- Hong Kong

- /

- Construction

- /

- SEHK:3928

Subdued Growth No Barrier To S&T Holdings Limited (HKG:3928) With Shares Advancing 26%

Despite an already strong run, S&T Holdings Limited (HKG:3928) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 187% following the latest surge, making investors sit up and take notice.

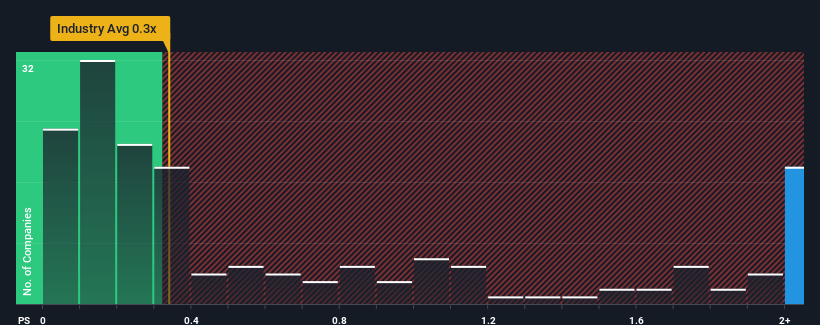

Following the firm bounce in price, you could be forgiven for thinking S&T Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 2.6x, considering almost half the companies in Hong Kong's Construction industry have P/S ratios below 0.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for S&T Holdings

What Does S&T Holdings' Recent Performance Look Like?

For instance, S&T Holdings' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on S&T Holdings will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For S&T Holdings?

S&T Holdings' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. Even so, admirably revenue has lifted 35% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 13% shows it's noticeably less attractive.

In light of this, it's alarming that S&T Holdings' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On S&T Holdings' P/S

The strong share price surge has lead to S&T Holdings' P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that S&T Holdings currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with S&T Holdings, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3928

China Next-Gen Commerce and Supply Chain

An investment holding company, engages in the construction services and property investment business in Singapore.

Excellent balance sheet with weak fundamentals.

Market Insights

Community Narratives