Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies REM Group (Holdings) Limited (HKG:1750) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for REM Group (Holdings)

How Much Debt Does REM Group (Holdings) Carry?

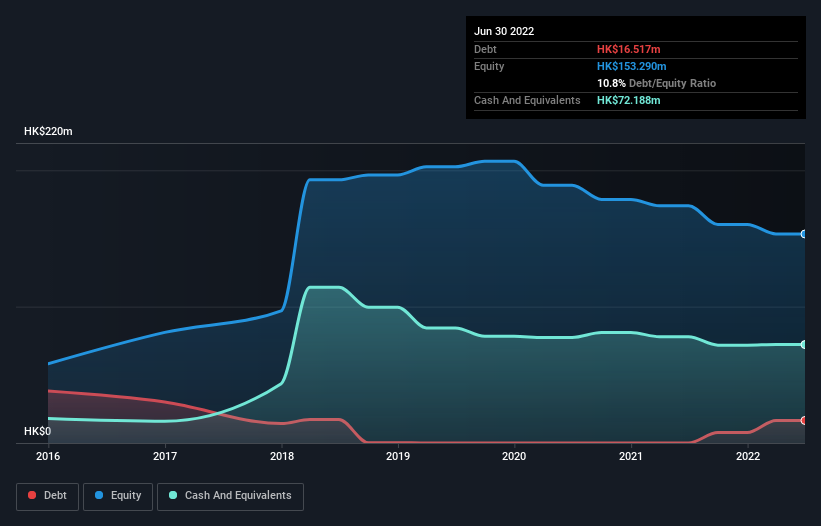

As you can see below, at the end of June 2022, REM Group (Holdings) had HK$16.5m of debt, up from HK$49.0k a year ago. Click the image for more detail. However, its balance sheet shows it holds HK$72.2m in cash, so it actually has HK$55.7m net cash.

A Look At REM Group (Holdings)'s Liabilities

We can see from the most recent balance sheet that REM Group (Holdings) had liabilities of HK$77.1m falling due within a year, and liabilities of HK$1.24m due beyond that. Offsetting this, it had HK$72.2m in cash and HK$73.7m in receivables that were due within 12 months. So it actually has HK$67.5m more liquid assets than total liabilities.

This excess liquidity is a great indication that REM Group (Holdings)'s balance sheet is almost as strong as Fort Knox. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Succinctly put, REM Group (Holdings) boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is REM Group (Holdings)'s earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, REM Group (Holdings) reported revenue of HK$169m, which is a gain of 22%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is REM Group (Holdings)?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that REM Group (Holdings) had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of HK$17m and booked a HK$20m accounting loss. Given it only has net cash of HK$55.7m, the company may need to raise more capital if it doesn't reach break-even soon. With very solid revenue growth in the last year, REM Group (Holdings) may be on a path to profitability. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for REM Group (Holdings) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1750

REM Group (Holdings)

An investment holding company, engages in the manufacture and sale of low-voltage electrical power distribution and control devices in Hong Kong, Macau, and the Mainland China.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion