- Hong Kong

- /

- Electrical

- /

- SEHK:8328

We Ran A Stock Scan For Earnings Growth And Xinyi Electric Storage Holdings (HKG:8328) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Xinyi Electric Storage Holdings (HKG:8328), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Xinyi Electric Storage Holdings

Xinyi Electric Storage Holdings' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Xinyi Electric Storage Holdings has managed to grow EPS by 30% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

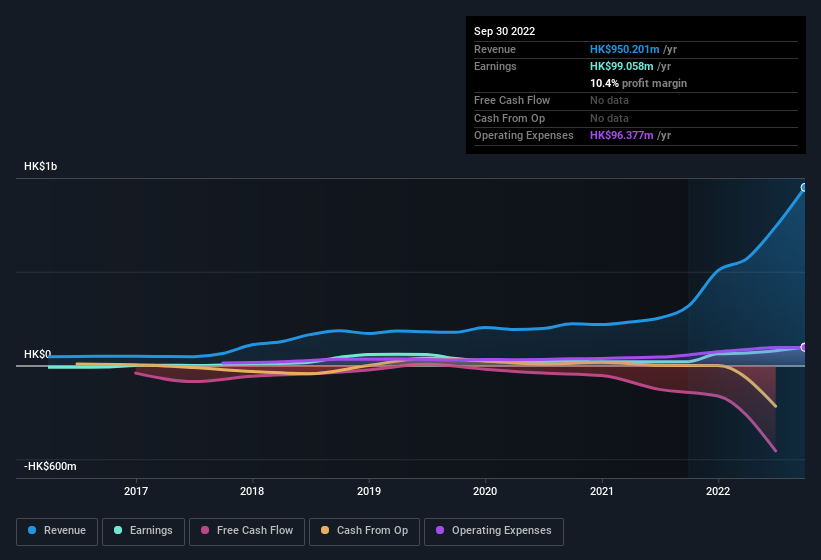

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Xinyi Electric Storage Holdings is growing revenues, and EBIT margins improved by 9.7 percentage points to 16%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Xinyi Electric Storage Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's pleasing to note that insiders spent HK$398m buying Xinyi Electric Storage Holdings shares, over the last year, without reporting any share sales whatsoever. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the Non-Executive Chairman of the Board, Ching Sai Tung, who made the biggest single acquisition, paying HK$201m for shares at about HK$5.52 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Xinyi Electric Storage Holdings will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 71% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. HK$3.2b That level of investment from insiders is nothing to sneeze at.

Should You Add Xinyi Electric Storage Holdings To Your Watchlist?

For growth investors, Xinyi Electric Storage Holdings' raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. Still, you should learn about the 1 warning sign we've spotted with Xinyi Electric Storage Holdings.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Xinyi Electric Storage Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8328

Xinyi Electric Storage Holdings

An investment holding company, engages in the energy storage, EPC services, automobile glass repair and replacement services, photovoltaic (PV) films, and other businesses in the People’s Republic of China, Hong Kong, Canada, Malaysia, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives