If You Like EPS Growth Then Check Out Haitian International Holdings (HKG:1882) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Haitian International Holdings (HKG:1882). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Haitian International Holdings

How Quickly Is Haitian International Holdings Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Haitian International Holdings grew its EPS by 17% per year. That's a pretty good rate, if the company can sustain it.

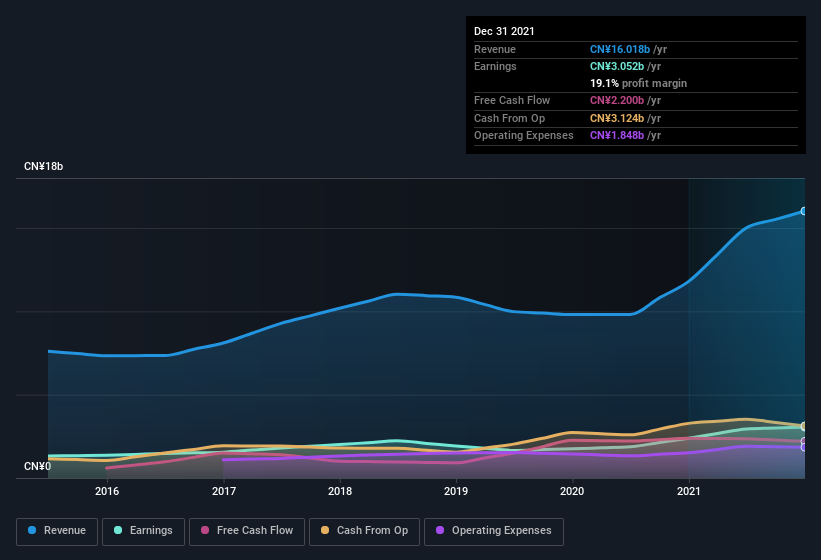

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Haitian International Holdings maintained stable EBIT margins over the last year, all while growing revenue 36% to CN¥16b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Haitian International Holdings's forecast profits?

Are Haitian International Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Insider selling of Haitian International Holdings shares was insignificant compared to the one buyer, over the last twelve months. Specifically the Senior VP of Sales & Marketing and Executive Director, Jianfeng Zhang, spent CN¥7.8m, paying about CN¥19.47 per share. That certainly pricks my ears up.

The good news, alongside the insider buying, for Haitian International Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CN¥202m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Jianming Zhang is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between CN¥14b and CN¥43b, like Haitian International Holdings, the median CEO pay is around CN¥4.2m.

The Haitian International Holdings CEO received total compensation of just CN¥1.3m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Haitian International Holdings Deserve A Spot On Your Watchlist?

One important encouraging feature of Haitian International Holdings is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. Before you take the next step you should know about the 1 warning sign for Haitian International Holdings that we have uncovered.

The good news is that Haitian International Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Haitian International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1882

Haitian International Holdings

An investment holding company, engages in the manufacture, distribution, and sale of plastic injection molding machines and related products in Mainland China, Hong Kong, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives