Does Haitian International Holdings (HKG:1882) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Haitian International Holdings (HKG:1882), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Haitian International Holdings

How Fast Is Haitian International Holdings Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Haitian International Holdings managed to grow EPS by 9.7% per year, over three years. That's a good rate of growth, if it can be sustained.

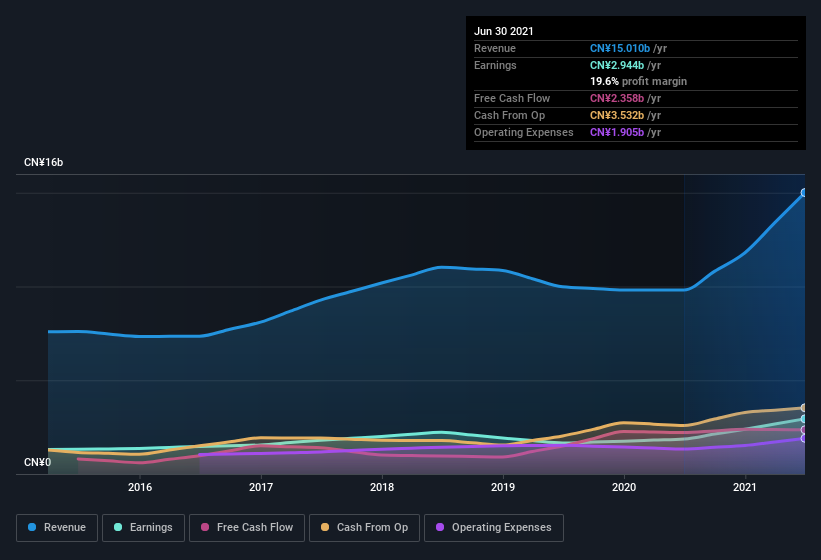

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Haitian International Holdings's EBIT margins were flat over the last year, revenue grew by a solid 53% to CN¥15b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Haitian International Holdings.

Are Haitian International Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In twelve months, insiders sold -CN¥7.5m worth of Haitian International Holdings shares. On the other hand, Senior VP of Sales & Marketing and Executive Director Jianfeng Zhang paid CN¥7.8m for shares, at a price of about CN¥19.47 per share. And that's a reason to be optimistic.

The good news, alongside the insider buying, for Haitian International Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold CN¥232m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Jianming Zhang, is paid less than the median for similar sized companies. For companies with market capitalizations between CN¥13b and CN¥41b, like Haitian International Holdings, the median CEO pay is around CN¥4.3m.

The CEO of Haitian International Holdings only received CN¥1.3m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Haitian International Holdings Worth Keeping An Eye On?

One important encouraging feature of Haitian International Holdings is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Haitian International Holdings is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Haitian International Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Haitian International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1882

Haitian International Holdings

An investment holding company, engages in the manufacture, distribution, and sale of plastic injection molding machines and related products in Mainland China, Hong Kong, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives