As global markets respond to recent political developments and economic indicators, U.S. stocks are approaching record highs driven by optimism around trade policies and artificial intelligence investments, while European and Japanese markets show mixed reactions to monetary policy shifts. In this dynamic environment, investors often seek stability through dividend stocks, which can provide a steady income stream amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

EVA Precision Industrial Holdings (SEHK:838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EVA Precision Industrial Holdings Limited is an investment holding company offering precision manufacturing services in China, Vietnam, and Mexico, with a market cap of HK$1.06 billion.

Operations: EVA Precision Industrial Holdings Limited generates revenue through its Automotive Components segment, which contributes HK$1.98 billion, and its Office Automation Equipment segment, which brings in HK$4.34 billion.

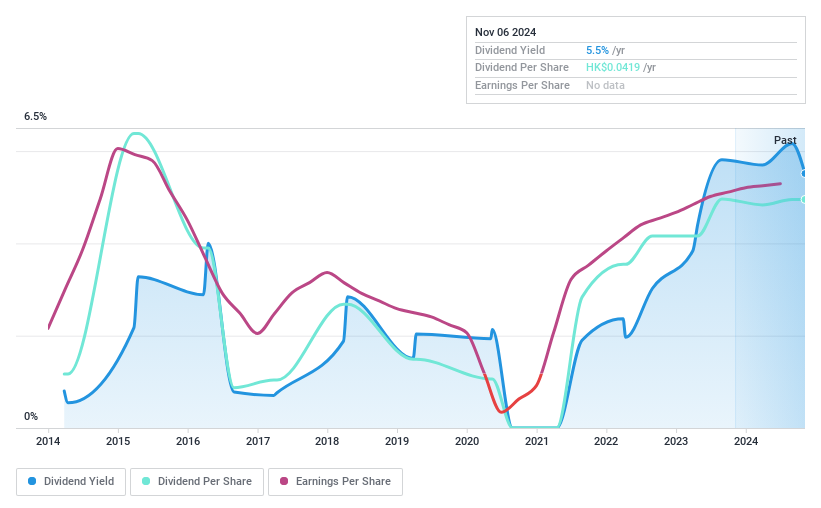

Dividend Yield: 6.5%

EVA Precision Industrial Holdings offers a mixed dividend profile. While the company trades at 84% below its estimated fair value and maintains a low payout ratio of 30.1%, ensuring dividends are covered by earnings and cash flows, its dividend history is volatile with unreliable payments over the past decade. The current yield of 6.87% is lower than Hong Kong's top-tier payers, suggesting potential but caution for income-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of EVA Precision Industrial Holdings.

- In light of our recent valuation report, it seems possible that EVA Precision Industrial Holdings is trading behind its estimated value.

QuickLtd (TSE:4318)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Quick Co., Ltd. operates in recruiting, human resources services, information publishing, and Internet-related businesses both in Japan and internationally, with a market cap of ¥40.20 billion.

Operations: Quick Co., Ltd.'s revenue is primarily derived from its Human Resources Service segment at ¥21.39 billion, followed by Recruiting at ¥3.49 billion, Local Information Service at ¥2.54 billion, Overseas operations contributing ¥2.26 billion, and the HR Platform generating ¥1.34 billion.

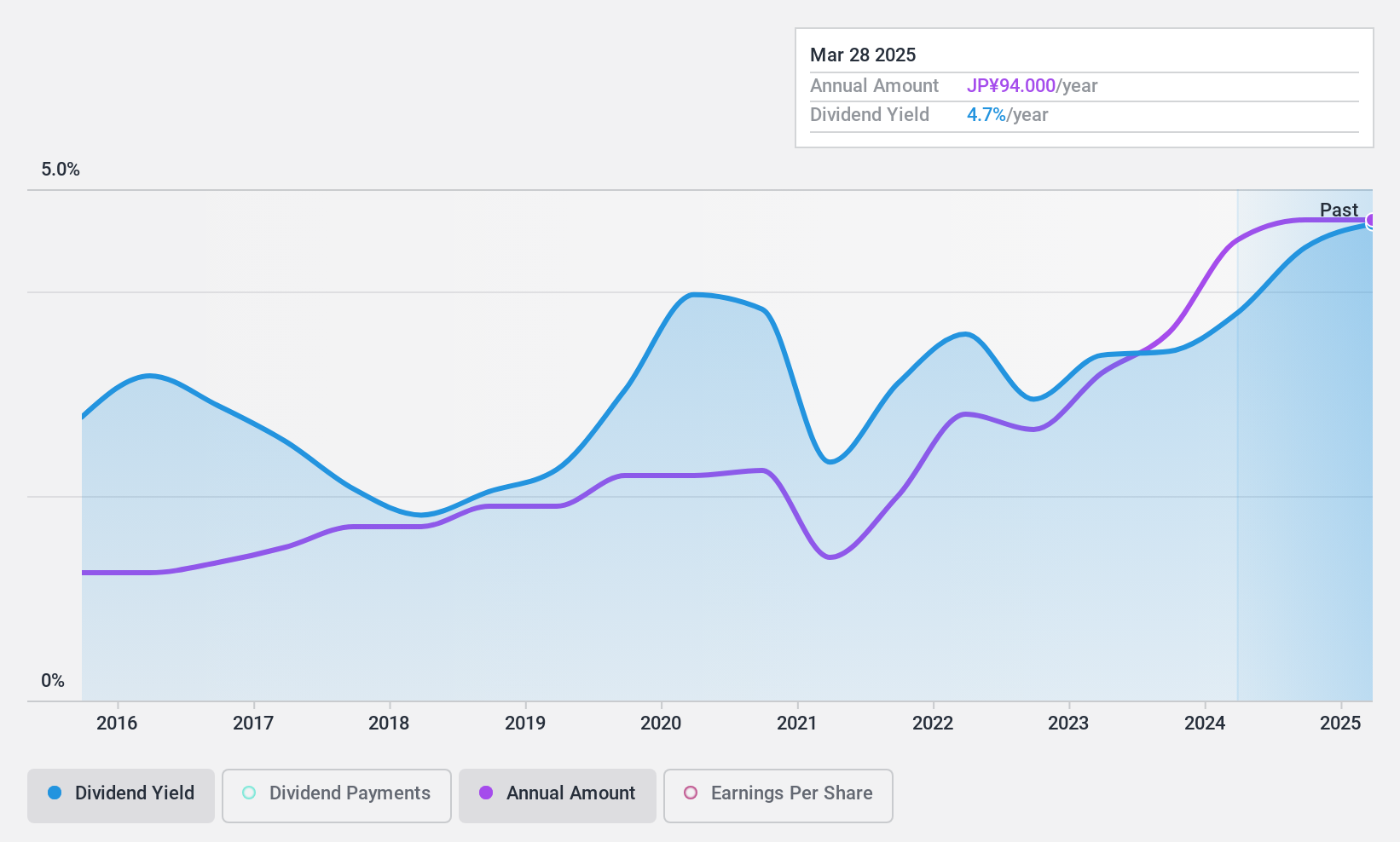

Dividend Yield: 4.3%

Quick Ltd. recently increased its dividend to JPY 47.00 per share, up from JPY 36.00 a year ago, reflecting a growing dividend trend over the past decade. The company maintains a sustainable payout ratio of 51.6%, supported by earnings and cash flows with a cash payout ratio of 58.9%. Despite these strengths, its dividends have been volatile and unreliable historically, though the current yield of 4.27% ranks in Japan's top quartile for dividend payers.

- Get an in-depth perspective on QuickLtd's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of QuickLtd shares in the market.

Komori (TSE:6349)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Komori Corporation is involved in the manufacture, sale, and repair of printing presses across Japan, North America, Europe, and Greater China with a market cap of ¥62.03 billion.

Operations: Komori Corporation's revenue segments are comprised of ¥80.50 billion from Japan, ¥22.47 billion from Europe, ¥15.72 billion from Greater China, and ¥10.52 billion from North America.

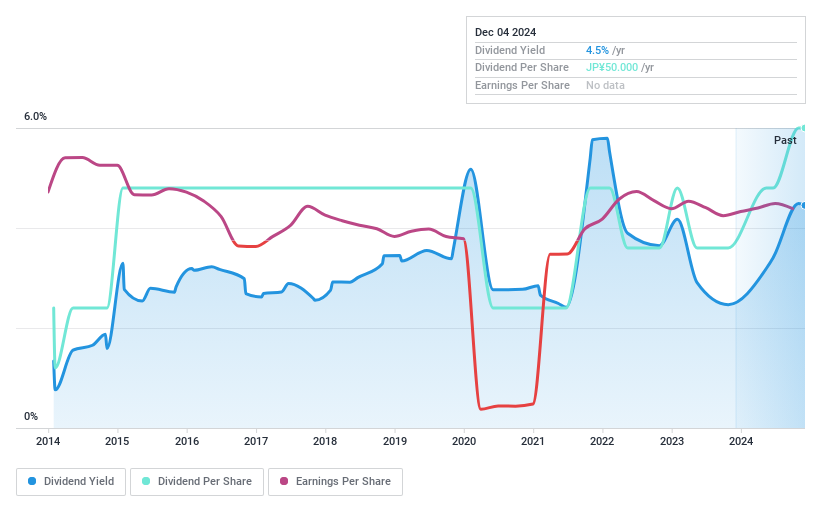

Dividend Yield: 4.2%

Komori Corporation announced a significant dividend increase to JPY 30.00 per share, doubling last year's payout. Despite an unstable dividend history marked by volatility, the current yield of 4.16% is among the top 25% in Japan. The company's dividends are well-covered with a payout ratio of 41.2% and cash flow coverage at 55.3%. Revised earnings guidance indicates improved financial performance, which may support future dividend sustainability despite past unreliability.

- Click to explore a detailed breakdown of our findings in Komori's dividend report.

- The analysis detailed in our Komori valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Dive into all 1981 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVA Precision Industrial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:838

EVA Precision Industrial Holdings

An investment holding company, provides precision manufacturing services in the People’s Republic of China, Vietnam, and Mexico.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives