As global markets display mixed performances with major U.S. indexes reaching record highs while others like the Russell 2000 decline, investors are keeping a keen eye on economic indicators such as job growth and Federal Reserve rate decisions. In this dynamic environment, dividend stocks can offer a stable income stream, making them an attractive consideration for those looking to balance growth with consistent returns amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.95% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.22% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.77% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.84% | ★★★★★★ |

Click here to see the full list of 1922 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

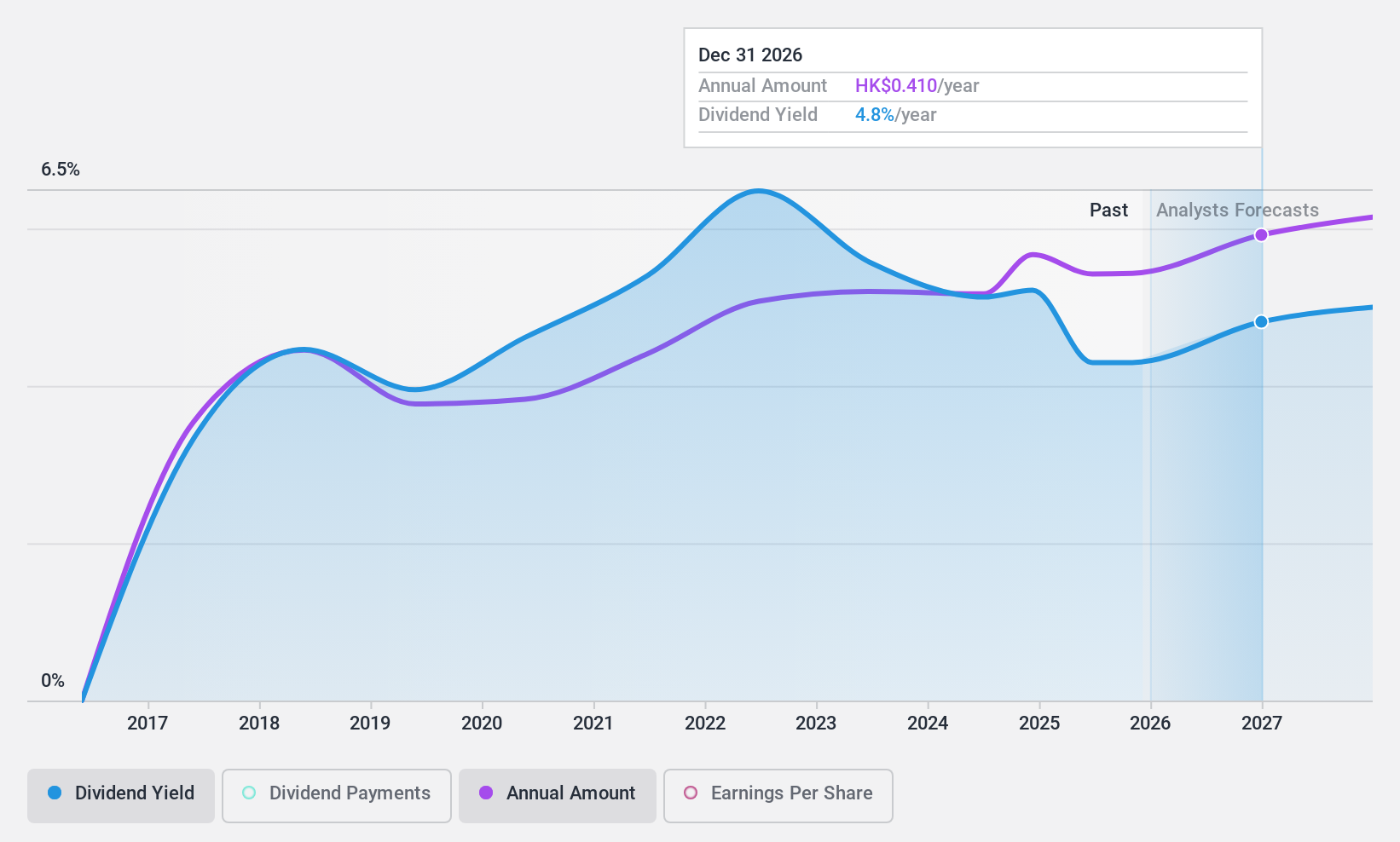

People's Insurance Company (Group) of China (SEHK:1339)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The People's Insurance Company (Group) of China Limited is an investment holding company offering insurance products and services in the People’s Republic of China and Hong Kong, with a market cap of approximately HK$316.54 billion.

Operations: The People's Insurance Company (Group) of China Limited generates revenue through its insurance products and services offered in the People’s Republic of China and Hong Kong.

Dividend Yield: 3.4%

People's Insurance Company (Group) of China exhibits a mixed profile for dividend investors. While its dividends are well-covered by earnings and cash flows, with payout ratios at 25.3% and 6.6% respectively, the company's dividend history has been unreliable over the past decade, showing volatility despite some growth. Trading at a significant discount to estimated fair value enhances its appeal; however, its current yield of 3.41% is relatively low compared to top-tier payers in Hong Kong's market. Recent announcements confirmed an interim dividend and board changes but do not alter the fundamental analysis significantly.

- Navigate through the intricacies of People's Insurance Company (Group) of China with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of People's Insurance Company (Group) of China shares in the market.

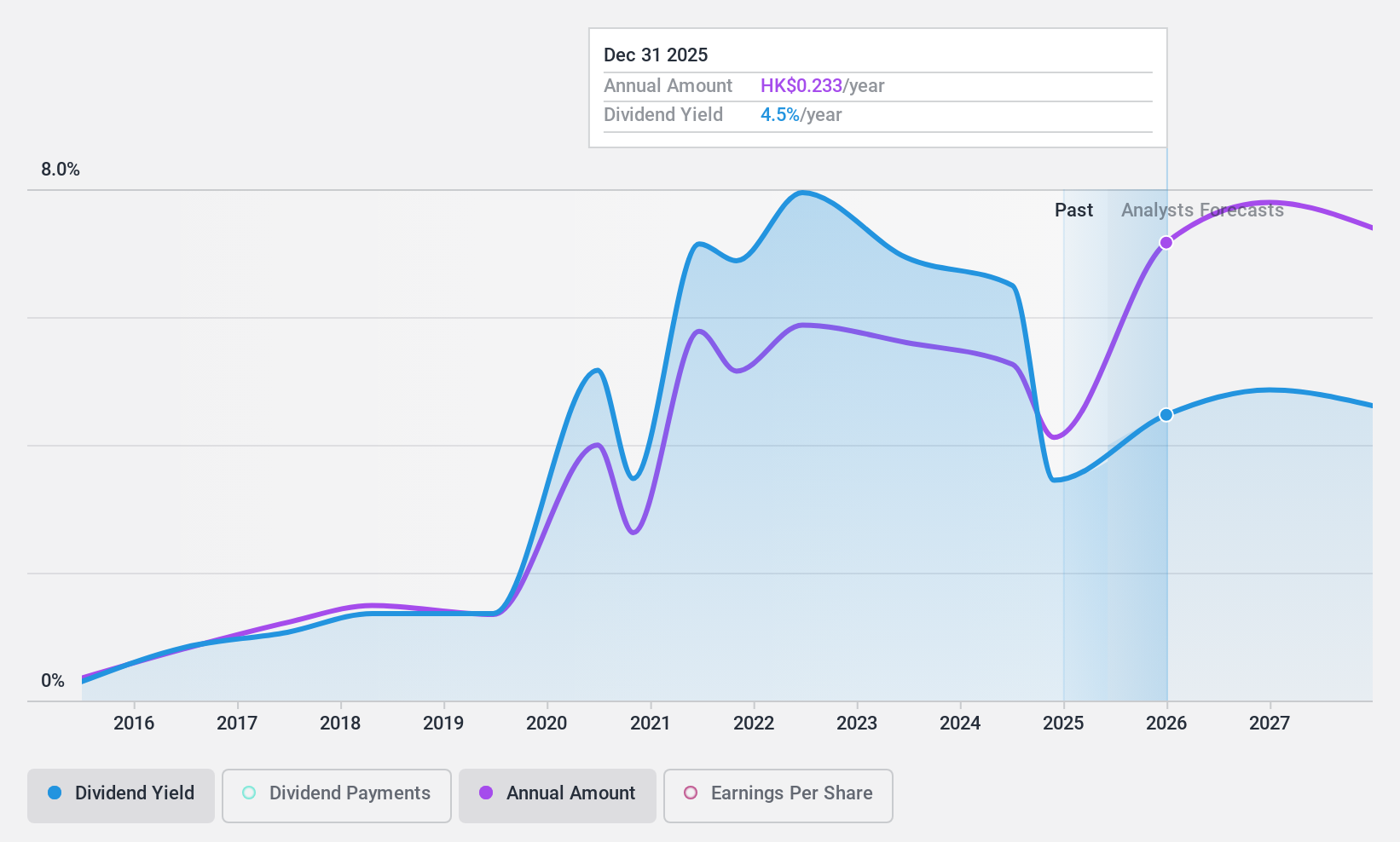

Zhongsheng Group Holdings (SEHK:881)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhongsheng Group Holdings Limited is an investment holding company involved in the sale and service of motor vehicles in the People's Republic of China, with a market cap of HK$37.87 billion.

Operations: Zhongsheng Group Holdings Limited generates revenue of CN¥179.81 billion from its operations in the sale of motor vehicles and the provision of related services in China.

Dividend Yield: 4.5%

Zhongsheng Group Holdings' dividend profile presents certain challenges, with a history of volatility and unreliability over the past decade. Despite this, dividends are covered by earnings and cash flows, with payout ratios at 49% and 51.6% respectively. Although its dividend yield of 4.47% is below Hong Kong's top-tier payers, the stock trades significantly below estimated fair value. Recent financial results were expected on December 6, which may impact future assessments.

- Delve into the full analysis dividend report here for a deeper understanding of Zhongsheng Group Holdings.

- Our comprehensive valuation report raises the possibility that Zhongsheng Group Holdings is priced lower than what may be justified by its financials.

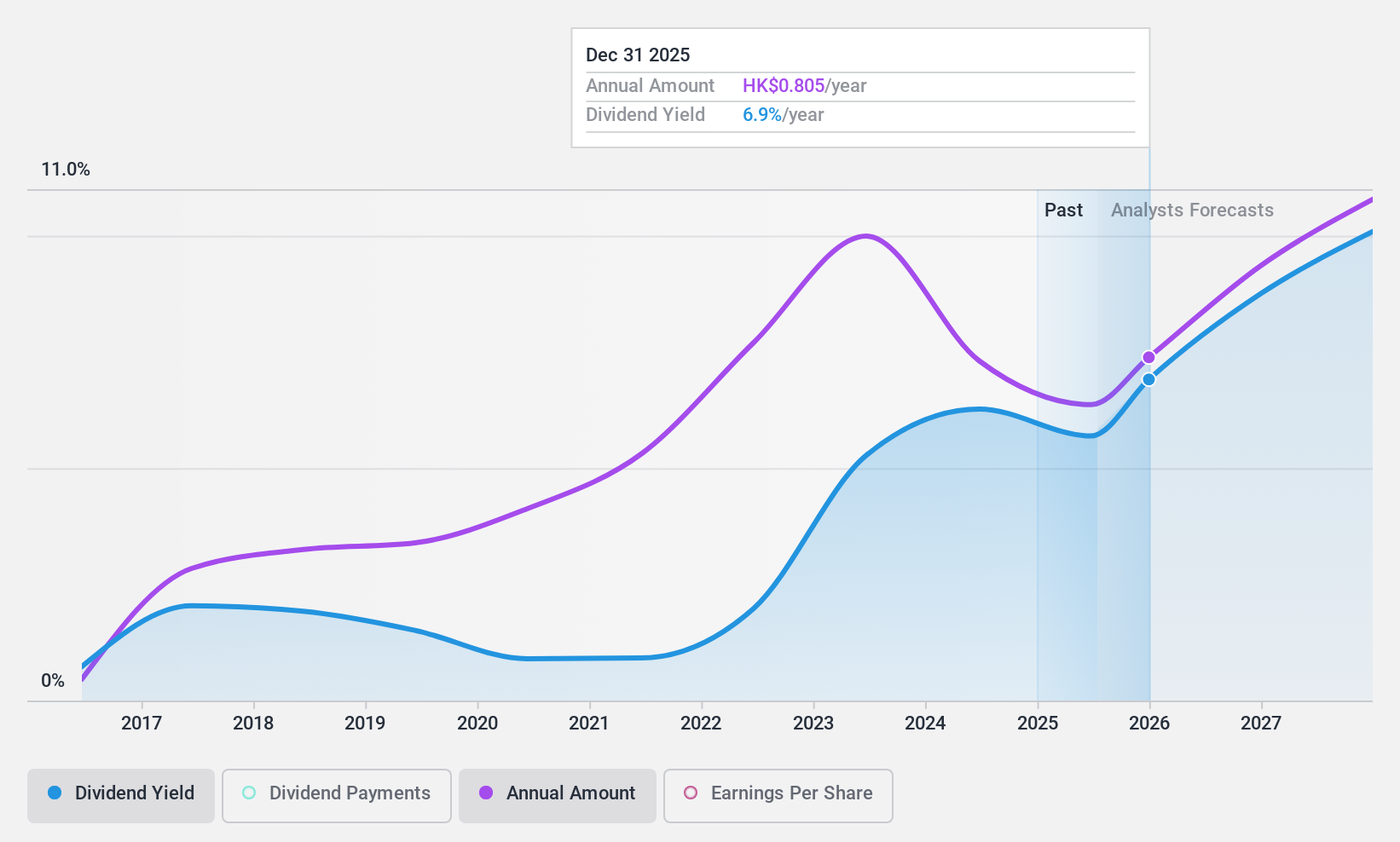

China CITIC Bank (SEHK:998)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China CITIC Bank Corporation Limited offers a range of banking products and services both in the People’s Republic of China and internationally, with a market cap of HK$378.32 billion.

Operations: China CITIC Bank Corporation Limited generates revenue through its diverse banking products and services offered domestically in the People’s Republic of China as well as internationally.

Dividend Yield: 7.4%

China CITIC Bank's dividend history is marked by volatility and unreliability over the past decade, though dividends are currently covered by a low payout ratio of 41.8%. The stock trades at a significant discount to its estimated fair value, offering potential value for investors. Recent earnings showed modest growth with net income rising slightly to CNY 51.83 billion for the first nine months of 2024, indicating stable financial performance amidst ongoing strategic considerations.

- Click to explore a detailed breakdown of our findings in China CITIC Bank's dividend report.

- According our valuation report, there's an indication that China CITIC Bank's share price might be on the cheaper side.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 1922 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1339

People's Insurance Company (Group) of China

An investment holding company, provides insurance products and services in the People’s Republic of China and Hong Kong.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives