- Hong Kong

- /

- Industrials

- /

- SEHK:3686

Insider Buying: The Clifford Modern Living Holdings Limited (HKG:3686) Independent Non-Executive Director Just Bought 120% More Shares

Even if it's not a huge purchase, we think it was good to see that Cham Ho, the Independent Non-Executive Director of Clifford Modern Living Holdings Limited (HKG:3686) recently shelled out HK$64k to buy stock, at HK$0.53 per share. While that isn't the hugest buy, it actually boosted their shareholding by 120%, which is good to see.

Check out our latest analysis for Clifford Modern Living Holdings

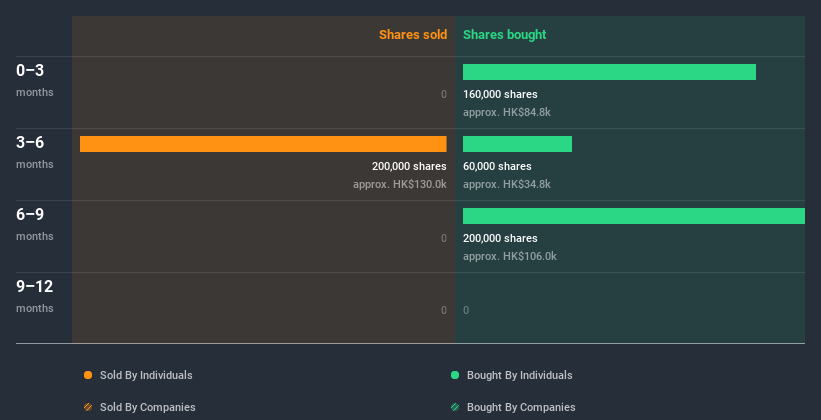

The Last 12 Months Of Insider Transactions At Clifford Modern Living Holdings

In fact, the recent purchase by Independent Non-Executive Director Cham Ho was not their only trade of Clifford Modern Living Holdings shares this year. Earlier in the year, they sold shares at a price ofHK$0.65 per share in a -HK$130k transaction. So we know that an insider sold shares at around the present share price of HK$0.55. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

Cham Ho purchased 420.00k shares over the year. The average price per share was HK$0.54. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Clifford Modern Living Holdings

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Clifford Modern Living Holdings insiders own about HK$408m worth of shares (which is 73% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Clifford Modern Living Holdings Insider Transactions Indicate?

It is good to see the recent insider purchase. And an analysis of the transactions over the last year also gives us confidence. When combined with notable insider ownership, these factors suggest Clifford Modern Living Holdings insiders are well aligned, and quite possibly think the share price is too low. One for the watchlist, at least! While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. At Simply Wall St, we found 2 warning signs for Clifford Modern Living Holdings that deserve your attention before buying any shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Clifford Modern Living Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Clifford Modern Living Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3686

Clifford Modern Living Holdings

An investment holding company, provides services to residents in developed properties under the Clifford brand name in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives