- Hong Kong

- /

- Construction

- /

- SEHK:1459

We Think Jujiang Construction Group (HKG:1459) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Jujiang Construction Group Co., Ltd. (HKG:1459) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Jujiang Construction Group

How Much Debt Does Jujiang Construction Group Carry?

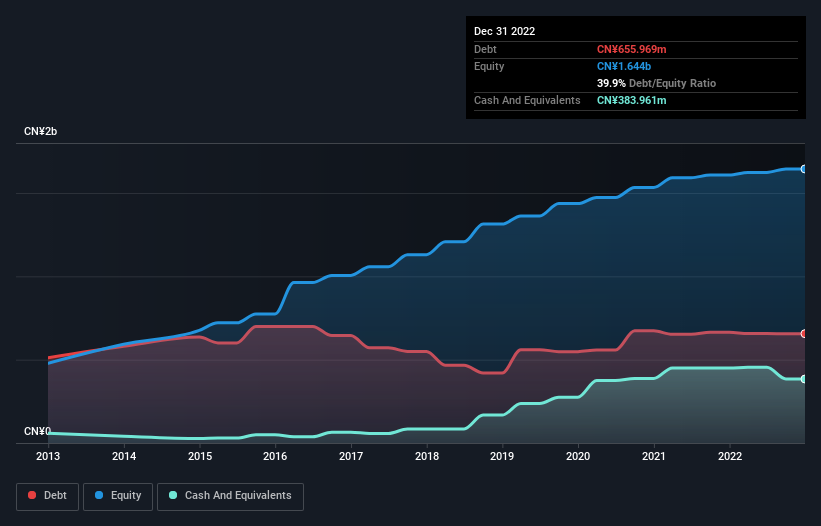

As you can see below, Jujiang Construction Group had CN¥656.0m of debt, at December 2022, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has CN¥384.0m in cash leading to net debt of about CN¥272.0m.

How Healthy Is Jujiang Construction Group's Balance Sheet?

According to the last reported balance sheet, Jujiang Construction Group had liabilities of CN¥4.69b due within 12 months, and liabilities of CN¥159.2m due beyond 12 months. On the other hand, it had cash of CN¥384.0m and CN¥4.84b worth of receivables due within a year. So it can boast CN¥371.9m more liquid assets than total liabilities.

This excess liquidity is a great indication that Jujiang Construction Group's balance sheet is almost as strong as Fort Knox. With this in mind one could posit that its balance sheet means the company is able to handle some adversity.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Jujiang Construction Group has net debt worth 2.1 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.1 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Importantly, Jujiang Construction Group's EBIT fell a jaw-dropping 47% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Jujiang Construction Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Jujiang Construction Group reported free cash flow worth 12% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Based on what we've seen Jujiang Construction Group is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to handle its total liabilities is pretty flash. When we consider all the factors mentioned above, we do feel a bit cautious about Jujiang Construction Group's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for Jujiang Construction Group (1 can't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1459

Jujiang Construction Group

Provides construction contracting services for residential, commercial, industrial, and public works in the People’s Republic of China and Hong Kong.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.