- Hong Kong

- /

- Construction

- /

- SEHK:1800

Investors Still Aren't Entirely Convinced By China Communications Construction Company Limited's (HKG:1800) Earnings Despite 35% Price Jump

The China Communications Construction Company Limited (HKG:1800) share price has done very well over the last month, posting an excellent gain of 35%. Looking back a bit further, it's encouraging to see the stock is up 56% in the last year.

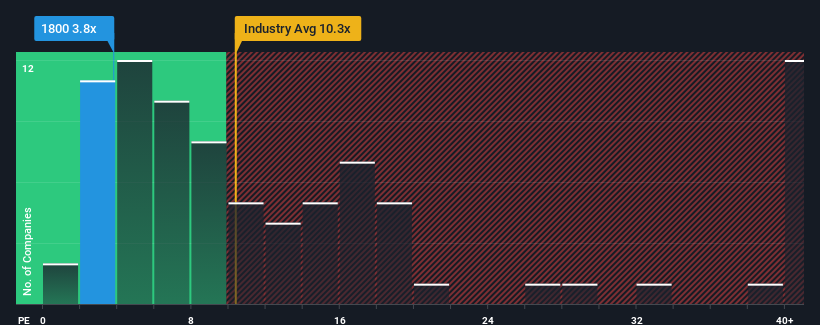

Although its price has surged higher, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 11x, you may still consider China Communications Construction as a highly attractive investment with its 3.8x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for China Communications Construction as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for China Communications Construction

What Are Growth Metrics Telling Us About The Low P/E?

China Communications Construction's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 24%. As a result, it also grew EPS by 14% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 11% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the market is forecast to expand by 12% per annum, which is not materially different.

With this information, we find it odd that China Communications Construction is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From China Communications Construction's P/E?

China Communications Construction's recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that China Communications Construction currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for China Communications Construction (1 can't be ignored!) that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1800

China Communications Construction

Engages in the infrastructure construction, infrastructure design, and dredging businesses.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives