- Hong Kong

- /

- Industrials

- /

- SEHK:25

Don't Buy Chevalier International Holdings Limited (HKG:25) For Its Next Dividend Without Doing These Checks

It looks like Chevalier International Holdings Limited (HKG:25) is about to go ex-dividend in the next three days. If you purchase the stock on or after the 11th of December, you won't be eligible to receive this dividend, when it is paid on the 22nd of December.

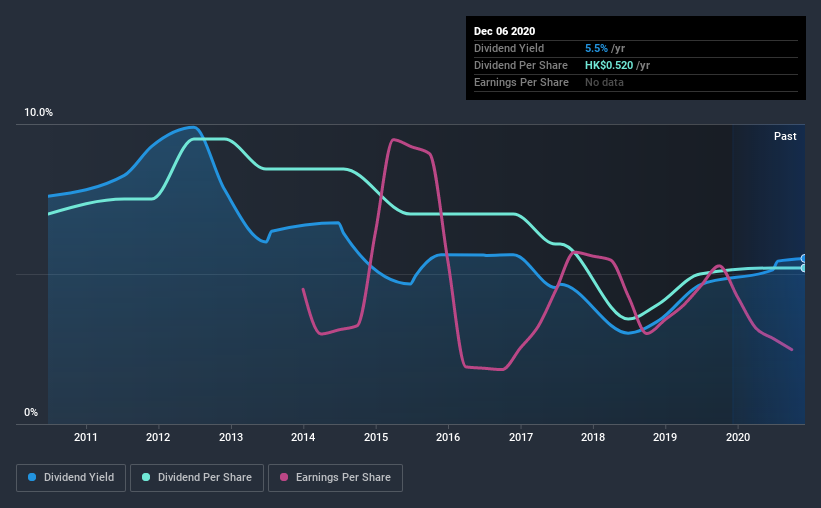

Chevalier International Holdings's next dividend payment will be HK$0.16 per share, on the back of last year when the company paid a total of HK$0.52 to shareholders. Based on the last year's worth of payments, Chevalier International Holdings has a trailing yield of 5.5% on the current stock price of HK$9.42. If you buy this business for its dividend, you should have an idea of whether Chevalier International Holdings's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Chevalier International Holdings

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Fortunately Chevalier International Holdings's payout ratio is modest, at just 35% of profit. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 108% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want look more closely here.

Chevalier International Holdings paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were Chevalier International Holdings to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Readers will understand then, why we're concerned to see Chevalier International Holdings's earnings per share have dropped 24% a year over the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Chevalier International Holdings has seen its dividend decline 2.9% per annum on average over the past 10 years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

To Sum It Up

Should investors buy Chevalier International Holdings for the upcoming dividend? Chevalier International Holdings's earnings per share have fallen noticeably and, although it paid out less than half its profit as dividends last year, it paid out a disconcertingly high percentage of its cashflow, which is not a great combination. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Although, if you're still interested in Chevalier International Holdings and want to know more, you'll find it very useful to know what risks this stock faces. Every company has risks, and we've spotted 3 warning signs for Chevalier International Holdings (of which 1 makes us a bit uncomfortable!) you should know about.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Chevalier International Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Chevalier International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:25

Chevalier International Holdings

Engages in the construction and engineering, property investment and development, healthcare investment, car dealership, and other businesses.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives