- Hong Kong

- /

- Trade Distributors

- /

- SEHK:8009

Chinese Energy Holdings Limited's (HKG:8009) CEO Compensation Looks Acceptable To Us And Here's Why

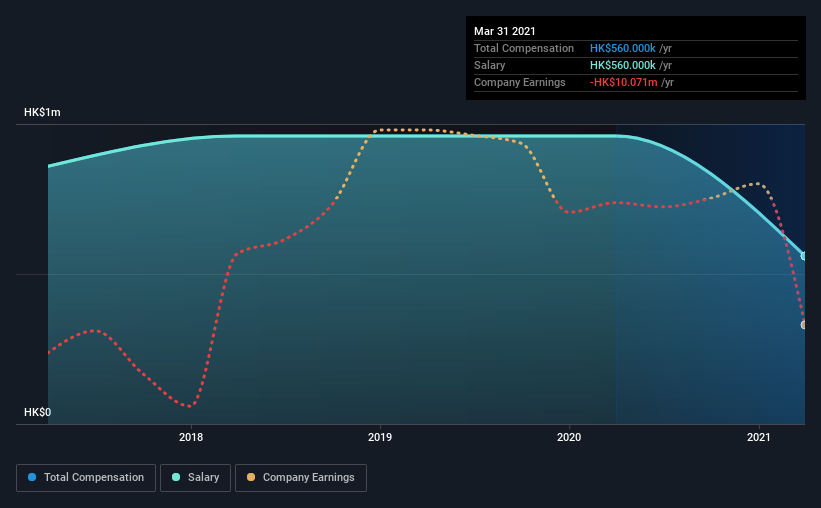

Performance at Chinese Energy Holdings Limited (HKG:8009) has been rather uninspiring recently and shareholders may be wondering how CEO HN Chen plans to fix this. At the next AGM coming up on 13 August 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

View our latest analysis for Chinese Energy Holdings

Comparing Chinese Energy Holdings Limited's CEO Compensation With the industry

At the time of writing, our data shows that Chinese Energy Holdings Limited has a market capitalization of HK$51m, and reported total annual CEO compensation of HK$560k for the year to March 2021. That's a notable decrease of 42% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth HK$560k.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.5m. This suggests that HN Chen is paid below the industry median. Furthermore, HN Chen directly owns HK$6.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$560k | HK$960k | 100% |

| Other | - | - | - |

| Total Compensation | HK$560k | HK$960k | 100% |

Speaking on an industry level, nearly 86% of total compensation represents salary, while the remainder of 14% is other remuneration. At the company level, Chinese Energy Holdings pays HN Chen solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Chinese Energy Holdings Limited's Growth

Over the last three years, Chinese Energy Holdings Limited has shrunk its earnings per share by 28% per year. In the last year, its revenue is up 16%.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Chinese Energy Holdings Limited Been A Good Investment?

The return of -46% over three years would not have pleased Chinese Energy Holdings Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Chinese Energy Holdings rewards its CEO solely through a salary, ignoring non-salary benefits completely. The loss to shareholders over the past three years is certainly concerning. The poor performance of the share price might have something to do with the lack of earnings growth. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Chinese Energy Holdings that investors should be aware of in a dynamic business environment.

Switching gears from Chinese Energy Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8009

Chinese Energy Holdings

Chinese Energy Holdings Limited, an investment holding company, engages in the trading of liquefied natural gas products in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives