- Hong Kong

- /

- Construction

- /

- SEHK:1799

We Ran A Stock Scan For Earnings Growth And Xinte Energy (HKG:1799) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Xinte Energy (HKG:1799). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Xinte Energy

Xinte Energy's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Xinte Energy's EPS went from CN¥1.60 to CN¥6.53 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

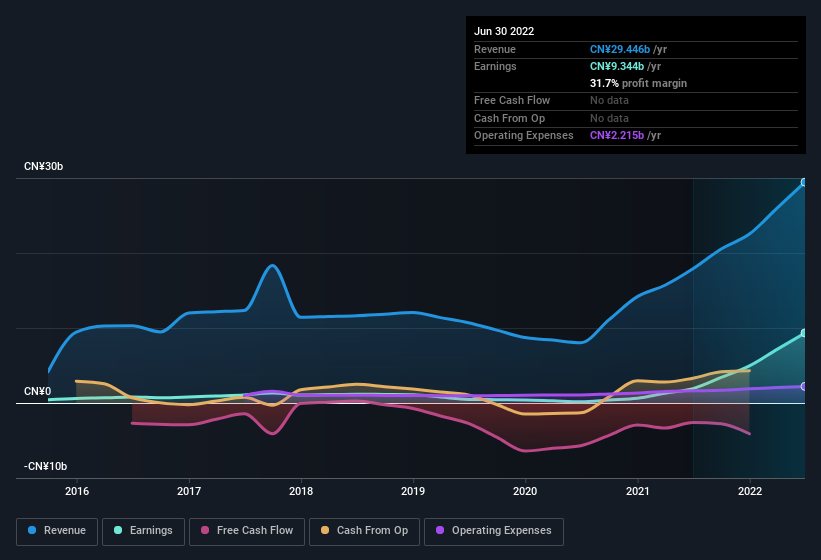

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Xinte Energy is growing revenues, and EBIT margins improved by 28.7 percentage points to 43%, over the last year. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Xinte Energy's future EPS 100% free.

Are Xinte Energy Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Xinte Energy shares worth a considerable sum. Indeed, they hold CN¥213m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Xinte Energy Worth Keeping An Eye On?

Xinte Energy's earnings per share growth have been climbing higher at an appreciable rate. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Xinte Energy is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Even so, be aware that Xinte Energy is showing 4 warning signs in our investment analysis , and 2 of those can't be ignored...

Although Xinte Energy certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1799

Xinte Energy

Engages in the research and development, production, and sale of polysilicon in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives