Asian Stocks Estimated To Be Trading Below Fair Value In September 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious monetary policies and fluctuating economic indicators, Asian stocks present intriguing opportunities for investors seeking value. In this environment, identifying stocks trading below their fair value becomes crucial, as these may offer potential for appreciation when broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Takara Bio (TSE:4974) | ¥942.00 | ¥1829.46 | 48.5% |

| SRE Holdings (TSE:2980) | ¥3325.00 | ¥6495.81 | 48.8% |

| Pansoft (SZSE:300996) | CN¥17.19 | CN¥33.87 | 49.2% |

| Kolmar Korea (KOSE:A161890) | ₩77800.00 | ₩154695.49 | 49.7% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.29 | CN¥77.70 | 49.4% |

| Fositek (TWSE:6805) | NT$967.00 | NT$1863.14 | 48.1% |

| Everest Medicines (SEHK:1952) | HK$54.95 | HK$107.13 | 48.7% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥70.42 | CN¥135.70 | 48.1% |

| COVER (TSE:5253) | ¥1900.00 | ¥3657.59 | 48.1% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.81 | CN¥59.50 | 48.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

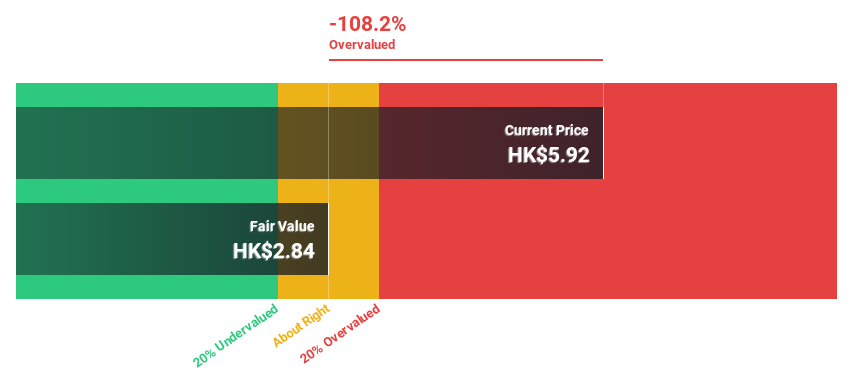

Morimatsu International Holdings (SEHK:2155)

Overview: Morimatsu International Holdings Company Limited specializes in designing, manufacturing, installing, operating, and maintaining core equipment and process systems for chemical reactions, biological reactions, and polymerization, with a market cap of HK$13.40 billion.

Operations: The company's revenue primarily comes from the sale of comprehensive pressure equipment, amounting to CN¥6.16 billion.

Estimated Discount To Fair Value: 35.5%

Morimatsu International Holdings is trading at HK$10.76, significantly below its estimated fair value of HK$16.69, highlighting its undervaluation based on cash flows. Despite a decline in sales and net income for the first half of 2025, the company forecasts robust annual earnings growth of 23%, outpacing the Hong Kong market's expected growth rate. However, recent significant insider selling could be a concern for potential investors considering this stock's undervalued status.

- Our growth report here indicates Morimatsu International Holdings may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Morimatsu International Holdings.

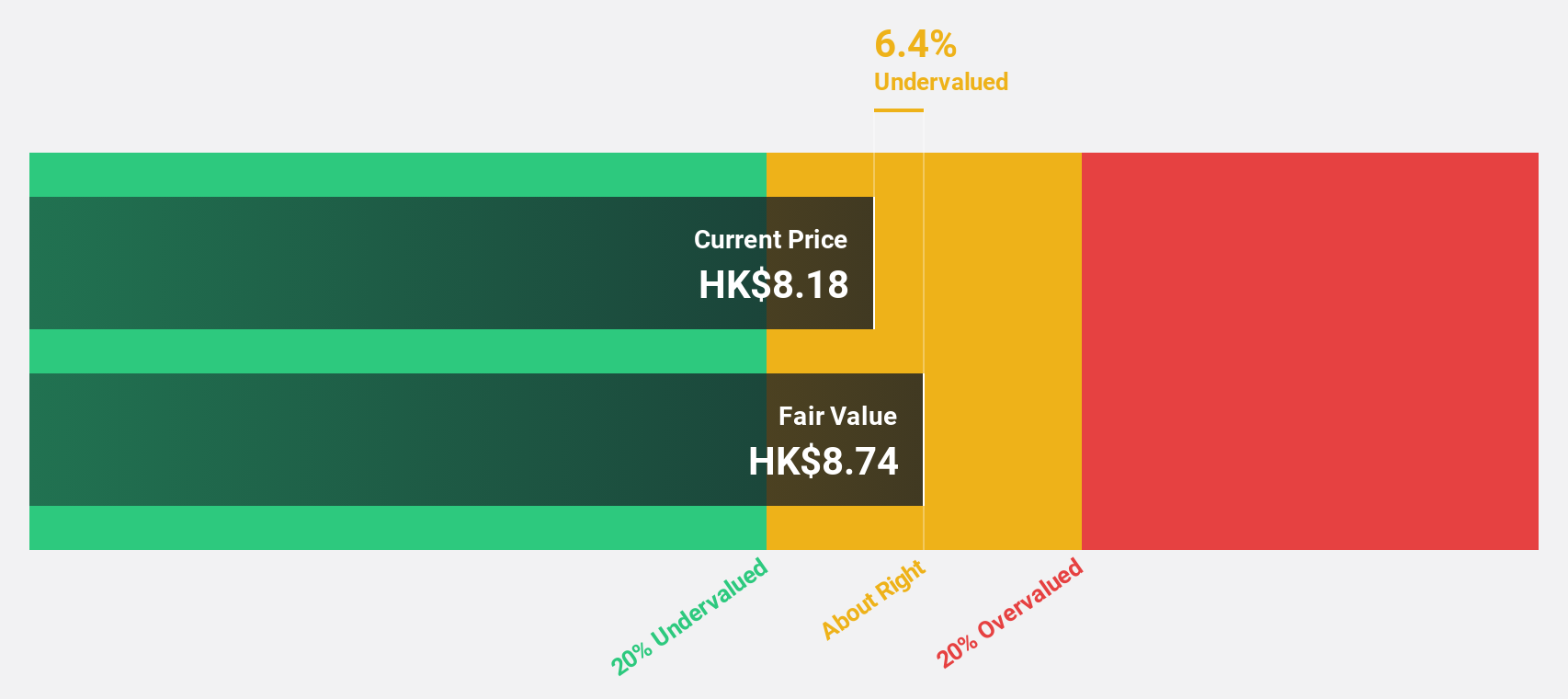

Sany Heavy Equipment International Holdings (SEHK:631)

Overview: Sany Heavy Equipment International Holdings Company Limited engages in the manufacturing and sale of mining and logistics equipment, electricity, power station project products, petroleum and new energy manufacturing equipment, spare parts, and related services, with a market cap of approximately HK$24.36 billion.

Operations: Sany Heavy Equipment International Holdings generates revenue through the production and sale of mining and logistics equipment, electricity and power station project products, petroleum and new energy manufacturing equipment, as well as spare parts and related services.

Estimated Discount To Fair Value: 13.7%

Sany Heavy Equipment International Holdings, trading at HK$7.54, is undervalued relative to its fair value estimate of HK$8.74. Recent earnings for H1 2025 show a rise in sales to CNY 12.24 billion and net income to CNY 1.29 billion, indicating strong financial performance despite lower profit margins compared to last year. With forecasted annual earnings growth of 29.5%, it surpasses the Hong Kong market's average growth expectations significantly.

- The analysis detailed in our Sany Heavy Equipment International Holdings growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Sany Heavy Equipment International Holdings.

