CHTC Fong's International Company Limited's (HKG:641) Share Price Boosted 37% But Its Business Prospects Need A Lift Too

CHTC Fong's International Company Limited (HKG:641) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 32%.

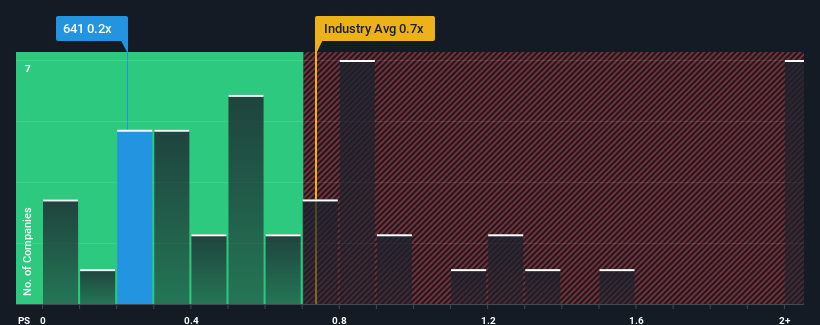

Even after such a large jump in price, it would still be understandable if you think CHTC Fong's International is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Hong Kong's Machinery industry have P/S ratios above 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for CHTC Fong's International

What Does CHTC Fong's International's P/S Mean For Shareholders?

For example, consider that CHTC Fong's International's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on CHTC Fong's International will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CHTC Fong's International will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For CHTC Fong's International?

CHTC Fong's International's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. As a result, revenue from three years ago have also fallen 27% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 15% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that CHTC Fong's International is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Despite CHTC Fong's International's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of CHTC Fong's International revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for CHTC Fong's International (2 are potentially serious) you should be aware of.

If you're unsure about the strength of CHTC Fong's International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:641

CHTC Fong's International

An investment holding company, manufactures and sells dyeing and finishing machines in the People’s Republic of China, Hong Kong, the rest of Asia Pacific, Europe, North and South America, and internationally.

Good value slight.

Market Insights

Community Narratives