN¥40.08 billion, has shown stable financial performance recently. The company reported sales of CN¥18.69 billion for the first nine months of 2025, reflecting a slight increase from the previous year. Its net income rose to CN¥2.8 billion, indicating improved profitability with higher profit margins compared to last year. Despite a relatively inexperienced management team and low return on equity at 11.5%, the company's debt is well-covered by operating cash flow and it trades significantly below estimated fair value, suggesting potential investment appeal in its sector.

- Unlock comprehensive insights into our analysis of Inner Mongolia Junzheng Energy & Chemical GroupLtd stock in this financial health report.

- Gain insights into Inner Mongolia Junzheng Energy & Chemical GroupLtd's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Embark on your investment journey to our 3,624 Global Penny Stocks selection here.

- Seeking Other Investments? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601216

Inner Mongolia Junzheng Energy & Chemical GroupLtd

Inner Mongolia Junzheng Energy & Chemical Group Co.,Ltd.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)