- Hong Kong

- /

- Construction

- /

- SEHK:1556

Chinney Kin Wing Holdings Limited's (HKG:1556) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Despite an already strong run, Chinney Kin Wing Holdings Limited (HKG:1556) shares have been powering on, with a gain of 26% in the last thirty days. Looking further back, the 21% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

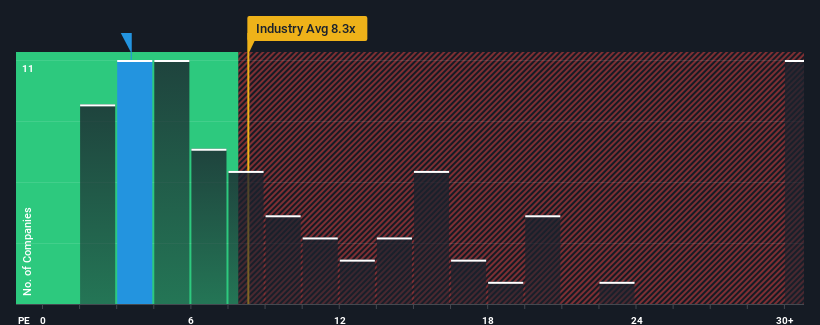

Even after such a large jump in price, Chinney Kin Wing Holdings may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 3.5x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Chinney Kin Wing Holdings has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Chinney Kin Wing Holdings

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Chinney Kin Wing Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 25% last year. The strong recent performance means it was also able to grow EPS by 56% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 20% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Chinney Kin Wing Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Chinney Kin Wing Holdings' P/E

Chinney Kin Wing Holdings' recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Chinney Kin Wing Holdings revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Chinney Kin Wing Holdings that we have uncovered.

You might be able to find a better investment than Chinney Kin Wing Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1556

Chinney Kin Wing Holdings

An investment holding company, engages in foundation construction, and drilling and site investigation works for public and private sectors in Hong Kong.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives