- Hong Kong

- /

- Construction

- /

- SEHK:1783

More Unpleasant Surprises Could Be In Store For Envision Greenwise Holdings Limited's (HKG:1783) Shares After Tumbling 31%

Envision Greenwise Holdings Limited (HKG:1783) shares have had a horrible month, losing 31% after a relatively good period beforehand. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 146% in the last twelve months.

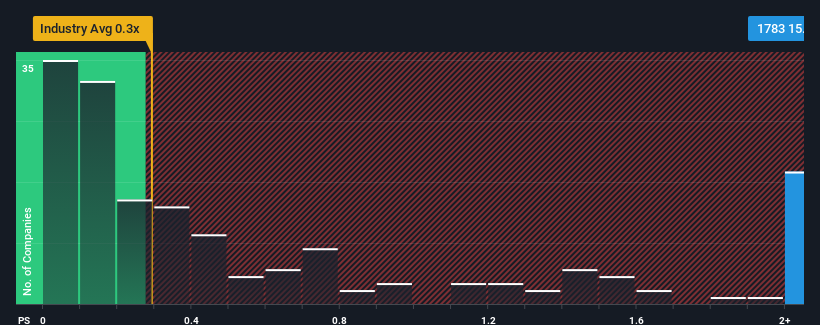

Although its price has dipped substantially, when almost half of the companies in Hong Kong's Construction industry have price-to-sales ratios (or "P/S") below 0.3x, you may still consider Envision Greenwise Holdings as a stock not worth researching with its 15x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Envision Greenwise Holdings

How Has Envision Greenwise Holdings Performed Recently?

Revenue has risen firmly for Envision Greenwise Holdings recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Envision Greenwise Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

Envision Greenwise Holdings' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. Pleasingly, revenue has also lifted 32% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 8.9% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's curious that Envision Greenwise Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Envision Greenwise Holdings' P/S Mean For Investors?

Envision Greenwise Holdings' shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Envision Greenwise Holdings has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Envision Greenwise Holdings (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Envision Greenwise Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1783

Envision Greenwise Holdings

An investment holding company, operates in the construction business in Hong Kong and the People’s Republic of China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026