- Hong Kong

- /

- Construction

- /

- SEHK:1315

We Don’t Think Green Economy Development's (HKG:1315) Earnings Should Make Shareholders Too Comfortable

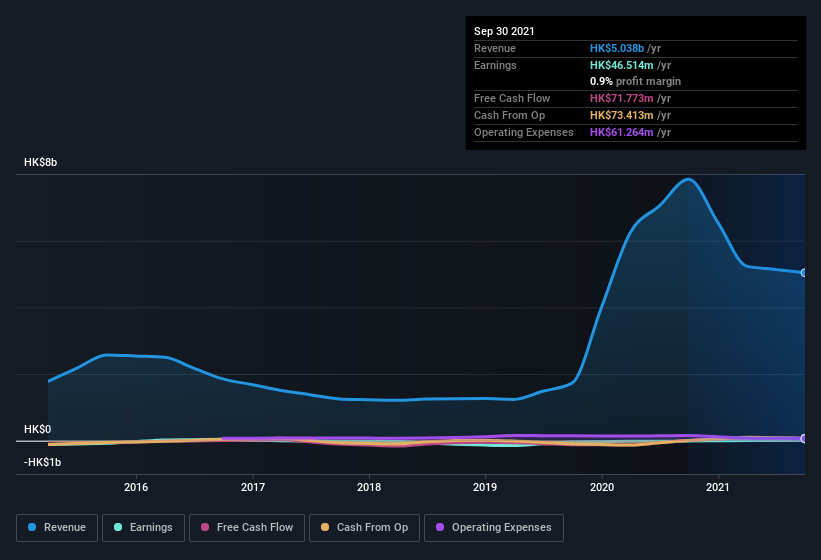

Solid profit numbers didn't seem to be enough to please Green Economy Development Limited's (HKG:1315) shareholders. We think that they might be concerned about some underlying details that our analysis found.

Check out our latest analysis for Green Economy Development

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. Green Economy Development expanded the number of shares on issue by 25% over the last year. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Green Economy Development's historical EPS growth by clicking on this link.

How Is Dilution Impacting Green Economy Development's Earnings Per Share? (EPS)

Three years ago, Green Economy Development lost money. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, if Green Economy Development's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Green Economy Development.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that Green Economy Development's profit was boosted by unusual items worth HK$24m in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. We can see that Green Economy Development's positive unusual items were quite significant relative to its profit in the year to September 2021. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Green Economy Development's Profit Performance

In its last report Green Economy Development benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. For the reasons mentioned above, we think that a perfunctory glance at Green Economy Development's statutory profits might make it look better than it really is on an underlying level. If you'd like to know more about Green Economy Development as a business, it's important to be aware of any risks it's facing. For example - Green Economy Development has 3 warning signs we think you should be aware of.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade Green Economy Development, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1315

Green Economy Development

An investment holding company, engages in the construction activities in Hong Kong, and the People's Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives