Is China State Construction Development Holdings (HKG:830) A Risky Investment?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, China State Construction Development Holdings Limited (HKG:830) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for China State Construction Development Holdings

What Is China State Construction Development Holdings's Debt?

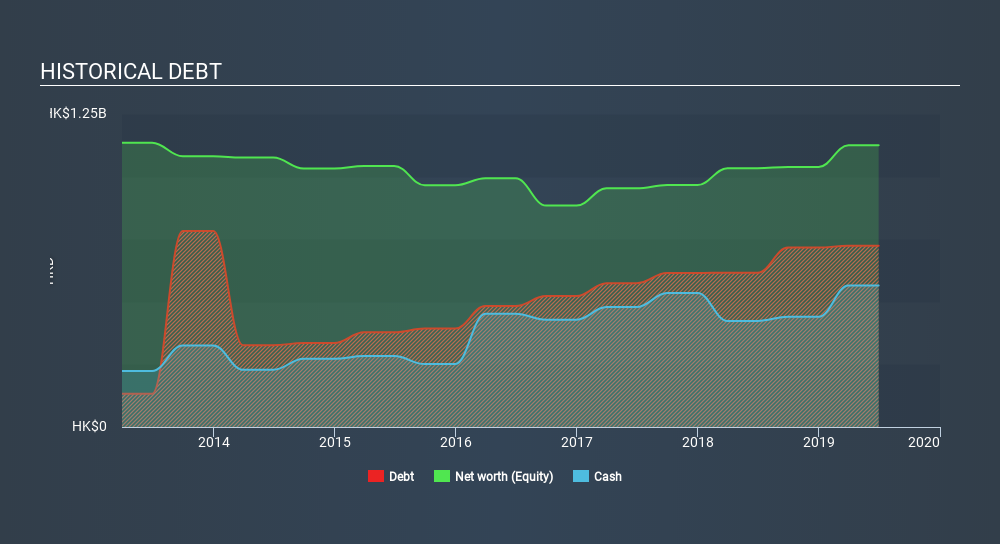

As you can see below, at the end of June 2019, China State Construction Development Holdings had HK$723.7m of debt, up from HK$616.5m a year ago. Click the image for more detail. On the flip side, it has HK$564.7m in cash leading to net debt of about HK$159.0m.

How Healthy Is China State Construction Development Holdings's Balance Sheet?

The latest balance sheet data shows that China State Construction Development Holdings had liabilities of HK$2.75b due within a year, and liabilities of HK$255.4m falling due after that. Offsetting these obligations, it had cash of HK$564.7m as well as receivables valued at HK$2.57b due within 12 months. So it actually has HK$132.5m more liquid assets than total liabilities.

This surplus suggests that China State Construction Development Holdings has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With net debt sitting at just 0.59 times EBITDA, China State Construction Development Holdings is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 8.7 times the interest expense over the last year. Fortunately, China State Construction Development Holdings grew its EBIT by 3.8% in the last year, making that debt load look even more manageable. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine China State Construction Development Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, China State Construction Development Holdings's free cash flow amounted to 25% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

China State Construction Development Holdings's net debt to EBITDA suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. All these things considered, it appears that China State Construction Development Holdings can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that China State Construction Development Holdings is showing 3 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:830

China State Construction Development Holdings

An investment holding company, engages in the general contracting business in Hong Kong and internationally.

Undervalued with solid track record.

Market Insights

Community Narratives