- Hong Kong

- /

- Industrials

- /

- SEHK:656

Fosun International (SEHK:656): Exploring Fair Value After a Recent Share Price Slide

Reviewed by Kshitija Bhandaru

See our latest analysis for Fosun International.

Looking beyond the recent slide, Fosun International’s share price is still up a robust 21% year-to-date, with plenty of momentum built over the past quarter’s 7.9% gain. That said, the one-year total shareholder return of 3.7% hints at some volatility beneath the surface. The five-year picture remains a stark reminder of past challenges, with total return down 37% despite this year’s recovery.

If you’re open to finding unexpected opportunities, you may want to explore fast growing stocks with high insider ownership next.

The question now is whether Fosun International’s recent dip means the stock is trading below its true value or if the current price already reflects expectations for future growth. Is there real upside, or is the market fully informed?

Most Popular Narrative: Fairly Valued

With Fosun International’s last close at HK$5.35 and the prevailing narrative suggesting fair value at HK$5.31, the valuation debate is closer than ever. This sets the stage for a reveal of the key drivers behind it.

The group's strong health segment momentum, underpinned by expanding innovative drug pipelines, rising overseas licensing revenues, and the growing elderly population's demand for pharmaceuticals and healthcare services, is set to fuel sustainable growth and higher net margins within its healthcare business.

Curious about what really powers this fair value? The underlying calculation relies on bold projections for profits and a future earnings multiple that turns heads. Unlock the details that separate average stock stories from true market movers. Dive in to uncover what could drive Fosun’s next leap.

Result: Fair Value of $5.31 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in key business segments and ongoing high debt could undermine earnings momentum and limit the scope of Fosun International’s recovery.

Find out about the key risks to this Fosun International narrative.

Another View: What Does Our DCF Model Say?

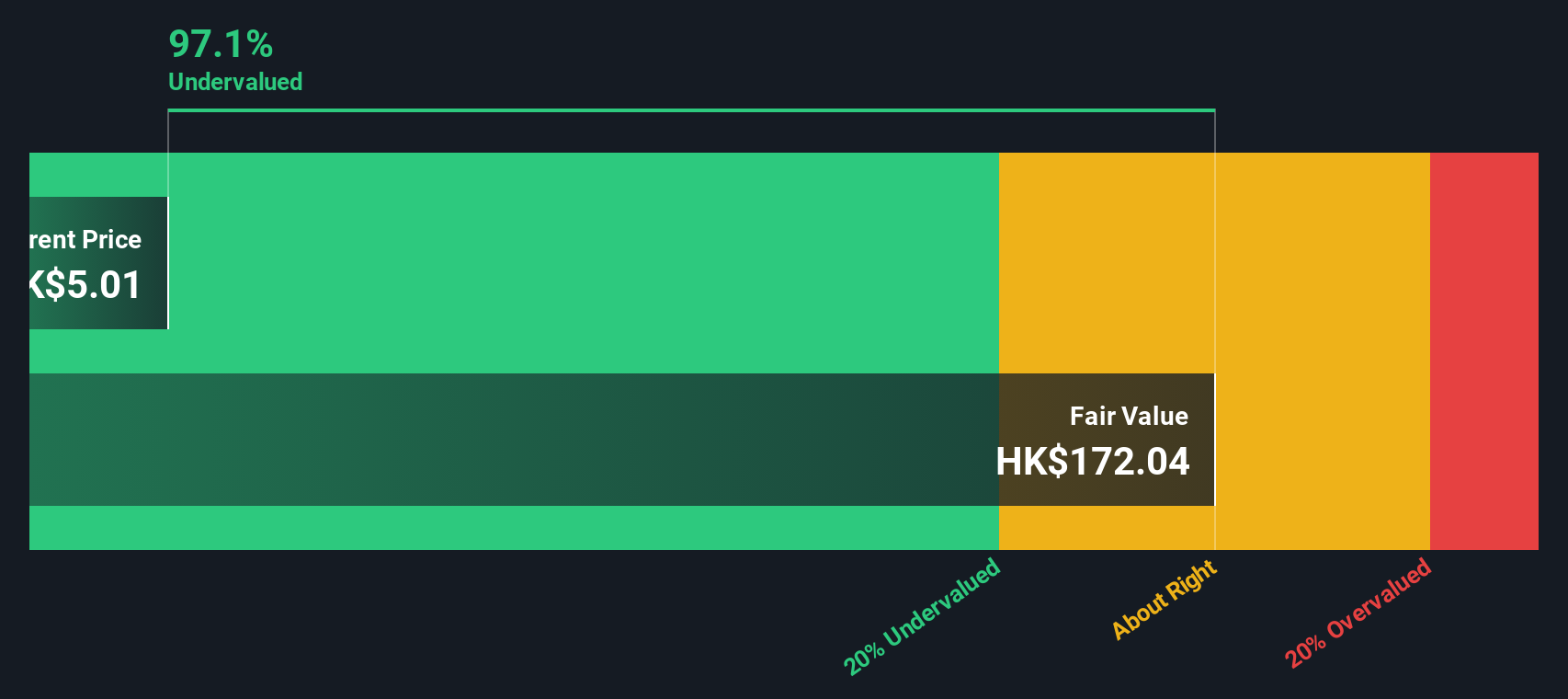

While multiples suggest Fosun International is attractively valued, our SWS DCF model paints an even starker picture, estimating fair value at HK$172.15, which is over 30 times the current price. Such a dramatic gap could mean an overlooked opportunity or simply reflect risk the market is not willing to ignore. Is the real answer somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fosun International Narrative

If you see things differently or want to dig deeper on your own terms, you can shape your own view of Fosun International in just a few minutes. Do it your way

A great starting point for your Fosun International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors do not just watch single stocks move; they keep their radar tuned for fresh opportunities. See what you could be missing right now.

- Uncover tech’s next disruptors by checking out these 24 AI penny stocks making waves in artificial intelligence and automation.

- Boost your portfolio’s income potential and stability by browsing these 19 dividend stocks with yields > 3% that consistently deliver solid yields above 3%.

- Get ahead of the curve by reviewing these 79 cryptocurrency and blockchain stocks pushing the boundaries of finance with cutting-edge blockchain innovation and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:656

Fosun International

Operates in the health, happiness, wealth, and intelligent manufacturing sectors in Mainland China, Portugal, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives