- Hong Kong

- /

- Real Estate

- /

- SEHK:1972

3 SEHK Stocks With Intrinsic Discounts Ranging From 13.7% To 44.7%

Reviewed by Simply Wall St

As global markets face economic uncertainties and mixed signals from major indices, the Hong Kong market has not been immune to these fluctuations. Despite this, opportunities exist for discerning investors to uncover undervalued stocks that offer intrinsic discounts. In a market characterized by volatility and cautious sentiment, identifying stocks trading below their intrinsic value can provide a margin of safety and potential upside.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bosideng International Holdings (SEHK:3998) | HK$3.61 | HK$6.74 | 46.5% |

| CIMC Enric Holdings (SEHK:3899) | HK$5.75 | HK$10.40 | 44.7% |

| Zhaojin Mining Industry (SEHK:1818) | HK$12.10 | HK$21.47 | 43.6% |

| WuXi XDC Cayman (SEHK:2268) | HK$20.45 | HK$39.26 | 47.9% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$11.36 | HK$19.86 | 42.8% |

| Digital China Holdings (SEHK:861) | HK$3.22 | HK$6.08 | 47% |

| United Company RUSAL International (SEHK:486) | HK$2.30 | HK$4.25 | 45.9% |

| Vobile Group (SEHK:3738) | HK$1.48 | HK$2.62 | 43.4% |

| Jinke Smart Services Group (SEHK:9666) | HK$7.42 | HK$13.83 | 46.3% |

| Innovent Biologics (SEHK:1801) | HK$42.95 | HK$79.69 | 46.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

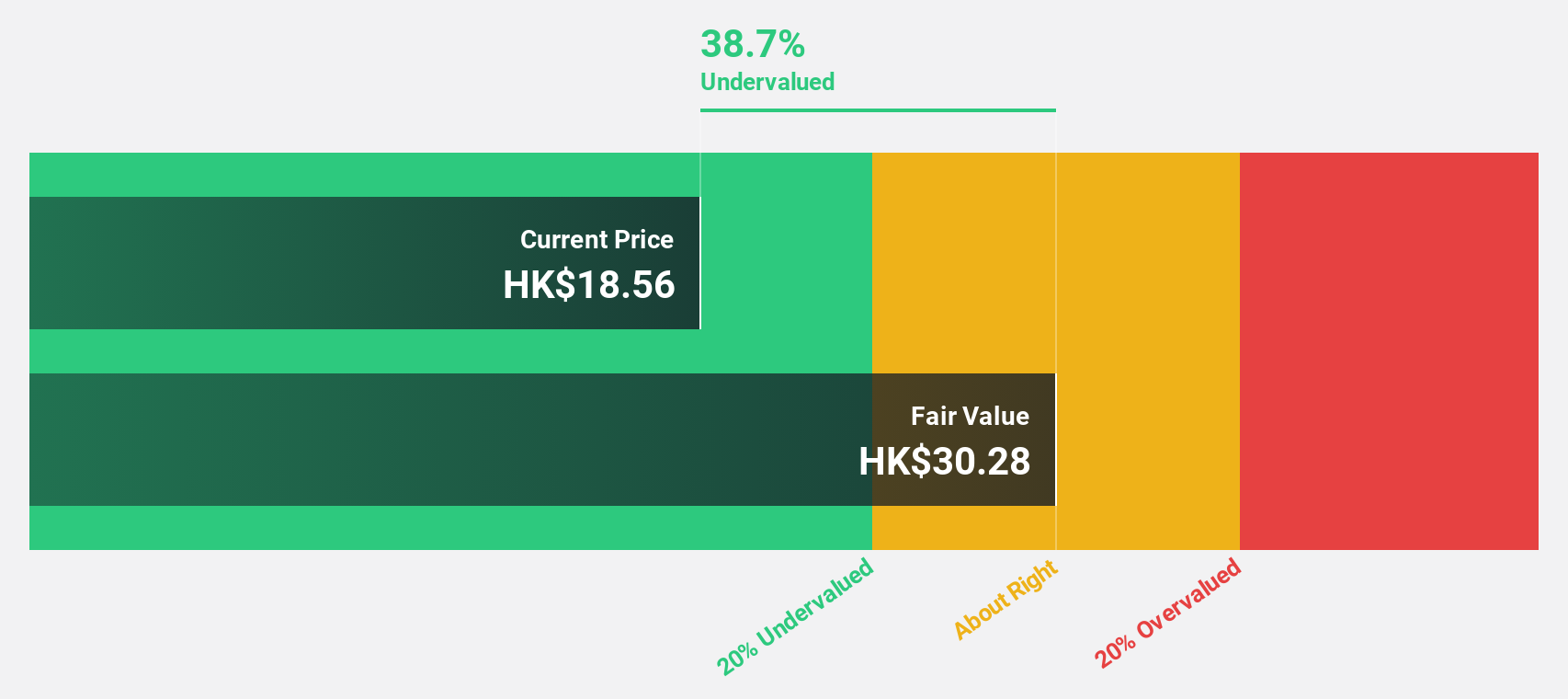

Swire Properties (SEHK:1972)

Overview: Swire Properties Limited, with a market cap of HK$81.85 billion, develops, owns, and operates mixed-use commercial properties in Hong Kong, Mainland China, the United States, and internationally.

Operations: Swire Properties generates revenue from three primary segments: Property Investment (HK$14.39 billion), Hotels (HK$945 million), and Property Trading (HK$119 million).

Estimated Discount To Fair Value: 24.3%

Swire Properties is trading at HK$14, significantly below its estimated fair value of HK$18.49. Despite a decline in profit margins from 38.5% to 14.4% year-over-year, earnings are forecast to grow by 25.34% annually over the next three years, outpacing the Hong Kong market's growth rate of 11.7%. The recent share buyback program aims to enhance net asset value and earnings per share, potentially boosting investor confidence.

- The analysis detailed in our Swire Properties growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Swire Properties.

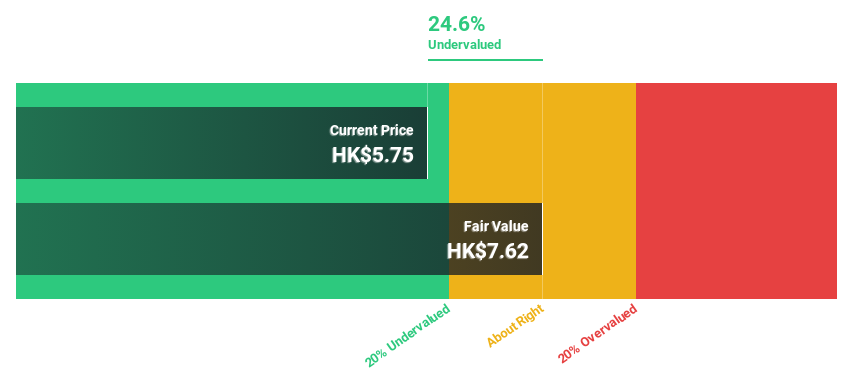

CIMC Enric Holdings (SEHK:3899)

Overview: CIMC Enric Holdings Limited offers transportation, storage, and processing equipment and services for the clean energy, chemicals, environmental, and liquid food sectors globally with a market cap of HK$11.66 billion.

Operations: The company's revenue segments include CN¥16.49 billion from Clean Energy, CN¥4.59 billion from Liquid Food, and CN¥3.31 billion from Chemical and Environmental sectors.

Estimated Discount To Fair Value: 44.7%

CIMC Enric Holdings is trading at HK$5.75, significantly below its estimated fair value of HK$10.4. Earnings are forecast to grow 20.87% annually over the next three years, outpacing the Hong Kong market's growth rate of 11.7%. Recent earnings results showed a slight decline in net income from CNY 568.67 million to CNY 486.14 million year-over-year despite increased sales, indicating potential challenges ahead but also highlighting its undervaluation based on discounted cash flow analysis.

- Our earnings growth report unveils the potential for significant increases in CIMC Enric Holdings' future results.

- Unlock comprehensive insights into our analysis of CIMC Enric Holdings stock in this financial health report.

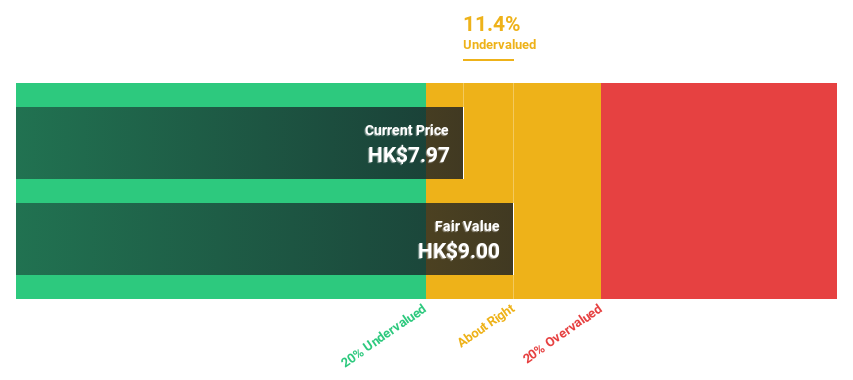

Adicon Holdings (SEHK:9860)

Overview: Adicon Holdings Limited operates medical laboratories in the People’s Republic of China and has a market cap of HK$5.59 billion.

Operations: Adicon Holdings Limited generates CN¥3.12 billion in revenue from its Healthcare Facilities & Services segment.

Estimated Discount To Fair Value: 13.7%

Adicon Holdings is trading at HK$7.7, below its estimated fair value of HK$8.93. Earnings are forecast to grow 31.2% annually, significantly outpacing the Hong Kong market's 11.7% growth rate, while revenue growth is expected to be 14.8% per year, also above the market average of 7.3%. Recent half-year results showed a decline in sales and net income compared to last year but maintained steady earnings per share from continuing operations at CNY 0.14

- Upon reviewing our latest growth report, Adicon Holdings' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Adicon Holdings.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 23 Undervalued SEHK Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1972

Swire Properties

Develops, owns, and operates mixed-use, primarily commercial properties in Hong Kong, Mainland China, the United States, and internationally.

Fair value with moderate growth potential.