- Hong Kong

- /

- Industrials

- /

- SEHK:1

CK Hutchison Holdings (SEHK:1): Is the Stock Still Undervalued After Recent Gains?

Reviewed by Simply Wall St

Most Popular Narrative: 15.5% Undervalued

According to the most closely followed analysis of CK Hutchison Holdings, the stock is trading well below its estimated fair value. This widely cited narrative indicates a 15.5% discount, suggesting meaningful upside if the forecasts play out.

Sustained investment and efficiency-driven growth in the Ports division, including expanded facilities in key geographies and increased storage income, position the company to benefit from global trade resilience and supply chain optimization. This supports higher revenue and stable cash flows. Strategic expansion and modernization of the group's retail arm (notably A.S. Watson's store portfolio and loyalty program development, plus omni-channel and dark store initiatives), are anticipated to drive same-store sales growth and operational leverage, contributing to higher revenue and sustainable bottom-line growth.

Curious what is fueling this bold undervaluation? The answer lies in a series of aggressive projections for revenue, profits, and margins. These numbers hint at a potential transformation across CK Hutchison’s global businesses. Big changes are expected. The underlying assumptions behind these forecasts just might surprise you.

Result: Fair Value of $61.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, recurring gains from asset sales and currency moves, as well as ongoing weakness in Mainland China retail, could quickly challenge the bullish valuation case.

Find out about the key risks to this CK Hutchison Holdings narrative.Another View: The Market Ratio Test

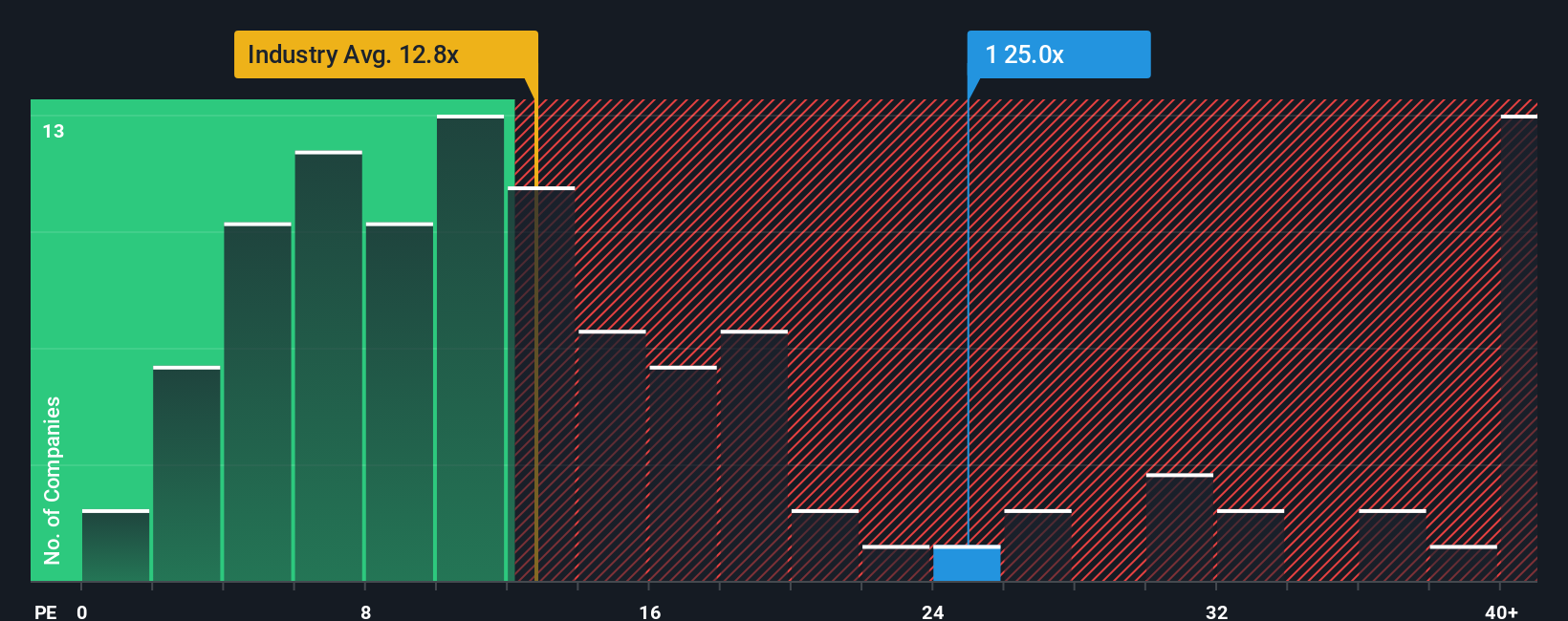

Looking through another lens, the current market price appears quite expensive relative to similar companies in the region. This view challenges the optimistic growth narrative and raises the question: has value already been priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding CK Hutchison Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own CK Hutchison Holdings Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft a custom view of CK Hutchison Holdings in under three minutes. Do it your way

A great starting point for your CK Hutchison Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock even more opportunities using our powerful screeners. Don’t limit yourself to just one stock when standout options are just a click away.

- Spot companies with exceptional cash flow potential and quickly access undervalued picks through our undervalued stocks based on cash flows.

- Find established names offering strong income by checking out stocks with reliable yields above 3% with dividend stocks with yields > 3%.

- Uncover trendsetting innovations shaping the digital health space by tapping into the future of medical technology via healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:1

CK Hutchison Holdings

An investment holding company, primarily operates in ports and related services, retail, infrastructure, and telecommunications businesses in Hong Kong, Mainland China, Europe, Canada, Asia, Australia, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives