- Hong Kong

- /

- Electrical

- /

- SEHK:658

Is Now The Time To Put China High Speed Transmission Equipment Group (HKG:658) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like China High Speed Transmission Equipment Group (HKG:658). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for China High Speed Transmission Equipment Group

How Fast Is China High Speed Transmission Equipment Group Growing Its Earnings Per Share?

In the last three years China High Speed Transmission Equipment Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, China High Speed Transmission Equipment Group's EPS soared from CN¥0.51 to CN¥0.80, over the last year. That's a fantastic gain of 56%.

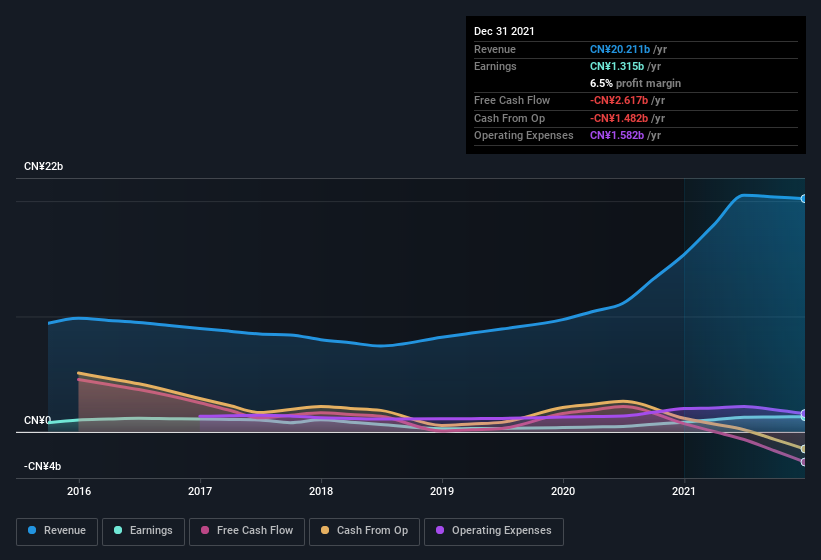

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note China High Speed Transmission Equipment Group achieved similar EBIT margins to last year, revenue grew by a solid 32% to CN¥20b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are China High Speed Transmission Equipment Group Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. Our analysis has discovered that the median total compensation for the CEOs of companies like China High Speed Transmission Equipment Group with market caps between CN¥2.7b and CN¥11b is about CN¥3.7m.

The China High Speed Transmission Equipment Group CEO received CN¥2.5m in compensation for the year ending December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is China High Speed Transmission Equipment Group Worth Keeping An Eye On?

You can't deny that China High Speed Transmission Equipment Group has grown its earnings per share at a very impressive rate. That's attractive. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. We think that based on its merits alone, this stock is worth watching into the future. We don't want to rain on the parade too much, but we did also find 1 warning sign for China High Speed Transmission Equipment Group that you need to be mindful of.

Although China High Speed Transmission Equipment Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade China High Speed Transmission Equipment Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:658

China High Speed Transmission Equipment Group

Engages in the research, design, development, manufacture, and sale of various mechanical transmission equipment in the People’s Republic of China, the United States, Europe, and internationally.

Mediocre balance sheet and slightly overvalued.