Asian Market Insights: Beijing Jingcheng Machinery Electric And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Amidst the backdrop of global economic uncertainty, Asian markets have shown resilience, with some sectors continuing to attract investor interest. As investors navigate these complex conditions, penny stocks remain a notable area for potential growth due to their affordability and the opportunities they present in emerging markets. Although considered a term from past market eras, penny stocks can still offer significant value when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.39 | SGD9.44B | ★★★★★☆ |

| Bosideng International Holdings (SEHK:3998) | HK$4.12 | HK$47.22B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.33 | HK$844.27M | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.86 | HK$640.48M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.30 | THB2.58B | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.02 | CN¥3.5B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.215 | SGD42.83M | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.475 | SGD452.86M | ★★★★★★ |

| China Zheshang Bank (SEHK:2016) | HK$2.37 | HK$80B | ★★★★★★ |

| Playmates Toys (SEHK:869) | HK$0.61 | HK$719.8M | ★★★★★★ |

Click here to see the full list of 1,169 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Beijing Jingcheng Machinery Electric (SEHK:187)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing Jingcheng Machinery Electric Company Limited manufactures and sells gas storage and transportation equipment in China and internationally, with a market cap of HK$7.58 billion.

Operations: Revenue segment information for Beijing Jingcheng Machinery Electric Company Limited is not reported.

Market Cap: HK$7.58B

Beijing Jingcheng Machinery Electric, with a market cap of HK$7.58 billion, operates in the gas storage and transportation sector. Despite being unprofitable, it has reduced losses over the past five years by 6.7% annually and expects a net profit turnaround for 2024. The company maintains more cash than debt, with short-term assets exceeding liabilities significantly, providing financial stability. However, its share price remains highly volatile and earnings growth lags behind industry standards due to its current unprofitability. Recent board changes could impact strategic direction as it navigates these challenges in the penny stock landscape.

- Unlock comprehensive insights into our analysis of Beijing Jingcheng Machinery Electric stock in this financial health report.

- Explore historical data to track Beijing Jingcheng Machinery Electric's performance over time in our past results report.

China Dongxiang (Group) (SEHK:3818)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Dongxiang (Group) Co., Ltd. operates in the design, development, marketing, and sale of sport-related apparel, footwear, and accessories both in China and internationally, with a market cap of HK$2.55 billion.

Operations: The company generates revenue from its China-Apparel segment, amounting to CN¥1.72 billion.

Market Cap: HK$2.55B

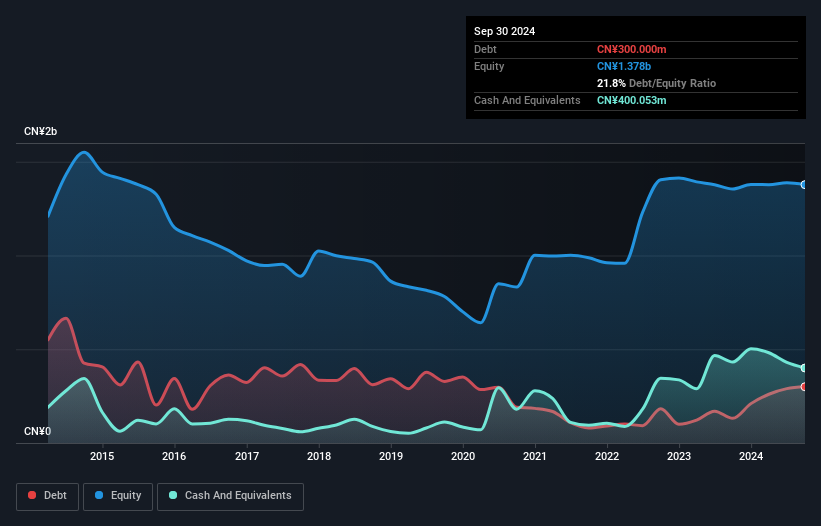

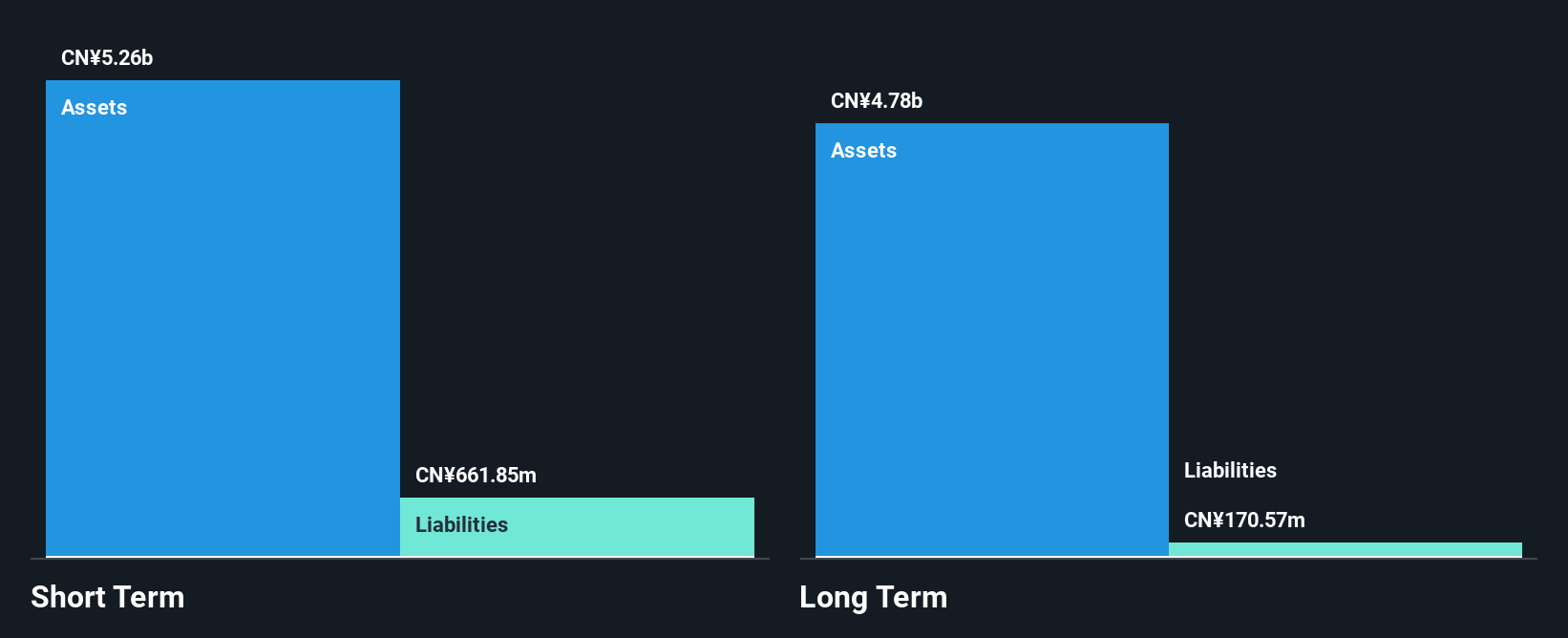

China Dongxiang (Group) Co., Ltd., with a market cap of HK$2.55 billion, operates in the sports apparel sector and is currently unprofitable, having seen losses increase by 42% annually over the past five years. Despite this, the company maintains financial stability with CN¥4.9 billion in short-term assets exceeding both short-term and long-term liabilities significantly. It is debt-free, eliminating concerns about interest coverage or cash flow issues related to debt servicing. Recent board changes include appointing Ms. Tang Songlian as an independent non-executive director, potentially influencing future governance and strategic decisions amidst its challenges in the penny stock arena.

- Get an in-depth perspective on China Dongxiang (Group)'s performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into China Dongxiang (Group)'s track record.

Digital Domain Holdings (SEHK:547)

Simply Wall St Financial Health Rating: ★★★★☆☆

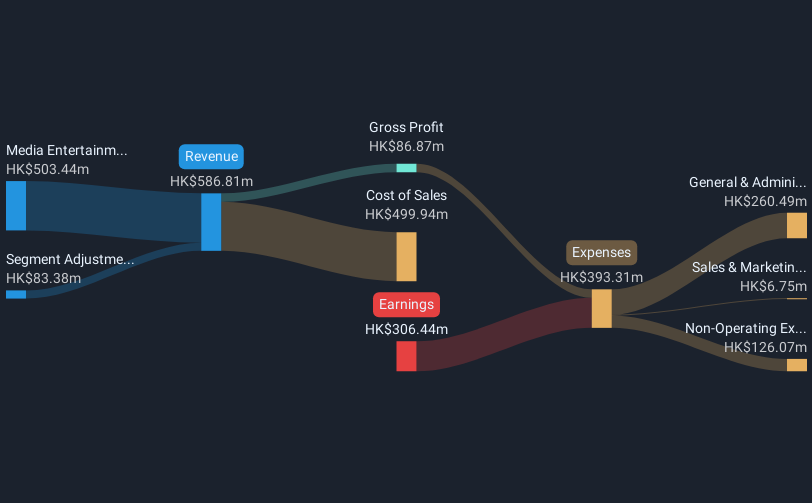

Overview: Digital Domain Holdings Limited is an investment holding company involved in the media entertainment and trading sectors across various regions including China, Hong Kong, the US, Canada, the UK, and India, with a market cap of HK$3.87 billion.

Operations: The company's revenue primarily comes from the Media Entertainment segment, which generated HK$503.44 million.

Market Cap: HK$3.87B

Digital Domain Holdings, with a market cap of HK$3.87 billion, primarily generates revenue from its Media Entertainment segment, which brought in HK$503.44 million. Despite being unprofitable, the company has reduced losses over five years and maintains short-term assets (HK$635.6M) that exceed both short-term and long-term liabilities. The recent appointment of Mr. Wong Cheung Lok as CEO and acting chairman may influence strategic direction amid financial challenges like a limited cash runway under a year if growth continues at historical rates. The board's average tenure is 3.8 years, indicating experienced governance amidst these transitions.

- Take a closer look at Digital Domain Holdings' potential here in our financial health report.

- Assess Digital Domain Holdings' previous results with our detailed historical performance reports.

Seize The Opportunity

- Jump into our full catalog of 1,169 Asian Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade China Dongxiang (Group), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3818

China Dongxiang (Group)

Engages in the design, development, marketing, and sale of sport-related apparel, footwear, and accessories in the People’s Republic of China and internationally.

Flawless balance sheet very low.