- Hong Kong

- /

- Trade Distributors

- /

- SEHK:399

Innovative Pharmaceutical Biotech's(HKG:399) Share Price Is Down 80% Over The Past Five Years.

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. For example, we sympathize with anyone who was caught holding Innovative Pharmaceutical Biotech Limited (HKG:399) during the five years that saw its share price drop a whopping 80%. The silver lining is that the stock is up 2.0% in about a week.

Check out our latest analysis for Innovative Pharmaceutical Biotech

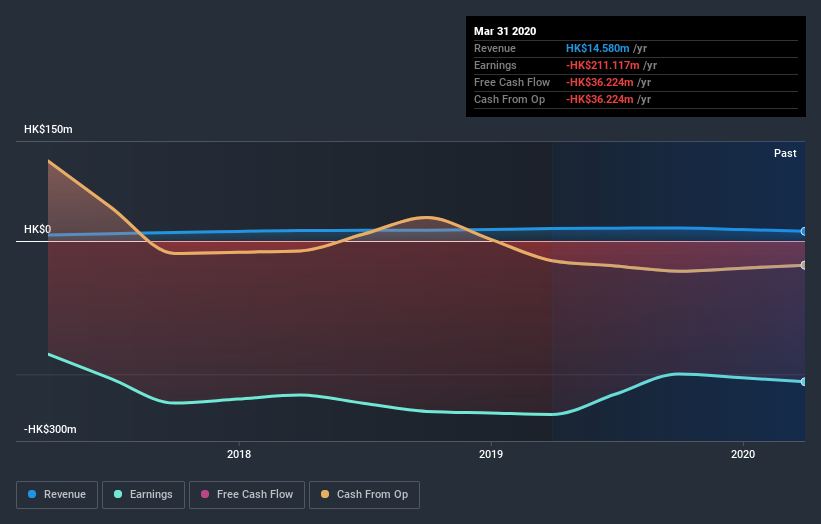

Because Innovative Pharmaceutical Biotech made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Innovative Pharmaceutical Biotech reduced its trailing twelve month revenue by 12% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 12% per year in the same time period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Innovative Pharmaceutical Biotech's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 12% in the last year, Innovative Pharmaceutical Biotech shareholders lost 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 12% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Innovative Pharmaceutical Biotech better, we need to consider many other factors. Take risks, for example - Innovative Pharmaceutical Biotech has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Innovative Pharmaceutical Biotech is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Innovative Pharmaceutical Biotech, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:399

Innovative Pharmaceutical Biotech

An investment holding company, engages in the trade of beauty equipment and products in the People’s Republic of China and Hong Kong.

Moderate with poor track record.

Market Insights

Community Narratives