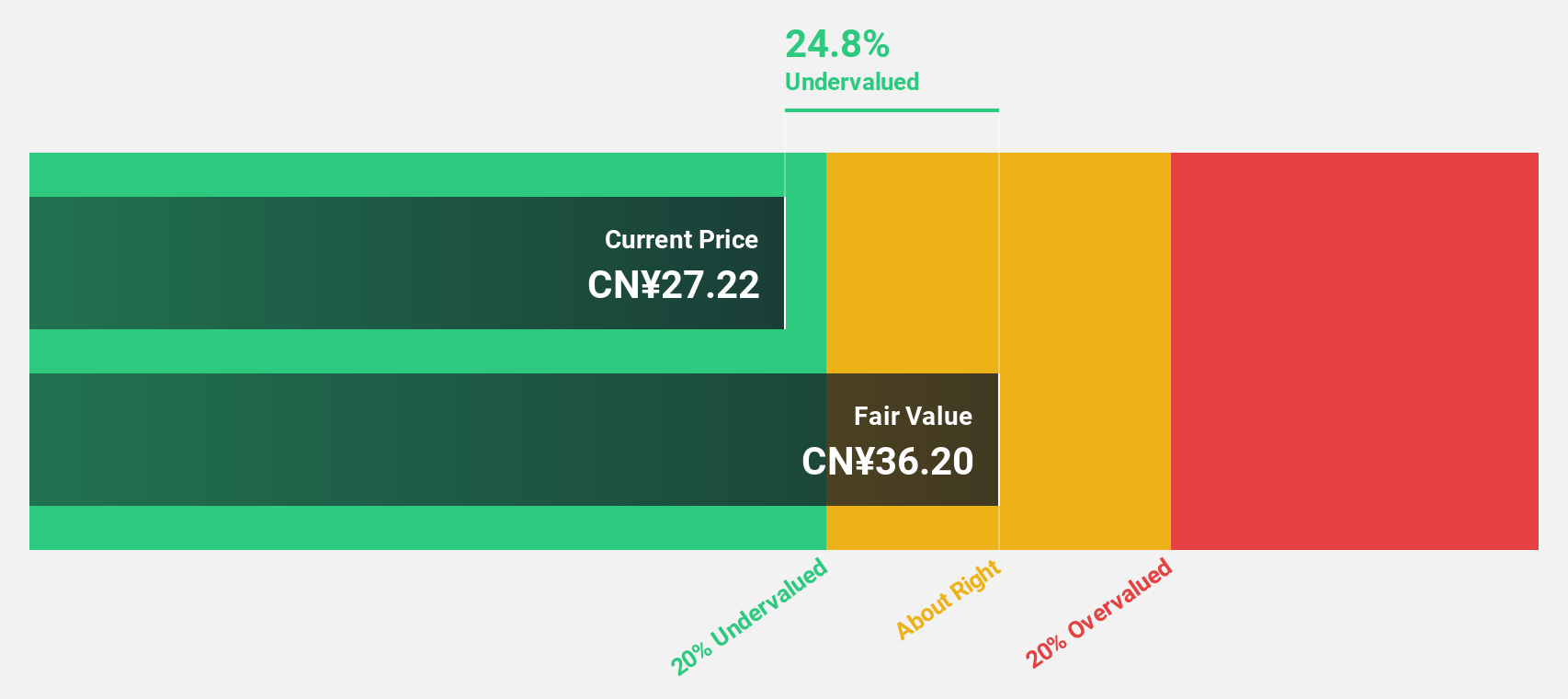

Sino Wealth Electronic (SZSE:300327)

Overview: Sino Wealth Electronic Ltd. designs, processes, manufactures, and sells integrated circuits in China and internationally with a market cap of CN¥8.99 billion.

Operations: The company's revenue primarily comes from Integrated Circuit Product Design and Sales, amounting to CN¥1.34 billion.

Estimated Discount To Fair Value: 28.2%

Sino Wealth Electronic, trading at CN¥26.49, is significantly undervalued with a fair value estimate of CN¥36.88. Despite a decline in net income to CN¥41.06 million for H1 2025, the stock remains attractive due to its forecasted annual earnings growth of 43%, surpassing the broader Chinese market's expectations. However, profit margins have decreased from last year and the dividend yield of 0.76% is not well covered by free cash flows, presenting potential risks for investors focused on cash flow valuation metrics.

- Upon reviewing our latest growth report, Sino Wealth Electronic's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Sino Wealth Electronic's balance sheet by reading our health report here.

Next Steps

- Gain an insight into the universe of 279 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2155

Morimatsu International Holdings

Designs, manufactures, installs, operates, and maintains core equipment, process systems, and solutions primarily for chemical reactions, biological reactions, and polymerization.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives