Ka Shui International Holdings Limited (HKG:822) Investors Are Less Pessimistic Than Expected

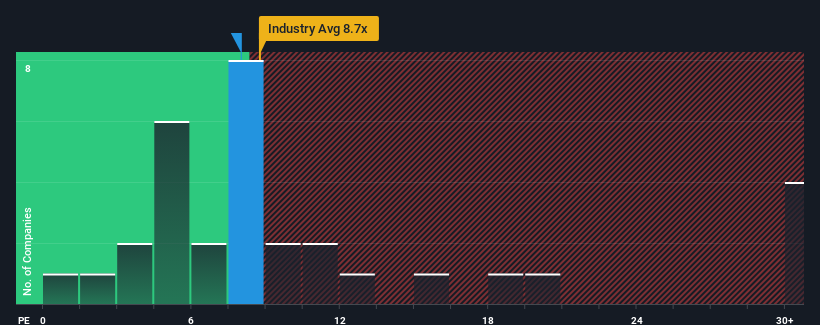

With a median price-to-earnings (or "P/E") ratio of close to 9x in Hong Kong, you could be forgiven for feeling indifferent about Ka Shui International Holdings Limited's (HKG:822) P/E ratio of 8x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

As an illustration, earnings have deteriorated at Ka Shui International Holdings over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Ka Shui International Holdings

Is There Some Growth For Ka Shui International Holdings?

There's an inherent assumption that a company should be matching the market for P/E ratios like Ka Shui International Holdings' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 65%. As a result, earnings from three years ago have also fallen 72% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 21% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Ka Shui International Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Ka Shui International Holdings revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Ka Shui International Holdings is showing 3 warning signs in our investment analysis, and 1 of those is potentially serious.

You might be able to find a better investment than Ka Shui International Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Ka Shui International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ka Shui International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:822

Ka Shui International Holdings

An investment holding company, engages in the manufacture and sale of zinc, magnesium, and aluminum alloy die casting products and components in the People’s Republic of China, the United States, and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives